UK interest rates may soon rise as Bank of England committee member signals he may vote for increase

'The evolution of the data is increasingly suggesting that we are approaching the moment when Bank Rate may need to rise,' said Gertjan Vlieghe

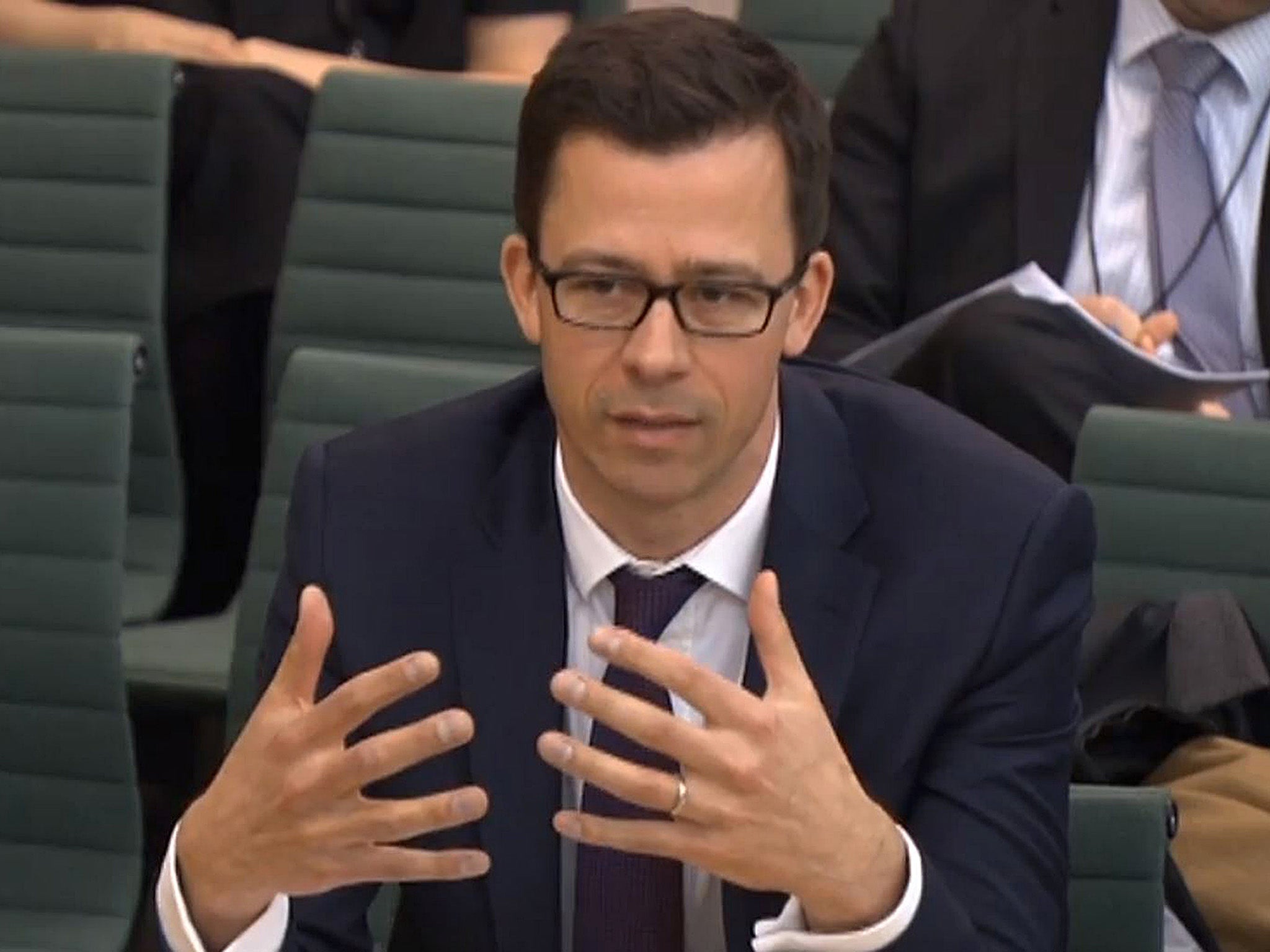

A dovish member of the Bank of England’s Monetary Policy Committee has signalled that he may be preparing to vote for a rate rise, reinforcing the impression that the central bank is about to put up the cost of borrowing for the first time in a decade.

In a speech on Friday, Gertjan Vlieghe, said: “The evolution of the data is increasingly suggesting that we are approaching the moment when [the] bank rate may need to rise.”

The nine-member Monetary Policy Committee voted on Thursday by 7:2 to keep rates on hold at their historic low of 0.25 per cent.

But the minutes of the meeting indicated that rates were also likely to rise “over the coming months” if the economic outlook develops as they project.

That implied an increase in rates to 0.5 per cent as soon as November, much earlier than markets were previously pricing in.

Sterling jumped to $1.3561 in the wake of Mr Vlieghe’s comments, up 1.2 per cent on the day to its highest level since June 2016.

Mr Vlieghe, a former partner at the hedge fund Brevan Howard who joined the MPC as an external member in 2015, had cemented his reputation as a dove in an interview with the The Independent in July when he suggested a rate rise would be “premature” and a “mistake”.

But on Friday, speaking to the Society of Business Economists, he said that there were signs of building wage pressure and that consumption had held up over the past year better than he had expected, shifting his view on the merits of a marginal increase in the cost of borrowing.

“If these data trends of reducing slack, rising pay pressure, strengthening household spending and robust global growth continue, the appropriate time for a rise in bank rate might be as early as in the coming months,” he said.

The Bank last put up rates in July 2007.

It cut them to 0.25 per cent, from a previous record low of 0.5 per cent, in August 2016 to support the economy after the Brexit referendum result.

In the wake of his speech Mr Vlieghe also signalled that any tightening would likely be part of a cycle, rather than merely a cancellation of the August 2016 hike.

“It’s obviously more than unwinding last August. We are making that judgement over a three-year period, so it will depend on how the data evolves,” he told reporters.

The two members of the MPC who voted for a rate rise this month were Ian McCafferty and Michael Saunders. The Bank’s chief economist Andy Haldane, who also had a dovish reputation, indicated in June he was moving towards a rate rise.

Assuming Mr Haldane and Mr Vleighe join the two exiting rate rise supporters that would require only one of the other five MPC members to change their minds to deliver a rate rise.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies