Intel seals $17 billion deal to buy Altera

The deal will see Intel acquire one of its own customers

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

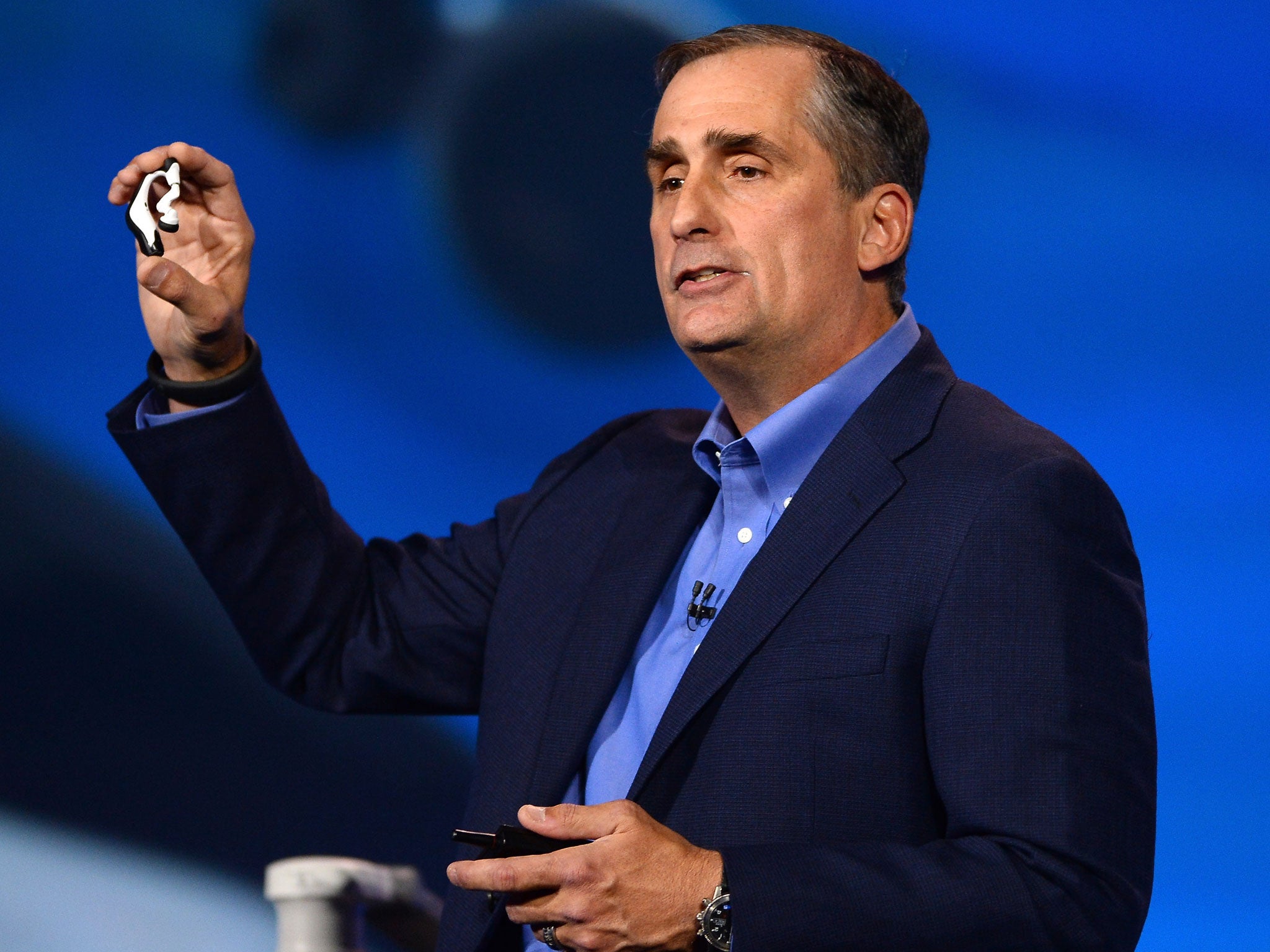

Your support makes all the difference.The microchip giant Intel has agreed to buy its smaller rival Altera in a bid worth $16.7bn (£11bn) in the latest wave of consolidation in the industry.

Altera shareholders will receive $54 per share in cash from Intel, whose pursuit of its smaller rival has been an open secret since the end of March. Altera is understood to have rejected a similar offer from Intel in April.

The deal will see Intel acquire one of its own customers. Altera designs chips but outsources their manufacture – primarily, although not exclusively, to Intel. Altera’s chips are programmable by customers after purchase and are used widely in cloud computing and smart technology products such as cars and electronic equipment.

The acquisition, which is still to be formally agreed upon by shareholders, will give Intel access to Altera’s range of chips, known as field programmable gate arrays. It will also serve to fend off competition for the lucrative server market from the likes of IBM and the UK’s Arm Holdings.

This is the second major acquisition in the semiconductor market in the last week – on Thursday, Avago Technologies agreed to pay $37bn for Broadcom, a record in the semiconductor industry. Intel will pay for Altera, which posted pre-tax profits of $1.9bn in 2014, using a combination of cash and debt. The boards of both companies have agreed to the terms.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments