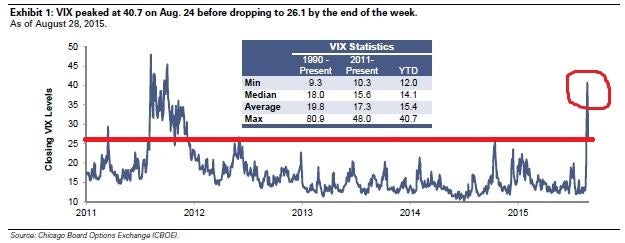

The one chart that shows stock markets only ever move this fast when there's about to be a recession

A Goldman Sachs analyst spotted that the VIX index is at recession levels

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A Goldman Sachs analyst has spotted that the VIX index, which is used to see how fast US stock market prices are changing, is at a level it only usually hits when the US is in recession.

Krag Gregory, a Goldman analyst with four maths degrees who has been called 'the oracle of VIX', said: "While extreme VIX levels periodically occur, our analysis shows that VIX levels in the high- twenties to low-thirties for extended periods of time are rare outside of recessions."

The stock market is in trouble when the VIX goes above the red line

Volatility in the stock market is not the only signal used to tell if the US is in recession, as first noted by Business Insider. But it does show that traders are nervous about something and trading more often. If all those traders got nervous enough to trade in the same direction at the same time, the stock market could plummet.

In fact, Gregory thinks the US is not at risk of recession, and the VIX will actually move lower.

VIX levels only go back to January 1990, but Gregory notes that it has only ever traded in the high twenties or early thirties during a recession. Average VIX levels in the first two recessions (1990-1991, 2001) were 25 and 26 respectively. The worst was the Great Financial Crisis in 2008 and 2009, when average VIX levels were 34.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments