JP Morgan hailed again as 'saviour of Wall Street'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.There is probably no other institution that could have pulled off what JP Morgan Chase has done in snatching Bear Stearns – until last weekend the fifth largest bank on Wall Street – in such rapid fashion and at a price so startlingly low. Even Bear Sterns' glittering Madison Avenue skyscraper is included in the deal.

It helps that among major financial houses, JP Morgan Chase has so far suffered the least damage from the worsening credit crisis. For that it largely has Jamie Dimon to thank: his priority since taking over as chief executive in 2006 has been to bolster its books in preparation for exactly this kind of downturn.

This crisis may be far from over. But it is possible that Mr Dimon, who was celebrating his 52nd birthday last Thursday night when word first reached him of the extent of Bear Stearns' predicament, will have earned a place in the history books as a saviour of Wall Street in one of its darkest hours. And that will be fitting, too. Because it is a club where one name towers above all others: JP Morgan.

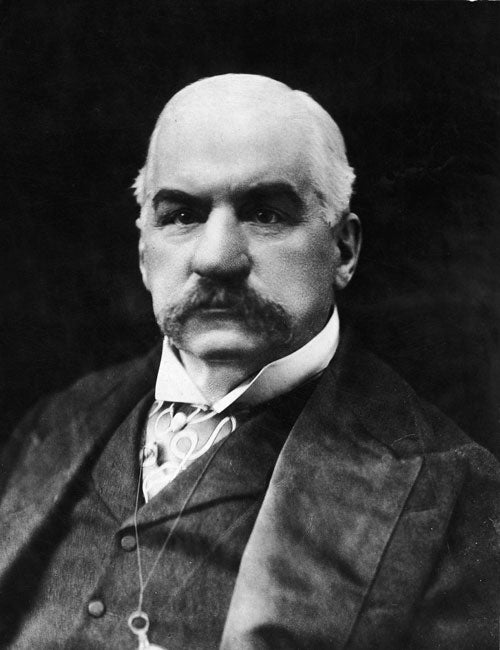

It is just over century since John Pierpont Morgan stepped in to save New York from almost certain financial meltdown in circumstances that have some similarities with those of today. On that occasion, in late 1907, the institution tumbling into the abyss was the Knickerbocker Trust Company. Other banks were refusing to honour its cheques, quickly triggering a system-wide panic. As head of the banking empire whose foundations had been laid mostly in England by his father, Junius Spencer Morgan, in the mid and late-1800s, J P Morgan took the rudder in the storm, creating a consortium with other bank and trust leaders to provide funds for banks that were similarly teetering. Within weeks, the Panic of 1907, as it was known, was largely over and Morgan became a hero.

As in the case of Bear Stearns, Mr Morgan received assistance in his endeavours from the federal government. He persuaded the Treasury Secretary, George Cortelyou, to make available $35m (£17.5m) in additional funds to increase liquidity – a significant sum at the time.

Within a few years of the scare, Washington acted to create a central banking system for the United States which became the Federal Reserve of today.

Reflecting on the crisis of 1907, Woodrow Wilson, who was later to become US President, wrote: "All this trouble could be averted if we appointed a committee of six or seven public-spirited men like J P Morgan to handle the affairs of our country."

A more detailed study of the period would reveal, however, that Mr Morgan was among those who sought to destabilise Knickerbocker in the first place.

It would be wrong, moreover, to equate today's JP Morgan Chase – or indeed Mr Dimon – with J P Morgan himself. By his death in 1913, he had eclipsed even the great industrialists Carnegie and Rockefeller in wealth and influence. Among his creations was the electronics giant General Electric. He was also a philanthropist who bequeathed most of his art collection to the Metropolitan Museum of Art.

The family tree of today's JP Morgan Chase is more complicated than a straight line of descent from Morgan and his father. It came into being in its current form – now about to change again with the gobbling of Bear Stearns – when Chase Manhattan Bank acquired JP Morgan and Company in 2000. (Chase had itself been purchased by Chemical Bank just four years earlier.)

Attached to the legend of Mr Morgan is the saying: "If you have to ask the price, you can't afford it." This is advice Mr Dimon presumably did not heed when he secured Bear Stearns over the weekend for a mere $2 a share. He can afford it.

The great crashes

*1907: The Panic

The banker's Panic of 1907 is regarded as the first great financial crisis of the modern era after the collapse of the South Sea Bubble and John Law's Mississippi Scheme some two centuries previously.

*1929: The Wall Street Crash

The financial disaster of 24 October 1929 saw 12,894,650 shares traded in panic selling on the New York Stock Exchange. Eleven speculators had killed themselves by 12.30pm. The damage from the crash was partially repaired by F D Roosevelt.

*1974: The British Banking crisis

A boom in the housing market resulting from cheap credit and deregulation, led in turn to a number of smaller banks being taken over and the Bank of England launching a number of rescue packages.

*1990: The Housing Crash

Some 247,000 people lost their homes between 1990 and 1993, as unemployment reached record levels and house prices slumped. The crash gave birth to the phenomenon of the "negative equity trap", where the value of a property falls below that of the outstanding mortgage debt.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments