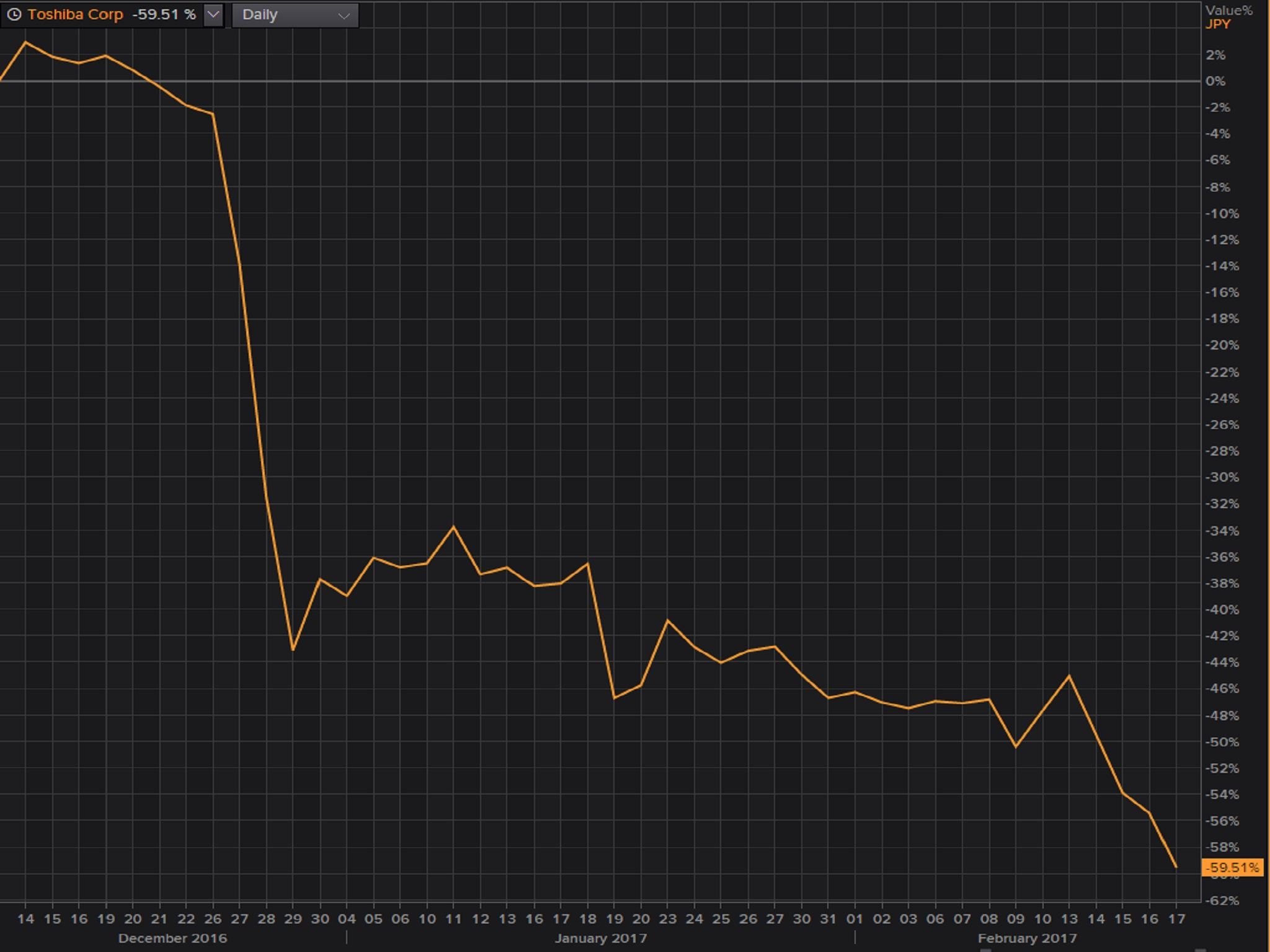

Toshiba shares hammered after credit rating warning

Toshiba owns a 60 per cent stake in NuGen, the group tasked with building a multibillion-pound nuclear power project in Cumbria

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Shares in Toshiba suffered a fresh battering on Friday after Standard & Poor’s said that it might slash the company’s credit rating by several notches.

The ratings company said that if the Japanese conglomerate received financial support that involved it restructuring its debt, S&P would consider it to be entering ‘selective default’.

S&P currently has a rating of CCC+ on Toshiba, implying that holders of its debt face substantial risk of not being repaid. It cut its rating last month and in December.

On Friday shares in Toshiba tumbled close to 10 per cent having already slipped more than 8 per cent on Tuesday after the group’s chairman resigned on the back of the company saying that it would book multi billion-dollar losses on its nuclear operations.

Whatever happens to Toshiba now could also have serious implications for the UK’s energy sector.

Toshiba owns a 60 per cent stake in NuGen, the group tasked with building a multibillion-pound nuclear power project in Cumbria that could create more than 20,000 jobs in the region.

Earlier this week, Kevin Coyne, an officer for trade union Unite, said Toshiba's announcement “is potentially a deeply troubling development and points to the need for the Government to take a more strategic approach in bringing new nuclear power stations on stream”.

Shares in Toshiba have now fallen 60 per cent since 13 December and 22.6 per cent this week.

Additional reporting by agencies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments