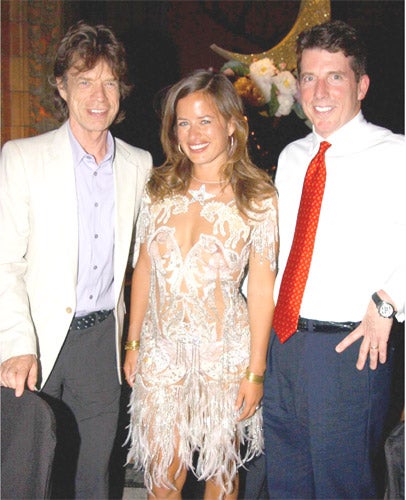

Bob Diamond: The £50m banker with a taste for golf and bonuses

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference."I wake up every day with a smile on my face. My job is about helping people." So said Bob Diamond, describing his love of his job at a Barclays results presentation before the financial world changed forever.

He was doing precious little smiling at this year's event earlier this week, glowering at Her Majesty's Press during what rapidly turned into an ill-tempered affair, particularly when the subject of bankers' bonuses cropped up.

Diamond, whose own package has come close to £50m in the good times, mounted a stout defence of City bonuses (he's not taking one this year although that's unlikely to prove much of a hardship), arguing that stellar pay is given only to reward stellar performance.

The evidence of this can arguably be seen in the performance of Barclays – it is doing rather better than any other UK bank, better in fact than most banks in a financial world still on life support thanks to the credit crunch.

The smooth, polished Diamond of old is showing some sharp edges, clearly nettled by the criticism he has faced and perhaps with some reason – the bank's current success is thanks in no small part to him and his team.

The preppie New Englander – who started his career in the halls of academe as a university lecturer in business – was headhunted to join BZW, Barclays' then investment banking operation, from Credit Suisse First Boston in 1996 after beginning his career in financial services at Morgan Stanley.

His meteoric rise began when BZW's shares business was sold to his old employer not long after he joined. Barclays Capital was what rose from the ashes, becoming a jewel in Barclays' crown under the Diamond's guiding hand.

An intense competitor, the father-of-three's office is full of pictures of sports teams he has coached together with numerous family photos and sports memorabilia. Now boasting dual nationality like a number of other Barclays Americans, he is also a passionate follower of the professional sports on both sides of the Atlantic. His favourite baseball team is the Boston Red Sox, which went from perennial laughing stock to become two time World Series winners and the current "team of the decade", during a rise that mirrors the way BarCap has risen from obscurity under Diamond to make Barclays a champion among Britain's banks.

On this side of the pond, he counts himself as a big Chelsea fan and has been a season ticket holder for 11 years. Barclays' sponsorship of the Premier League allowed him to fulfil a personal ambition by presenting the trophy to title winners Chelsea in 2005 and 2006.

Diamond's occasionally gruff demeanour contrasts with the more urbane face presented to the world by his boss, Barclays chief executive John Varley. The two went head to head in the battle to succeed the avuncular Canadian Matt Barrett in 2003.

Diamond only narrowly lost out, and some speculated that this might lead to his departure from Barclays but he seems to have shrugged off any disappointment he felt. His power has steadily increased and his influence has extended throughout the bank. Diamond keeps a punishing schedule and others are expected to follow suit. Thanks to him and his team, senior staff now also face an intensive – and intrusive – "topgrading" interview process that goes right back to what they liked at school and grills them on their families.

However, rumours of tension at the top have never really gone away despite repeated denials from both Varley and Diamond. Varley's appointment of Frits Seegers from Citigroup as chief executive of global retail and commercial banking in 2006 was widely seen as an attempt to create a counterpoint to Diamond's power base although he was handed the grandiose title of "President" shortly afterwards.

There was also talk that he was not entirely happy about Barclays failed attempt to merge with ABN Amro in 2007, which would have apparently given more to Seegers than it would to Diamond.

As it turned out, Sir Fred Goodwin's Royal Bank of Scotland trumped Barclays' proposed bid.

And if Diamond ever questioned the plan, he was certainly on the right track – the ABN Amro deal was a major contributor to the spectacular fall of Royal Bank and Sir Fred. Barclays, on the other, was able to find itself a much better deal thanks to Diamond, paying £2.2bn for the best part of bankrupt investment bank Lehman Brothers, a company long thought to be coveted by him. The benefits of that deal shone through in Barclays results. Diamond might not have been smiling publicly, but privately it is a different story. The deal may yet allow him the chance to realise a burning ambition of turning Barclays into a global powerhouse that could be mentioned in the same breath as JP Morgan, Goldman Sachs and his alma mata Morgan Stanley.

When Margaret Thatcher deregulated the City as part of the "big bang" of the 1980s she wanted to see the creation of world class British investment banks. It never happened as the Americans and Continental Europeans moved in and took over the City. Now, at last, it might although it has taken an only partly Anglicised American to do it.

And yet Diamond finds himself in the firing line, pilloried for his bonus payments and criticised for his ambition and business plan – despite the fact that if it is successful it will pump billions into Britain's battered exchequer.

Given that, perhaps it is no wonder that Diamond is no longer smiling. But if he is ultimately allowed to succeed, no one will be able to take the shine off him.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments