Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

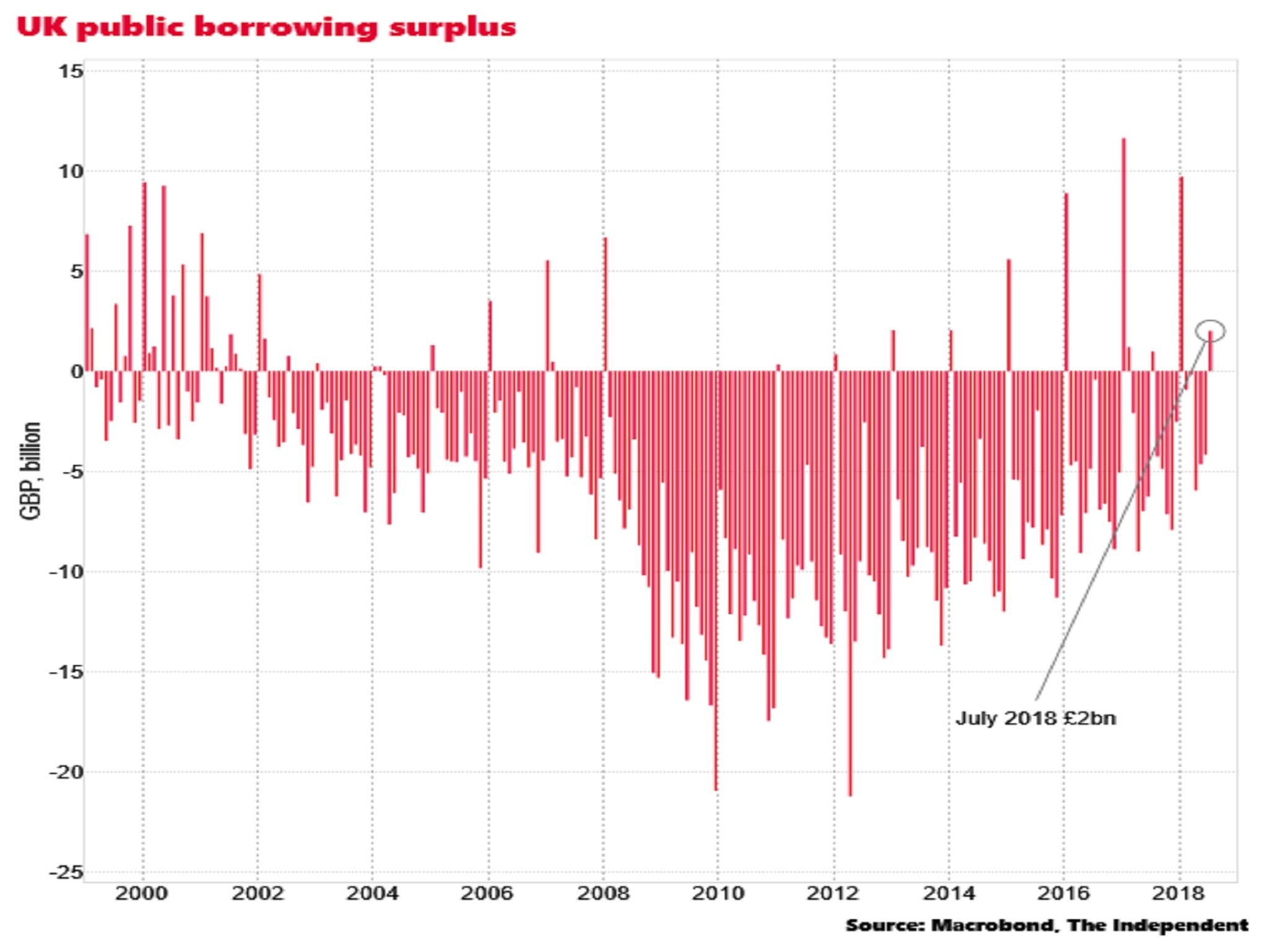

The government has registered its biggest budget surplus for the month of July in 18 years, in a reading likely to ratchet up pressure on the Tories to ease public sector austerity.

The Office for National Statistics (ONS) reported on Tuesday that tax revenues exceeded spending by £2bn in the month, better than the £1bn surplus City analysts had expected.

The last time the government recorded a larger July surplus in cash terms was in July 2000, when there was a £3.8bn surplus.

Total state borrowing for the 2018-19 fiscal year (four months in) is £12.8bn, down from £21.3bn at the same stage in 2017-18

The better than expected borrowing leaves the UK on course to undershoot the Office for Budget Responsibility’s most recent full-year borrowing projection of £37.1bn and will likely increase political pressure on the chancellor, Philip Hammond, to increase spending on overstretched public services in his Budget this autumn.

Largest July surplus since 2000

“As things stand, the chancellor should have some extra money to play with in the Autumn Budget – on top of the scope already contained within his fiscal mandate. And he should be able to deliver the extra funds for the NHS without compromising his fiscal target or having to find savings elsewhere,” said Ruth Gregory of Capital Economics.

“Faced with pressure from his own MPs to boost his party’s opinion poll standing and the political imperative to show that the economy has prospered after leaving the EU in March 2019, we expect the chancellor to use this scope to borrow more,” said Samuel Tombs of Pantheon.

The government has already committed to spend an additional £20bn on the NHS by 2023-24, without specifying where the money will come from.

And other public services are visibly creaking. The prisons minister, Rory Stewart, admitted on Monday that the crisis at HMP Birmingham was linked to large staffing cuts since 2010.

On the current trajectory public borrowing would come in at just £24bn in 2018-19, or around 1.3 per cent of GDP. The chancellor’s fiscal mandate compels him to be on course to run a structural deficit of below 2 per cent in 2020-21.

The ONS reported that in the financial year so far VAT receipts are up 5.7 per cent relative to the same period in 2017-18, while income and capital gains tax takings are 6 per cent higher. Corporation tax receipts are up 1.8 per cent.

But current spending is just 0.7 per cent higher.

A Treasury spokesperson said: “Thanks to the hard work of the British people, government borrowing is down by three-quarters and debt is due to begin its first sustained fall in a generation. But we cannot be complacent, and we must keep debt falling to build a stronger economy and secure a brighter future for the next generation.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments