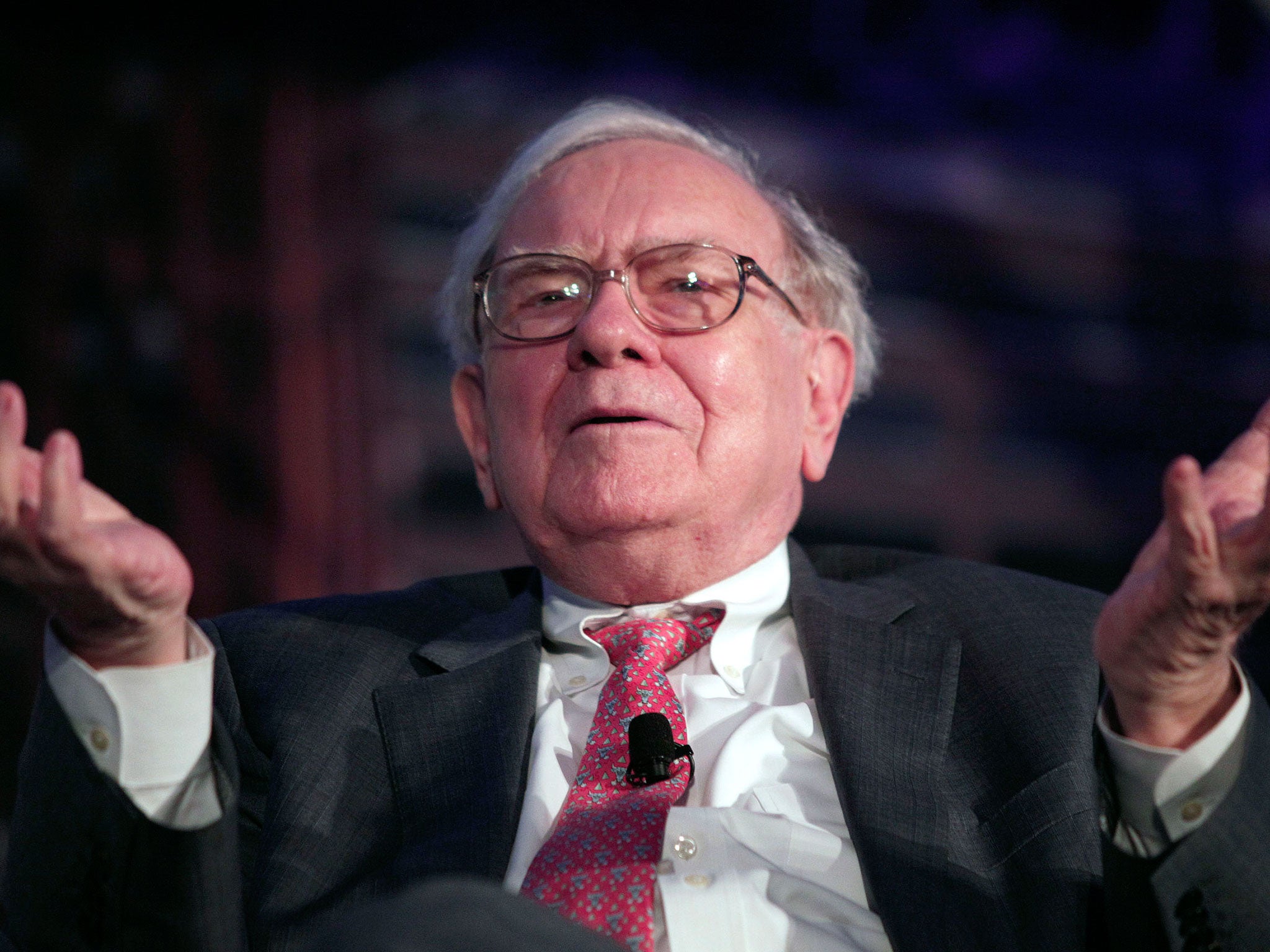

Warren Buffett: Tesco losses take millions off Berkshire Hathaway earnings

Financial report comes just weeks after Mr Buffett declared his stake in Tesco a ‘huge mistake’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Warren Buffett, known as the Sage of Omaha for his innate investment intelligence, has recorded a $678mn (£427mn) loss on his Tesco investment in the space of three months.

The billionaire was Tesco’s fourth-largest investor until last month, when he sold off a large chunk of his stake in the retailer, taking his investment down from nearly four per cent to below three per cent.

Mr Buffett, who has called his investment in Tesco a “huge mistake”, saw net profits of his investment vehicle Berkshire Hathaway fall in the three months to 30 September to $4.6bn (£2.9bn), down from $5.1bn (£3.21bn) a year ago.

Tesco is under criminal investigation by the Serious Fraud Office following the retailer’s £263mn accounting scandal.

The supermarket has seen its shares more than halve in the past 12 months following a series of profit warnings, the discovery that the business had been running without a finance director for five months, and the firing of its chief executive Philip Clarke.

A week after Mr Buffett significantly reduced his shares in the retailer he saw $1bn (£160mn) wiped off the value of his stake in IBM, after the tech giant recorded a 17 per cent drop in its third quarter profits.

Just days later, Coca-Cola caused Mr Buffett’s investment losses to climb to $2bn (£1.26mn) after the soft-drinks giant’s shares plummeted six per cent following flat sales and a lowered guidance for the year.

Despite this, total third quarter revenues at Berkshire Hathaway rose from $46.5bn (£2.93bn) to $51.2bn (£32.3bn) however, propped up by its energy and railroad investments, among others.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments