John Gutfreund: ‘King of Wall Street’ who transformed Salomon Brothers into one of the world’s most profitable investment banks

He told his traders to come into work every day ‘ready to bite the ass off a bear’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.John Gutfreund was proclaimed the “King of Wall Street” in 1985 for harnessing the egos and fiefdoms of Salomon Brothers into one of the most profitable investment banking firms, only to be deposed after a 1991 trading scandal. As managing partner and later as chairman, Gutfreund transformed Salomon from a traditional bond-trading firm into a pioneer in businesses such as mortgage-backed securities and computer-driven trading techniques.

“Gutfreund seemed able to smell money being lost,” Michael Lewis wrote in Liar’s Poker, his 1989 account of working at Salomon. “He was the last person a nerve-wracked trader wanted to see.” In overseeing Salomon’s transition from private partnership into what Lewis called “Wall Street’s first public corporation”, Gutfreund was a pioneer in taking the risks once assumed by a small group of senior partners and spreading them among shareholders. His view of business as a daily battle was captured in his exhortation to traders that they come to work “ready to bite the ass off a bear”.

Readers of the Lewis book were introduced to Gutfreund and the ways of Wall Street, including the game referenced by the title, which involves wagering on the serial numbers printed on the paper currency in players’ hands, and nerves-of-steel bluffing. In the opening pages, Gutfreund marches out of his office to challenge John Meriwether, his bond trader extraordinaire, to one contest, for $1m, backing down when Meriwether ups the proposed bet to $10m. The book “destroyed my career, and it made yours,” Gutfreund later told Lewis.

The New York-born son of a prosperous trucking-company owner, Gutfreund assumed control of Salomon in 1978. His reputation as a corporate infighter was burnished after he agreed to sell Salomon in 1981 for $554m to Phibro, a publicly owned commodities trading firm that had benefited from rising oil prices in the late 1970s. When the US Federal Reserve lowered the inflation rate, oil prices dropped while bond prices, Salomon’s lifeblood, rose.

Gutfreund seized on the reversal of fortunes to depose David Tendler, head of Phibro, in 1984. He renamed the company Salomon Inc, shrank what remained of Phibro and allowed his bond traders to use the company’s expanded capital base to boost profits. He broadened Salomon’s client services and its global presence by creating a mortgage securities unit, moving into mergers and acquisitions, building its foreign currency exchange operation and opening offices in Tokyo, Zurich and Frankfurt.

Salomon’s capital grew to $3.4bn from $209m when he took over, and Businessweek magazine put him on its cover in 1985 with the headline “King of Wall Street.”

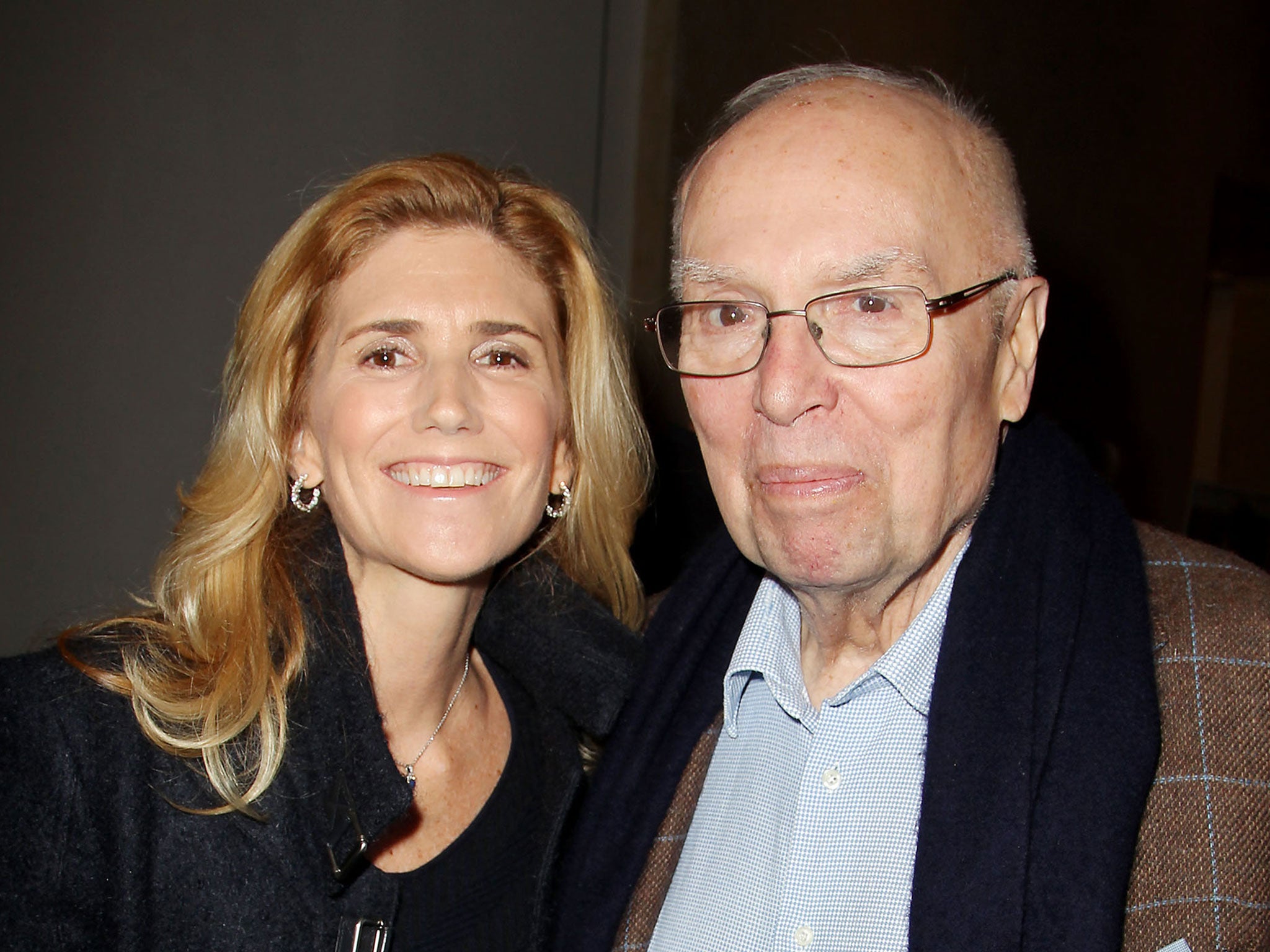

“He helped build Salomon into a superpower,” said Robert Rubin, former US Treasury secretary and a leader of rival Goldman Sachs. Gutfreund also became prominent in the New York social scene. In 1981 he married Susan Penn, a former beauty queen and Pan Am flight attendant. They were known for parties at their apartments on the East River and Fifth Avenue, and weekend trips to their home in Paris. Tom Wolfe denied that the Gutfreunds had inspired the fictional Bavardages in his 1987 novel Bonfire of the Vanities, the couple he called “this year’s host and hostess of the century, the most busily and noisily arrived of the arrivistes.”

Mistakes weakened Gutfreund’s grip on the firm, then led to his exit from Wall Street. In 1987 when Ronald Perelman, the head of Revlon, tried to buy a 14 per cent stake in Salomon, Gutfreund was forced to sell a 12 per cent share to Warren Buffett’s Berkshire Hathaway for $700m to discourage hostile challenges.

In 1991, Salomon admitted it had violated US Treasury rules by placing orders for securities in the name of customers who hadn’t authorised them. Paul Mozer, then head of government bond trading at Salomon, served four months in prison for lying to regulators. Gutfreund, criticised for failing to notify regulators quickly enough about Salomon’s false bids, resigned.

Gutfreund insisted he tried to do the right thing, but asked in 1996 how the public viewed him, he replied: “If they remember me, it will not be because I helped build Salomon as the No 1 underwriter in the world... but as somebody who got involved with a scandal.”

He paid a $100,000 civil penalty and was barred from serving as chief executive of a securities firm. Salomon was acquired by Travelers Group in 1998 and now is part of Citigroup.

He was born in 1929 in New York and graduated in English from Oberlin College in Ohio in 1951, serving in the Army in Korea from 1951 to 1953. His father Manuel owned a fleet of trucks and was a golfing partner of Billy Salomon, son of one of the firm’s founders, and after his father arranged an interview, John dropped thoughts of teaching literature and joined Salomon as a trainee in the statistical department. He moved quickly into trading municipal securities, and 25 years later, Billy Salomon named Gutfreund to succeed him as head of the firm.

Gutfreund kept a desk at the head of Salomon’s trading floor, giving interviews and conducting business, rarely without a cigar. He changed Salomon, for good with the 1981 Phibro deal, selling the partnership to a publicly held company. Billy Salomon was upset, saying he had left the firm in Gutfreund’s hands “in the hope and expectation that we would remain a general partnership for a long time.”

Salomon rode the bull markets of the 1980s, leading up to the 1987 plunge in equity markets. Gutfreund cancelled a planned new headquarters as profits fell and executives resigned. By 1988, he admitted that the management hadn’t kept up with the firm’s growth. “The world changed in some fundamental ways, and most of us were not on top of it,” he said. “We were dragged into the modern world.” Gutfreund rejected the company’s offered pay-out of $8.5m and took the case to arbitration, seeking up to $30m. He was awarded nothing. He later ran a consulting firm. In 2010 he said he had few regrets. “If I should have been a saint, I would have been,” he said.

John Halle Gutfreund, financier: born New York 14 September 1929; married firstly Joyce Low (there sons), secondly (one son); died 9 March 2016.

© The Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments