The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Pound-Dollar exchange rate: Sterling hits one-month high after Mark Carney hints at UK interest rate rise

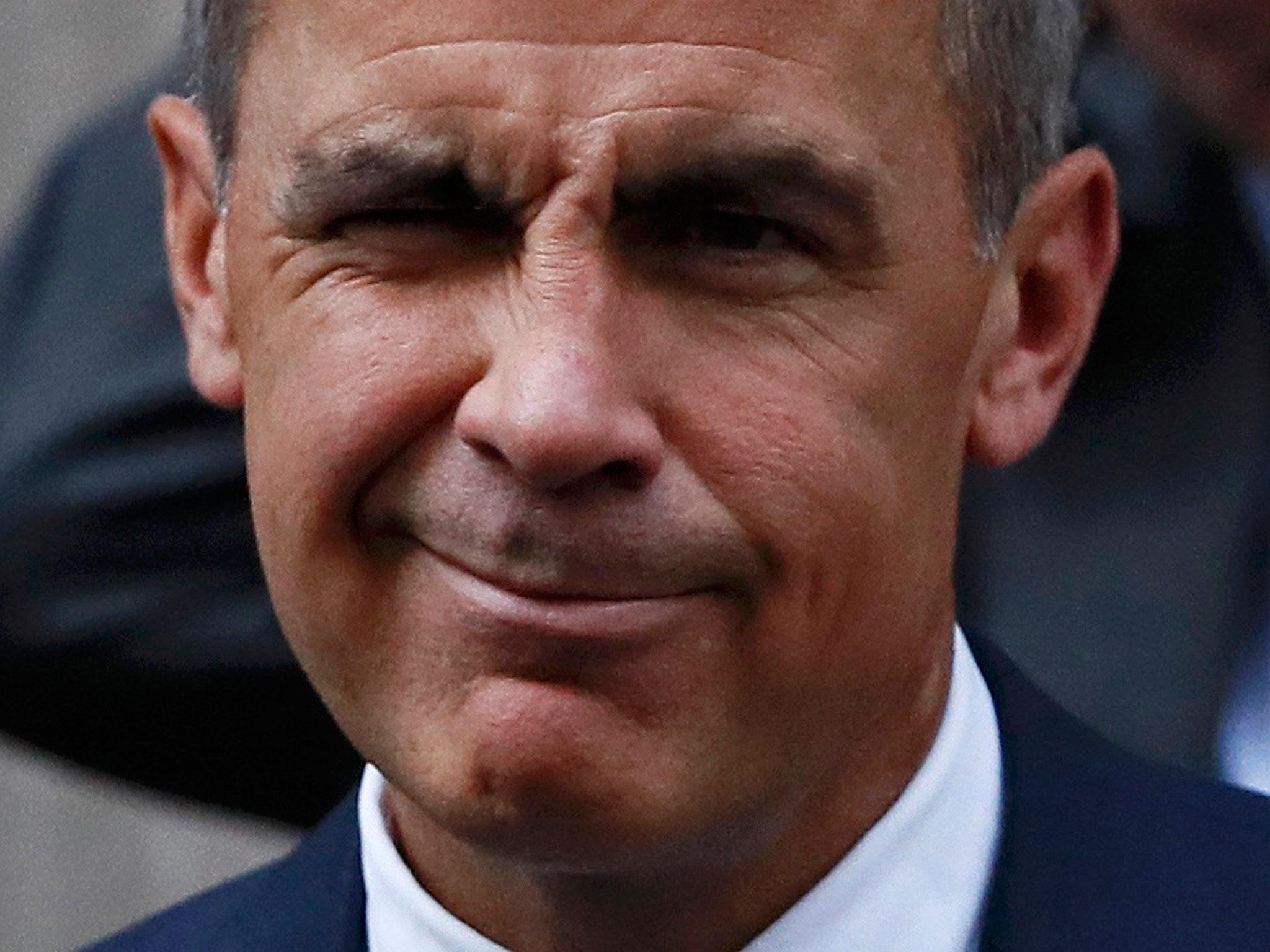

The Bank of England Governor gave his clearest signal yet that an interest rate rise could be on the way

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The pound maintained its gains against the dollar on Thursday after jumping to a one-month high following Mark Carney’s comments hinting at an interest rate rise.

The Bank of England Governor gave his clearest signal yet that an interest rate rise could be on the way, saying on Wednesday that “some removal of monetary stimulus is likely to become necessary if the trade-off facing the [Monetary Policy Committee] continues to lessen."

Sterling was trading just below $1.30 on Thursday morning.

Some analysts believe the Bank could raise rates as soon as the August MPC meeting. MUFG currency analyst Lee Hardman said: “We believe that the majority on the MPC is closer to raising rates than widely assumed. The recent surprise signal from previous arch dove BoE Chief Economist Haldane that he is close to raising rates has highlighted that opinions on the MPC can change quickly.”

See how much you could save on international money transfers with HiFX: sign up and make a transfer

The Bank of England's chief economist, Andy Haldane, surprised traders earlier this month by saying he was ready to raise rates, having previously positioned himself at the dovish end of the spectrum on rates. Mr Carney's and Mr Haldane's comments were interpreted as signalling a shift in the overall MPC orientation.

The MPC split 5-3 earlier this month over whether to raise rates from 0.25 per cent to 0.5 per cent.

In that vote the Governor and Mr Haldane both voted to hold. The three members in favour of a rate hike were Michael Saunders, Ian McCafferty and Kristin Forbes. Ms Forbes is leaving the MPC and will be replaced at the next meeting in August by Silvana Tenreyro.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments