Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

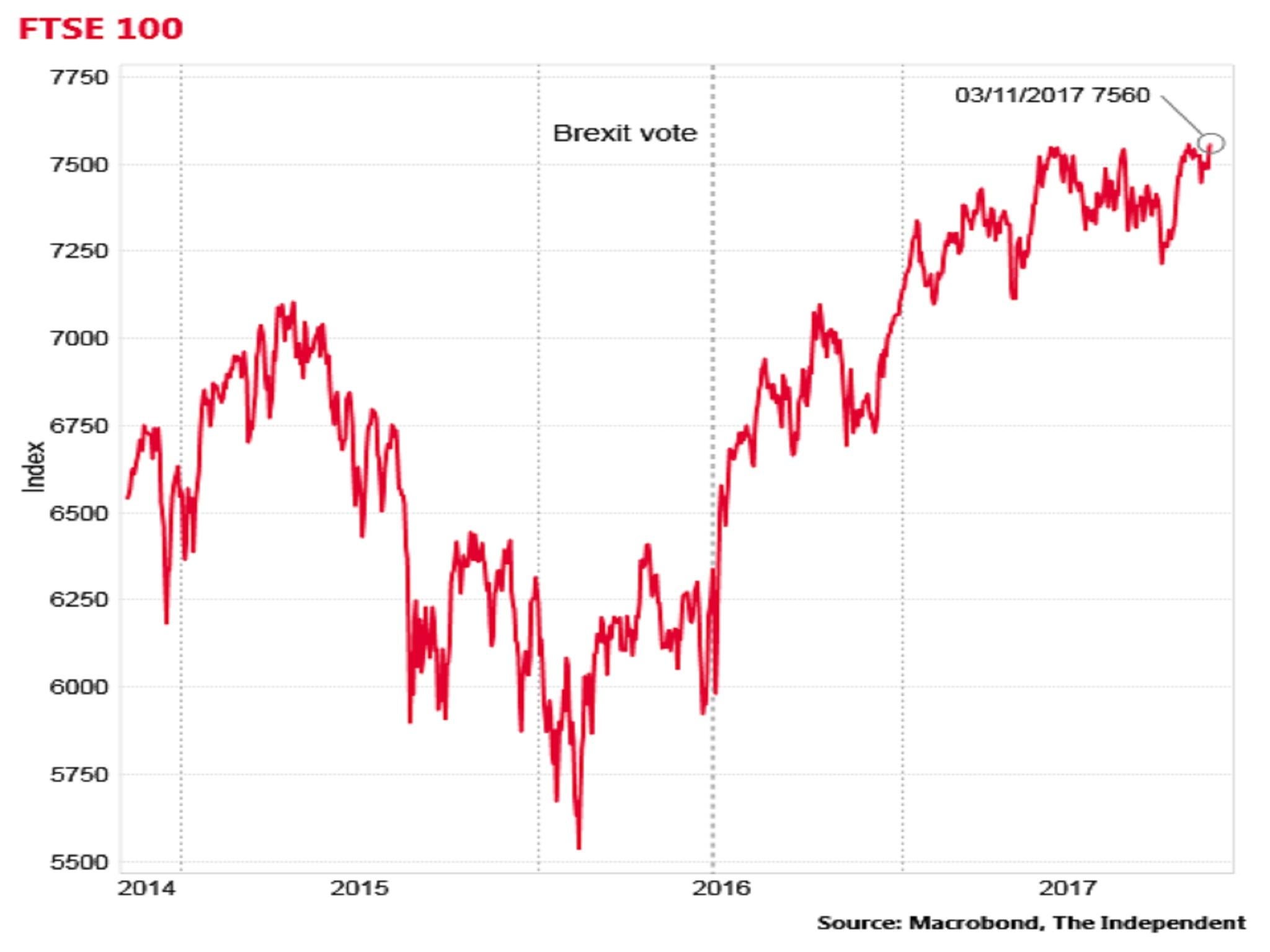

Your support makes all the difference.The FTSE 100 closed at a fresh record high on Friday, despite the Bank of England’s decision earlier this week to raise interest rates for the first time in over a decade.

The UK index of blue chip shares finished the trading session up 0.07 per cent at 7,560.35, beating the previous record close of 7,556.24 set on 12 October.

The FTSE 100 has increased by around 20 per cent since the June 2016 Brexit referendum, although it has been supported by a slump in the pound in the wake of the vote.

Since many of the firms in the index are multinationals with revenues in foreign currencies, a weaker sterling tends to support profits and valuations.

Sterling finished the day up 0.57 per cent against the euro at €1.1262 and up 0.15 per cent against the dollar at $1.3070.

Since the referendum sterling remains 13.8 per cent down against the greenback.

New record high

“Cash savers might still be waiting for the latest interest rate rise to feed through into their bank accounts, but stock market investors continue to reap the rewards of loose monetary policy and an improving global economy,” said Laith Khalaf of Hargreaves Lansdown.

“The global economy is doing pretty well at the moment, and with interest rates still staying low, that bodes well for the prospects for the stock market.”

On Thursday the Bank of England lifted its base rate from 0.25 per cent to 0.5 per cent, the first increase in the general cost of borrowing since July 2007, and the Bank’s forecast suggested at least two more hikes would be needed over the next three years to bring inflation back down to 2 per cent.

However, the decision prompted a 1.7 per cent drop for sterling against the dollar on Thursday, suggesting some scepticism among financial traders about whether such a degree of monetary tightening will be feasible as the UK heads towards Brexit in March 2019.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments