Taylor review on self-employment cannot recommend changes to tax policy

Matthew Taylor has told The Independent that he will, nevertheless, not shy away from highlighting the issue and that he believes the Treasury is already looking at reform

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The independent review headed by Matthew Taylor into the rights of self-employed and gig-economy workers has terms of reference from the Government that prevent it from recommending that the Treasury close loopholes in the tax system.

However, Mr Taylor has told The Independent, that his report will nevertheless not shy away from highlighting the issue of tax and that he believes the Treasury is moving in the direction of reform in any case.

The Institute for Fiscal Studies has highlighted that the current National Insurance system makes it considerably less expensive for employers to take on a self-employed contractor rather than a full-time employee.

And new analysis by the Trade Union Congress estimates that the sharp rise in self-employment in recent years, to 15 per cent of the workforce, is effectively costing the Government around £2bn a year in revenues.

“We’re not empowered to make tax recommendations but we are looking at why we have the model of work we have and it is clear that part of what drives this is the tax advantages of self-employed status,” Mr Taylor told The Independent, as he launched his review’s regional tour at the Google Campus in east London.

“It’s not frustrating and the main reason is that the Chancellor himself has flagged this up in the Autumn Statement. The Treasury is doing work on it. This is not something where I’m lobbing missiles at the Treasury and saying you need to think about this.”

In the Autumn Statement in November the Chancellor, Philip Hammond, announced that the Government would clamp down on the self-employed using disguised remuneration avoidance schemes.

At the same time, the Office for Budget Responsibility highlighted the threats to the tax take from the rising trend of self-employed individuals to create their own companies, which pay a lower rate of tax on income than individuals.

Greg Marsh, an entrepreneur and member of the Taylor committee’s expert panel, also said the issue of tax loopholes would not be ignored.

“Tax arbitrage is not a good way to run a company…[but] while there remains a perverse incentive in the tax system, economic actors will use them,” he said.

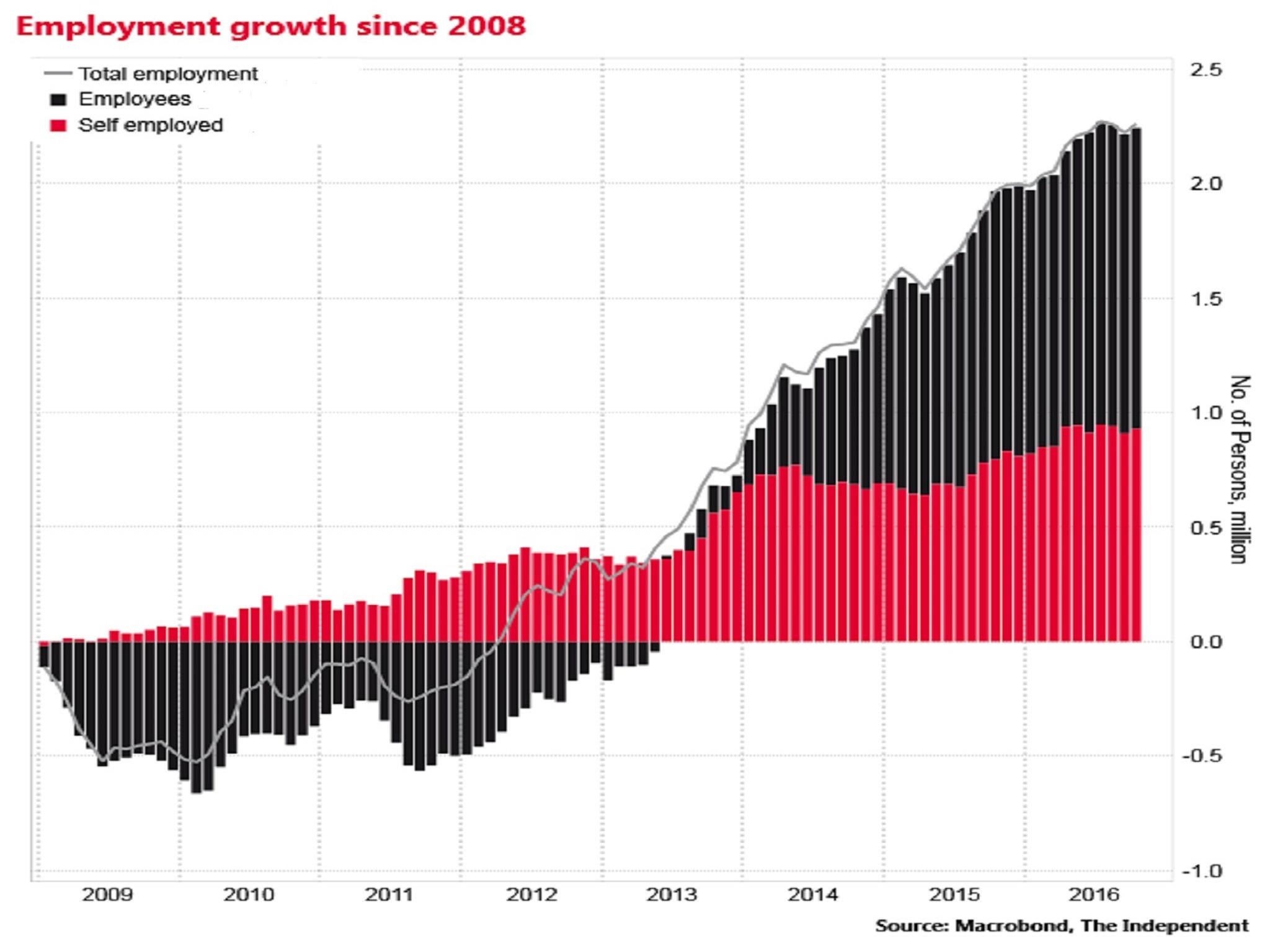

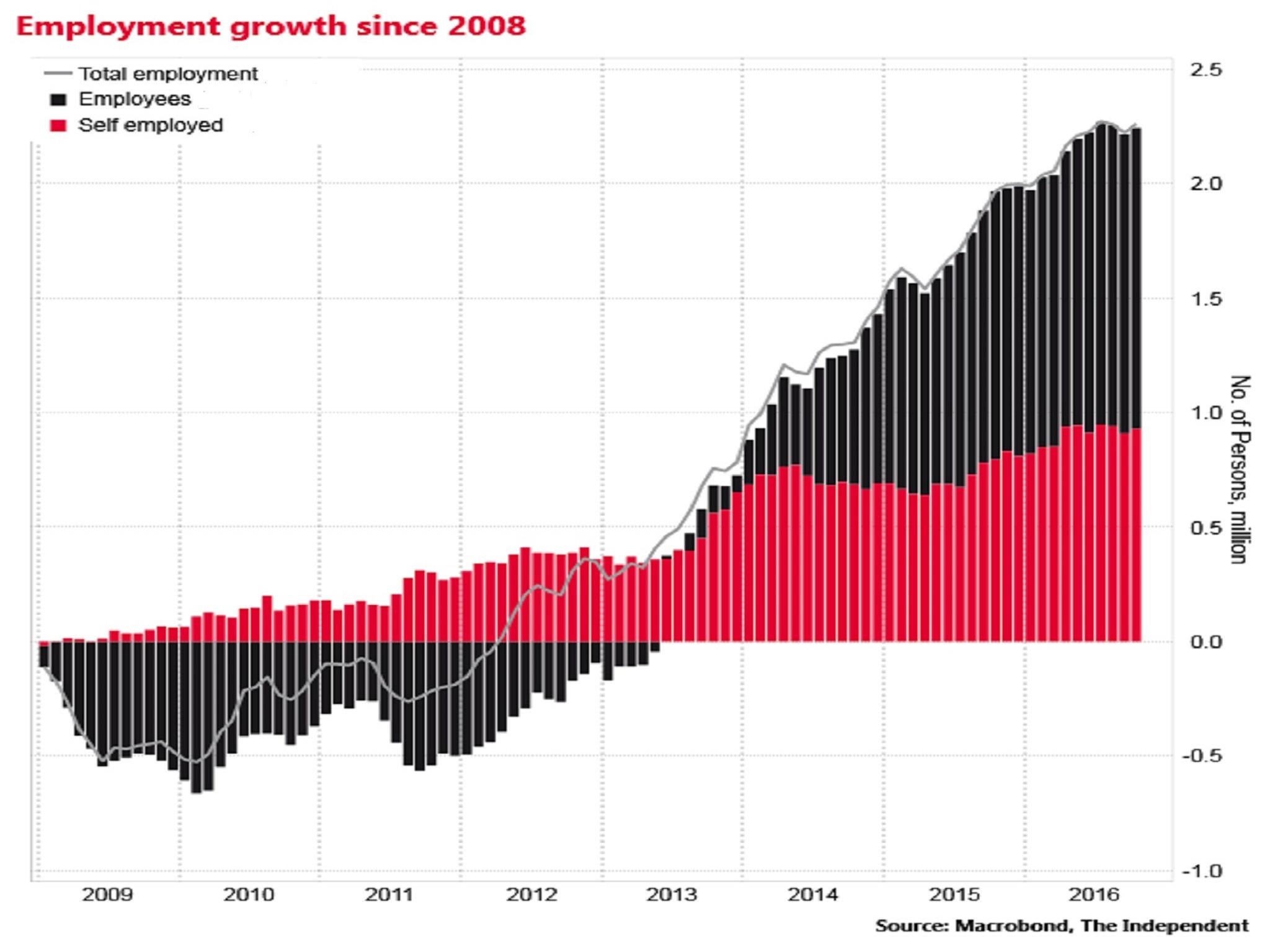

Some 40 per cent of all the 2.2 million jobs created since 2008 have been self-employed. And the typical self-employed worker is estimated to earn 20 per cent less than they did two decades ago according to research by the Resolution Foundation.

The self-employment jobs boom

A non-tax related proposal under active consideration by the Taylor committee is the creation of an official questionnaire website that enlightens someone over their true employment status - whether employee, worker or self-employed – and then shifts the onus onto the employer to disprove it, rather than the worker having to go to court.

Mr Taylor, the head of the Royal Society for the Encouragement of Arts, Manufactures and Commerce think tank and a former head of the Downing Street policy unit under Tony Blair, conceded that making such a system trusted would be problematic, not least checking that people are filling in their details accurately or honestly.

But he added: “We live in a world of machine learning and AI [artificial intelligence]. It shouldn’t be beyond our whit to develop a reasonably flexible tool that you can update and which give people pretty reliable information.”

New economy firms such as the cab-hailing app Uber and the food delivery firm Deliveroo have been accused by campaigners and some workers of dodging their legal and financial responsibilities to their workforce by designating them as self-employed contractors, rather than employees, meaning they miss out on holiday pay, the minimum wage and pension contributions.

The Court of Appeal ruled last week that a self-employed contractor working for Pimlico Plumbers had, in fact, been a worker.

Mr Taylor said he had already had talks with Uber and Deliveroo.

“Businesses always want to pay as little tax as they can and I’m sure if we make broad recommendations on the direction of travel on tax or employment which increases the burdens for them they won’t be happy about that,” he said.

“On the other hand they also say to me ‘what we want is clarity’ we are creative entrepreneurs. Help us to know what the law is, what the expectations are so we can design our business model around the rule. I don’t think we’re going to make everyone happy but if we do make things clearer for people it will be good for workers and also good for business.”

Mr Taylor was commissioned by Prime Minister Theresa May to lead the review last October.

The regional tour will also visit Maidstone, Coventry and Glasgow to take evidence from employees and employers.

The two other members of the Taylor panel are Paul Broadbent, the chief executive of the Gangmasters Licensing Authority, and Diane Nicol, an employment lawyer.

The final report is due to be delivered in the summer.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments