UK housing market weakness continues into 2018, finds RICS survey

Royal Institution of Chartered Surveyors reports the net balance for new buyer inquiries in January was -11 per cent, the tenth negative reading in a row

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK housing market’s weakness continued into 2018, according to the latest survey of chartered surveyors.

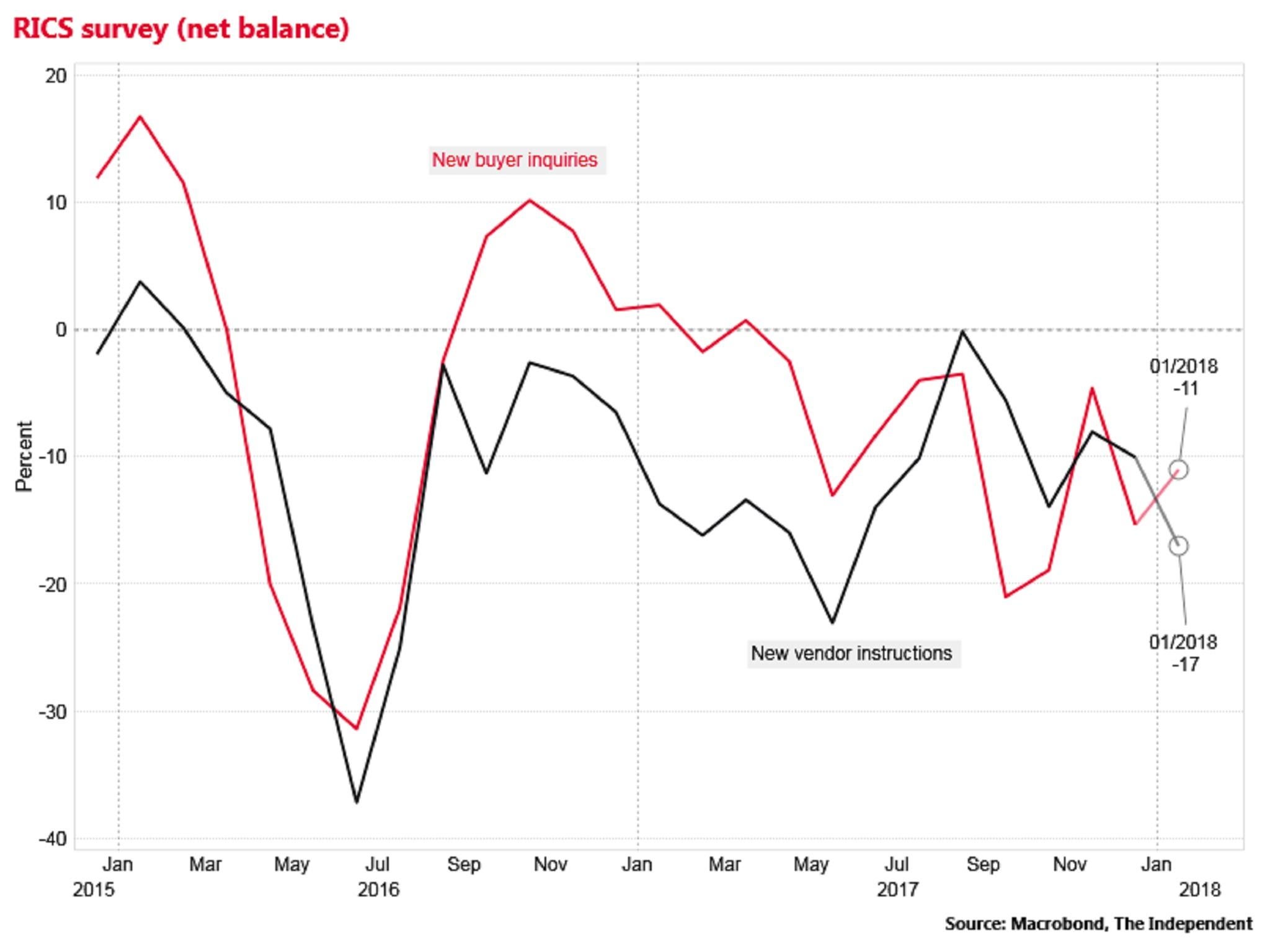

The Royal Institution of Chartered Surveyors (Rics) reported that the net balance for new buyer enquiries in January was –11 per cent, the 10th month in a row that the reading has been negative.

There was also weakness on the supply side of the market, with new instructions by vendors showing a net balance of –17 per cent, the weakest since May 2017.

The latest Halifax report on house prices released earlier this week showed a decline in average year-on-year house price growth to 2.2 per cent in January, down from a rate of 4.5 per cent as recently as October.

The Rics update follows data from the Bank of England showing that new mortgage approvals in December fell to their lowest in three years, and suggests this slackening of demand was not a temporary blip.

“The latest Rics results point to housing transactions at a headline remaining pretty subdued over the coming months,” said Simon Rubinsohn, the chief economist of RICS.

Squeeze on demand and supply

The Rics national price balance was in positive territory at 8 per cent in January, the second successive month of growth.

But it remained deep in negative territory in London and the South-east.

Rics reported that 67 per cent of respondents said sales prices for properties marketed above £1m were coming in below asking prices.

The net balance on prices was also negative in the North and East Anglia.

Several surveyors reported that Brexit and recent stamp duty bikes were having a negative impact on the market.

“Middle and upper market significantly affected by Brexit/Stamp Duty/Buyer profile change,” wrote John Frost of the Frost Partnership in Gerrards Cross, Buckinghamshire.

Before the 2016 referendum the Treasury projected that average national house prices by the end of 2018 could be 10 to 18 per cent lower than otherwise in the event of a Leave vote.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments