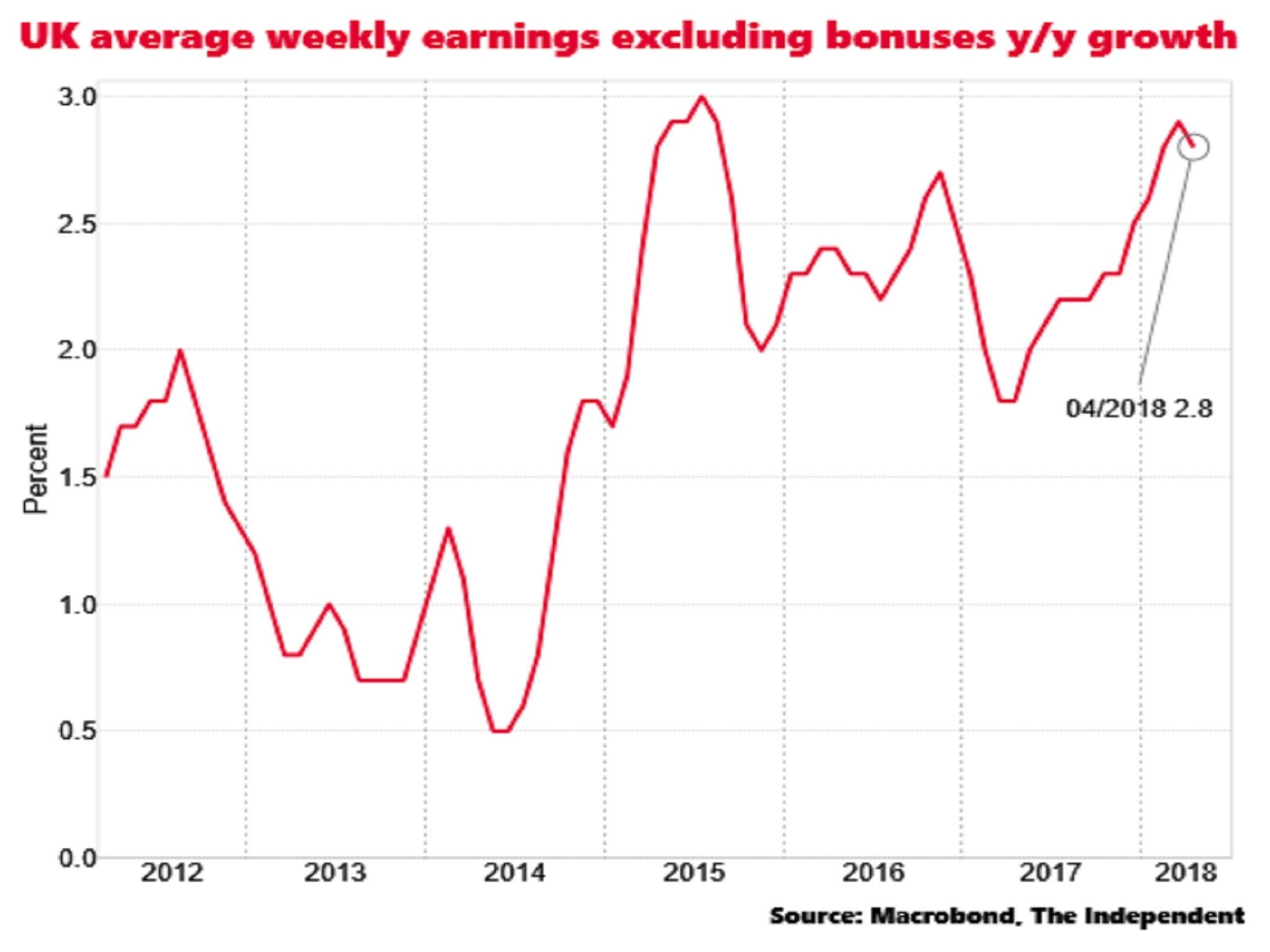

UK wage growth slows unexpectedly in April

Wage growth excluding bonuses, the measure the Bank of England tends to watch closely, slipped to 2.8 per cent, down from 2.9 per cent previously

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.UK wage growth fell short of expectations in April, raising further doubts over whether the Bank of England will raise interest rates this summer.

The Office for National Statistics (ONS) reported that average total wages grew by 2.5 per cent year-on-year in the three months to April, down from the 2.6 per cent rate in the same period to March.

Wage growth excluding bonuses, the measure the Bank of England tends to watch closely, slipped to 2.8 per cent, down from 2.9 per cent previously.

Both figures were lower than the consensus of City of London analysts, though the economy added a robust 146,000 net new jobs in the quarter and the employment rate hit a joint record high of 75.6 per cent.

The Bank of England’s Monetary Policy Committee (MPC) held off from hiking rates to 0.75 per cent in May on account of the slump in GDP growth in the first quarter to just 0.1 per cent.

But the Bank strongly suggested that it would raise rates later in 2018 if the economy bounced back as it expected.

However, manufacturing data for April released on Monday was its weakest since 2012. And Tuesday’s subdued wage data could also dissuade the Bank from hiking rates in August, the date of its next quarterly inflation report.

“Strong employment but softer earnings growth will likely keep uncertainty high about the prospects of an August interest rate hike by the Bank of England. We suspect that there is an increased chance that the Bank of England will hold fire on interest rates until November, given that the MPC wants to see clear, sustained evidence that the UK economy has improved from its first quarter relapse before hiking,” said Howard Archer of the EY Item Club.

“We still think that wage growth will incrementally rise this year, given that many firms are reporting severe recruitment difficulties. Wage growth should also strengthen in July, when the pay of 1.3 million NHS workers will rise by 3 per cent and backdated payments from April will be made,” said Samuel Tombs of Pantheon.

But Mr Tombs added that “the slowdown in GDP growth and labour demand this year means that there is little pressure on the MPC to hike rates until it sees a sustained recovery in wage growth actually come through in the data”.

The ONS reported that the official jobless rate was 4.2 per cent in the three months to April, the lowest since 1975.

Despite the dip in growth, wages are still now rising faster than inflation, which dipped to 2.4 per cent in April, according to the ONS.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments