UK housing market slump continues due to Brexit uncertainty and stamp duty increases

The RICS national three-month price expectation balance remained slightly negative, with London and the South East again deep in negative territory

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The national housing market remains in the doldrums, weighed down by Brexit-related uncertainty and stamp duty increases, according to the latest report from surveyors.

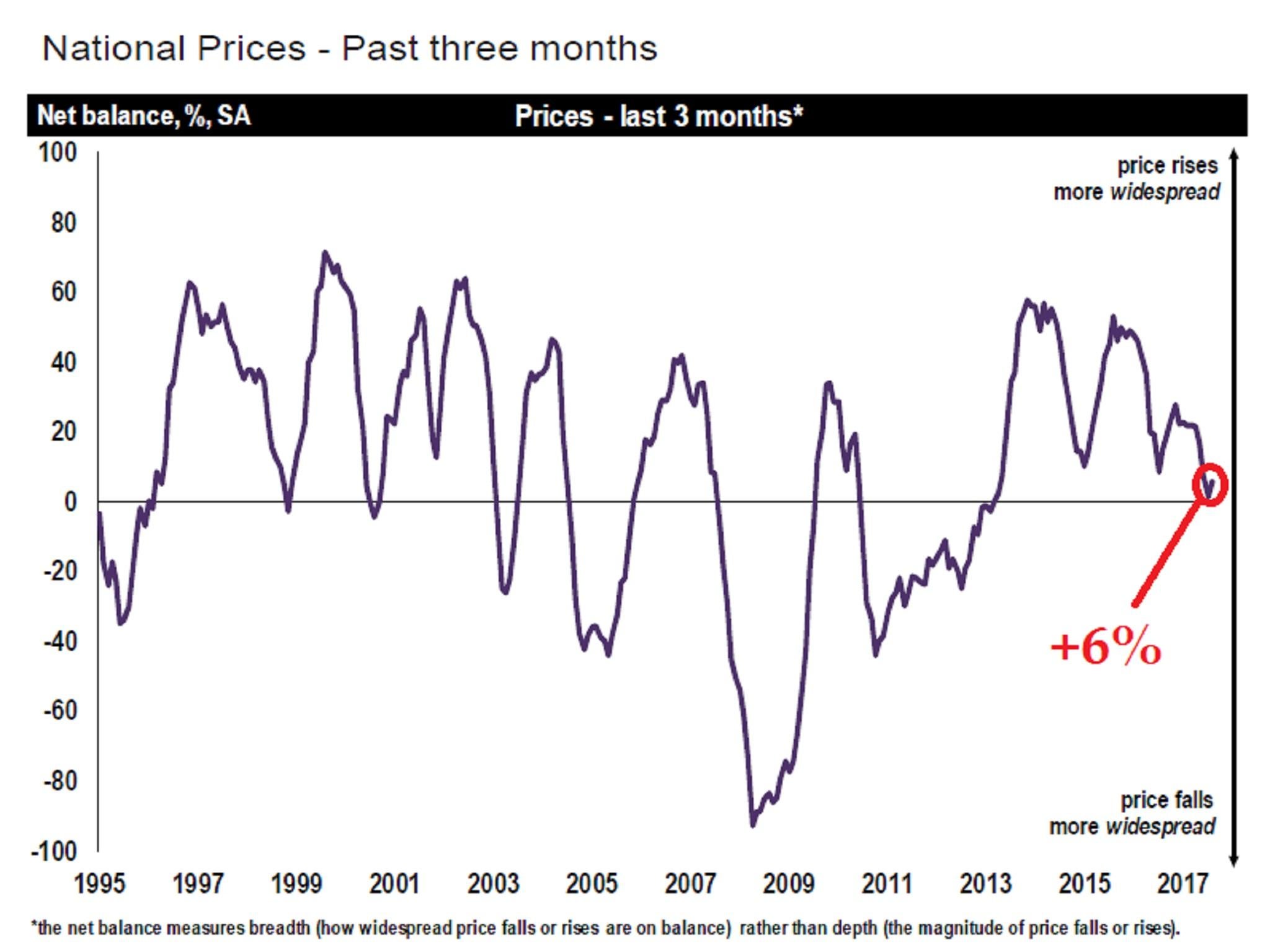

The August survey snapshot from the Royal Institution of Chartered Surveyors (RICS) shows a slight increase in the balance of surveyors expecting price increases over the next month from +1 per cent to +6 per cent.

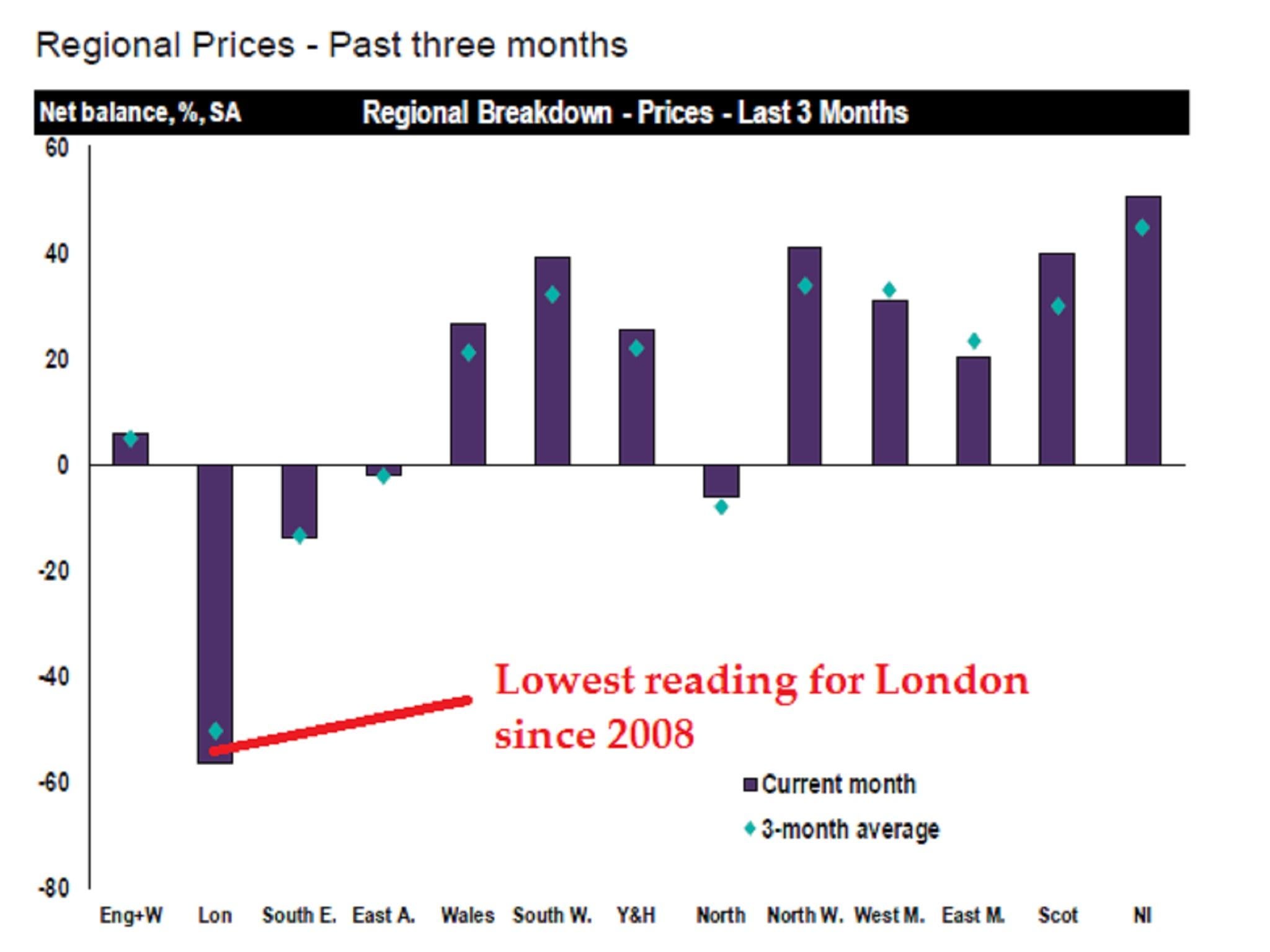

But the reading for London is well in negative territory and hit its weakest level since 2008.

The balance also fell further into negative territory in the South East of England.

There was a positive balance for Northern Ireland, the North West, Scotland and the South West.

The national three-month price expectation balance remained slightly negative, with London and the South East again deep in negative territory.

“Brexit uncertainties [are] not helping [the] market, also stamp duty levels not helping,” said Robert Ikin of surveyors Wright Marshall in Cheshire.

Subdued market

The most recent house prices report from the Office for National Statistics estimated annual house price growth of 5.1 per cent in July, unchanged from June, though down from a rate of 8.2 per cent at the time of the June 2016 Brexit referendum.

The Halifax index showed monthly growth of 2.6 per cent in August, up from 2.1 per cent in July.

However, the Nationwide’s index reported growth slowing from 2.9 per cent in July to 2.1 per cent in August.

Capital weakness

Before last year’s referendum the Treasury projected that house prices in 2018 could be 10 to 18 per cent lower than otherwise in the event of a Leave vote.

At the 2015 Autumn Statement, the previous Chancellor, George Osborne, introduced a three percentage point stamp duty surcharge on second homes and residential properties purchased by buy-to-let investors, which took affect in April 2016.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments