Brexit latest: September services growth casts doubt on new Bank of England rate cut

The Markit/CIPS Purchasing Managers’ Index came in at 52.6 in the month, with any reading above 50 signalling expansion

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The UK’s services firms continued to grow in September, according to the latest survey snapshot of the dominant sector.

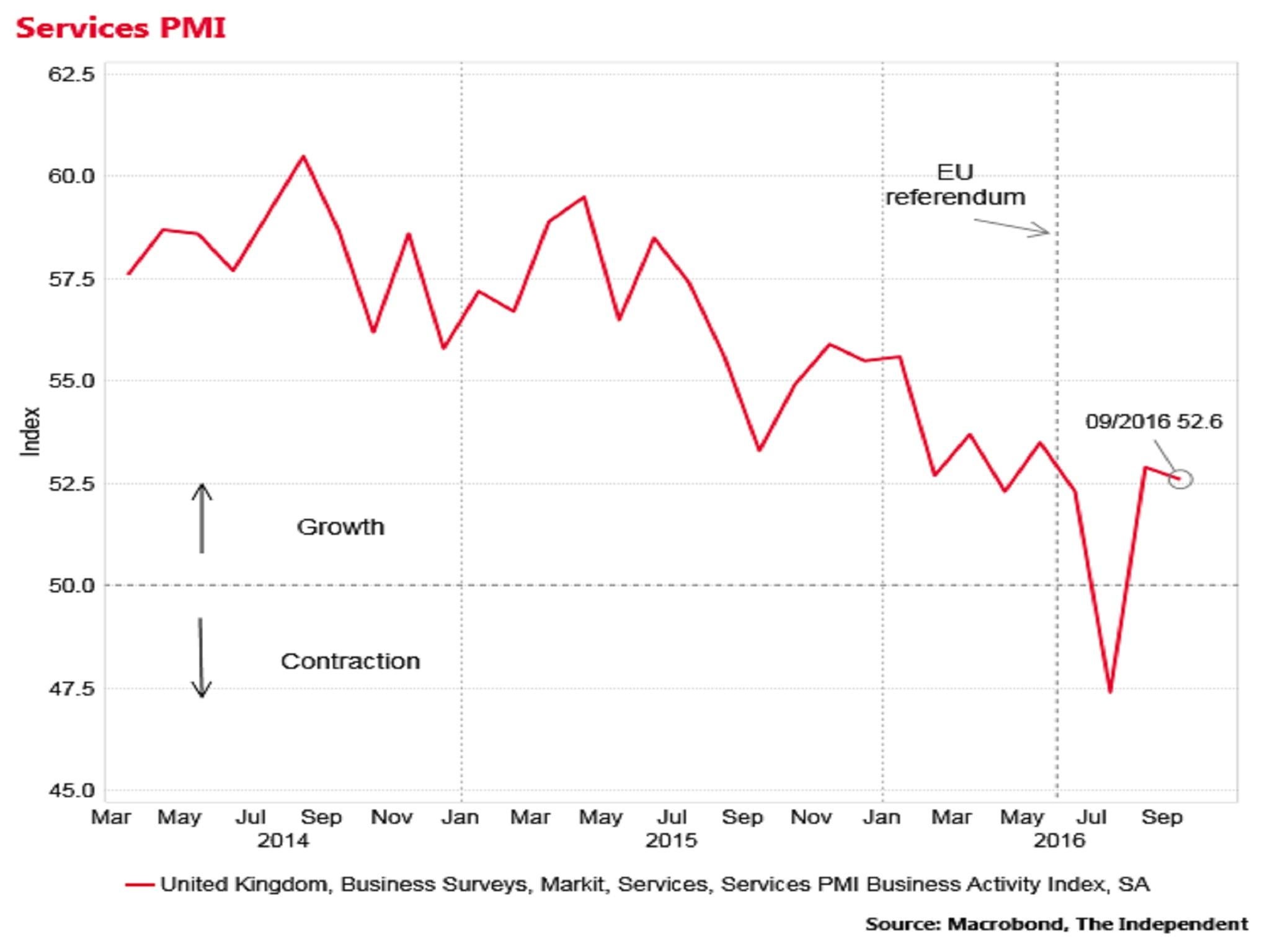

The Markit/CIPS Purchasing Managers’ Index came in at 52.6 in the month, with any reading above 50 signalling expansion.

The reading was higher than the 52 that City of London analysts had pencilled in, although it was slightly down on the 52.9 seen in the previous month.

Still growing

Chris Williamson of IHS Markit said the decent reading confirmed that the economy has not been adversely affected so far by the 23 June referendum vote, despite an ominously big plunge in survey indicators in July.

He added that the strong services reading was likely to “cast doubt” on the likelihood of another Bank of England rate cut next month.

The Bank had signalled that it would cut rates below 0.25 if the economy seemed to be deteriorating on the path it expected.

However, Ben Broadbent, a deputy governor of the Bank of England this morning said that it was not wise to “over interpret” the incoming survey data.

“The wiser course is to wait for the November Inflation Report, which gives us a good opportunity to reflect more systematically on the news since August, and what it implies – if anything – for the medium-term outlook,” he said in speech in London.

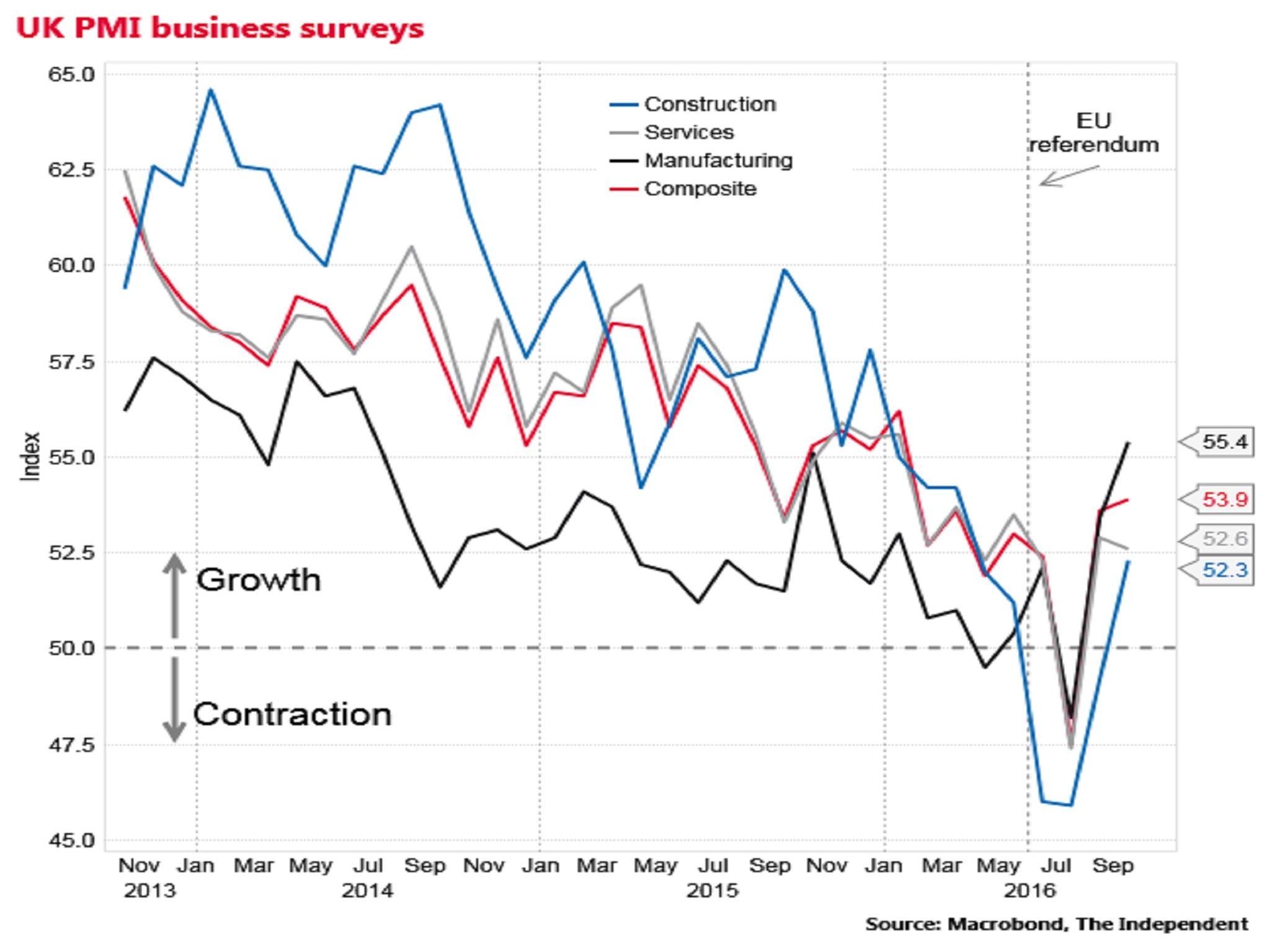

The strong services print for September follows much better than expected survey readings for manufacturing and construction earlier this week.

Analysts said the PMI surveys for the third quarter of the year, based on past relationships, were consistent with GDP expanding by 0.1-0.2 per cent, down from the 0.7 per cent output growth in the second quarter.

But Samuel Tombs of Pantheon said third-quarter growth could be as high as 0.5 per cent, since the correlation between the PMIs and the official data had weakened recently.

The Bank of England in August expected GDP growth to slow to 0.1 per cent, but is now anticipating 0.3 per cent growth.

Receding recession risk

“In aggregate the UK has lost some momentum and this will be increasingly evident in coming quarters,” said James Knightley of ING.

“The uncertainty Brexit is generating will likely lead to slower employment growth and a decline in investment, while rising inflation will eat into household spending power as we move through 2017.”

Howard Archer of IHS Global Insight also said that a slowdown was still likely.

“While the economy is currently holding up well, we still suspect that it will lose momentum over the coming months as uncertainty is fuelled by Article 50 being triggered by the end of March 2017 and likely very difficult negotiations with the EU increasingly come to the forefront,” he said.

The IMF yesterday reduced its 2017 UK growth forecast to 1.1 per cent due to Brexit, although it revised up its 2016 expectation to 1.8 per cent on the back of stronger than expected growth earlier this year.

Markit/CIPS said that new services business rose at the fastest pace since February and that the rate of job creation also picked up. But it added that future expectations remained “very low” by historical standards.

The PMI for September also showed the sharpest increase in service sector input prices in more than three and half years, reflecting the plunge in sterling since the 23 June referendum vote.

The pound this morning sank to a new 31-year low against the dollar as fears mount among currency traders that the UK is heading out of the single market by 2019.

Services account for just under 80 per cent of UK GDP so surveys of the sector are very closely watched by analysts.

The PMI survey covers transport, communication, finance, computing as well as hotels and restaurants.

It does not, however, cover retailers.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments