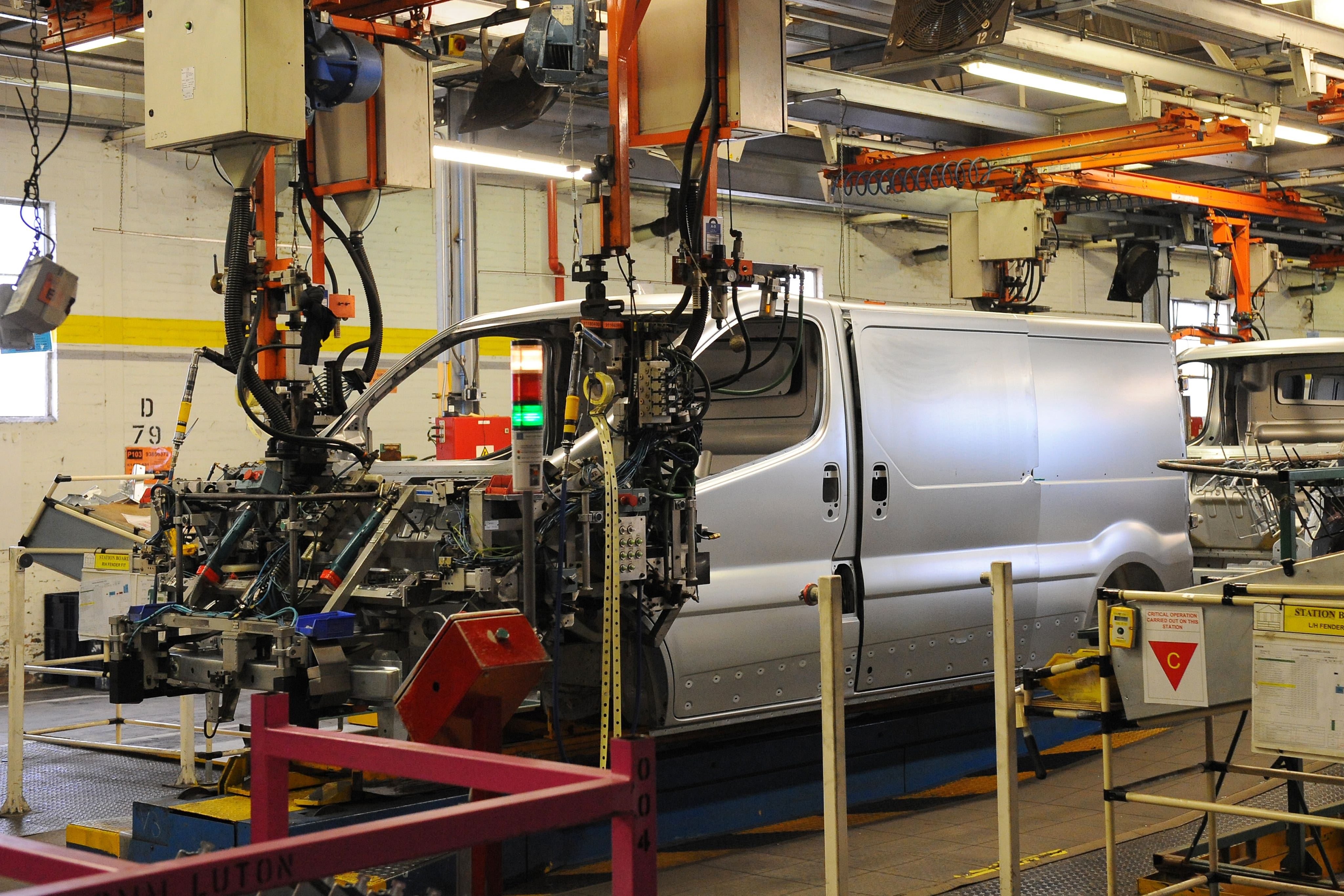

Vauxhall’s owner to close Luton van plant, putting 1,100 jobs at risk

The plant, which makes Vauxhall Vivaro vans, was due to be overhauled next year to make electric models.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The owner of the Vauxhall brand says it plans to close its factory in Luton which makes vans, putting 1,100 jobs at risk.

The plant, which makes Vauxhall Vivaro vans, was due to be overhauled next year to make electric models.

But Stellantis, the huge car maker which owns the brand, also warned that the site was at risk if more was not done to encourage the public to buy electric vehicles.

Luton is one of two large plants Stellantis owns in the UK, with the other being in Ellesmere Port. Both make vans. Ellesmere Port’s site specialises in smaller vans like the Vauxhall Combo after it stopped making the Astra car in 2021. Van making will now be done solely at the Ellesmere Port site.

The plants export their vehicles under the Opel brand around Europe, as well as making vehicles under Citroen and Peugeot brands, which Stellantis owns.

Last month, Stellantis warned that it would burn through €10bn of cash this year as it struggles with lower sales.

Car makers have been battling high energy costs after Russia’s invasion of Ukraine, and they have had to pass on costs to customers.

They did this very successfully in the wake of the pandemic when factory closures meant a shortage of cars. But now, as factories have been churning out more cars, they are met with customers feeling the pinch of higher energy bills and mortgage payments.

Their efforts to sell more electric cars have also stalled. EVas cost more to make because of the expensive materials needed to produce their large batteries. Stretched customers are choosing them at a slower rate, meaning car makers have had to slash their prices, eating away at margins.

Car makers also face fines if they do not ramp up electric car production n the UK.

At least 22 per cent of cars made in British factories must be battery-powered, and a tenth of vans, under today’s rules. Breaking the rules means either buying credits from competitors who are beating these targets - an unpopular option - or paying a fine of £15,000 per car.

All these pressures have led the industry to ask for help.

Ministers will now consult with the industry on the fines in order to avoid job cuts or other hardships in an already shrinking industry in Britain.

But this could be too late to save Luton’s plant, which has been operating since 1905.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments