Lloyds public share sale planned for spring – but should you buy?

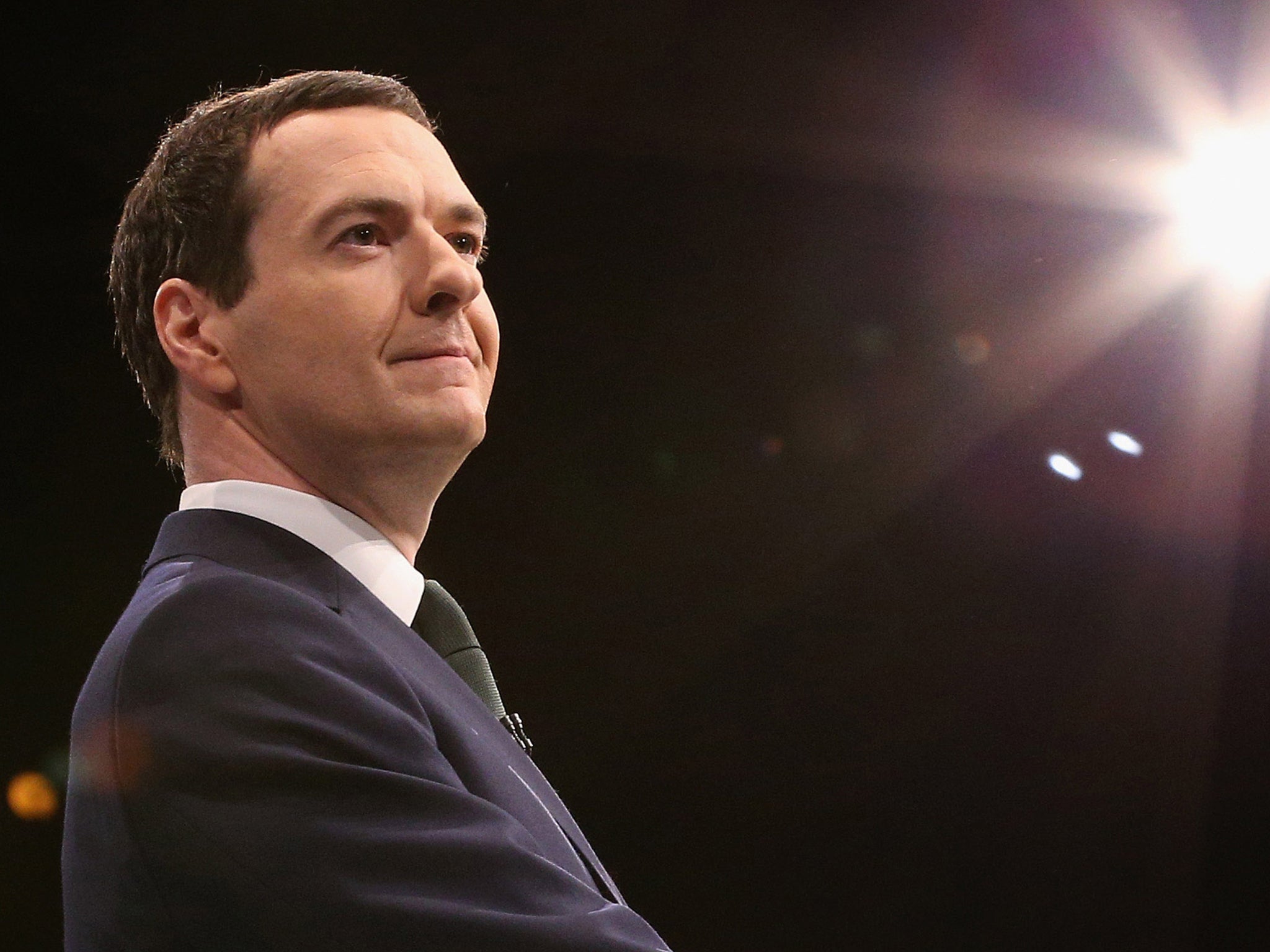

Lloyds shares amounting to £2 billion are to be make available to the public at a five per cent discount, according to Chancellor George Osborne

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Early next year, ordinary people will get the chance to buy shares in one of the banks that they bailed out with taxes after the financial crisis in 2008.

Lloyds shares amounting to £2 billion are to be make available to the public at a five per cent discount, according to Chancellor George Osborne, as the Government tries to sell off its final stake in the bank that had to be rescued for £20 billion in 2009.

Up to now, institutional investors have bought up shares in Lloyds as they have become available through the steady drip of 1 per cent tranches sold off by Osborne and the treasury this year. But now, ordinary people are encouraged to get involved. Those looking to invest less than £1000 will be given priority. There even one-for-10 bonus share for anyone who hangs onto the stock for a year.

But should you buy shares in Lloyds?

The Chancellor has offered certain benefits for getting involved in this share sale.

For a start there's the 5 per cent discount and the bonus scheme, which altogether means private investors are looking at a 15 per cent discount on what the shares would normally cost.

Plus, there's the expected dividend income that comes along with being a shareholder. It is estimated that that will be about 4 per cent of the share price, which a much better rate that most savings accounts are currently offering.

Bank shares are also seen as a play on economic growth, which is expected to hit 2.4 per cent this year.

Since its bailout Lloyds bosses have been working to turn the bank around and their efforts have been bearing fruit.

It recently resumed paying a dividend and first-half profits rose 15 per cent to £4.4 billion this year.

Is there any reason to stay away from the sale?

As with any stock, share prices can go down as well as up, so there is always a risk investing in such assets.

And while the discount may seem generous, the full 15 per cent offer is only available to those who hold onto their shares for a year, in which time the share price could fluctuate.

It's also worth bearing in mind that Lloyds is exposed to the property market as a large portion of its lending involves mortgages.

There could therefore be a knock-on effect on the bank if the housing market suffers, or if mortgages get more expensive to repay as the interest rates rise.

Banks are also having to deal with a lot of new regulation and it's not yet clear what the total impact of the changes will be on profitability.

How do you buy shares?

The government hasn't released the full details of how it would work, but if it's like the Royal Mail privatisation it's likely that retail investors would be able to pick up shares through brokers like Hargreaves Lansdown and Barclays.

At this stage, all prospective buyers should do is register their interest here.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments