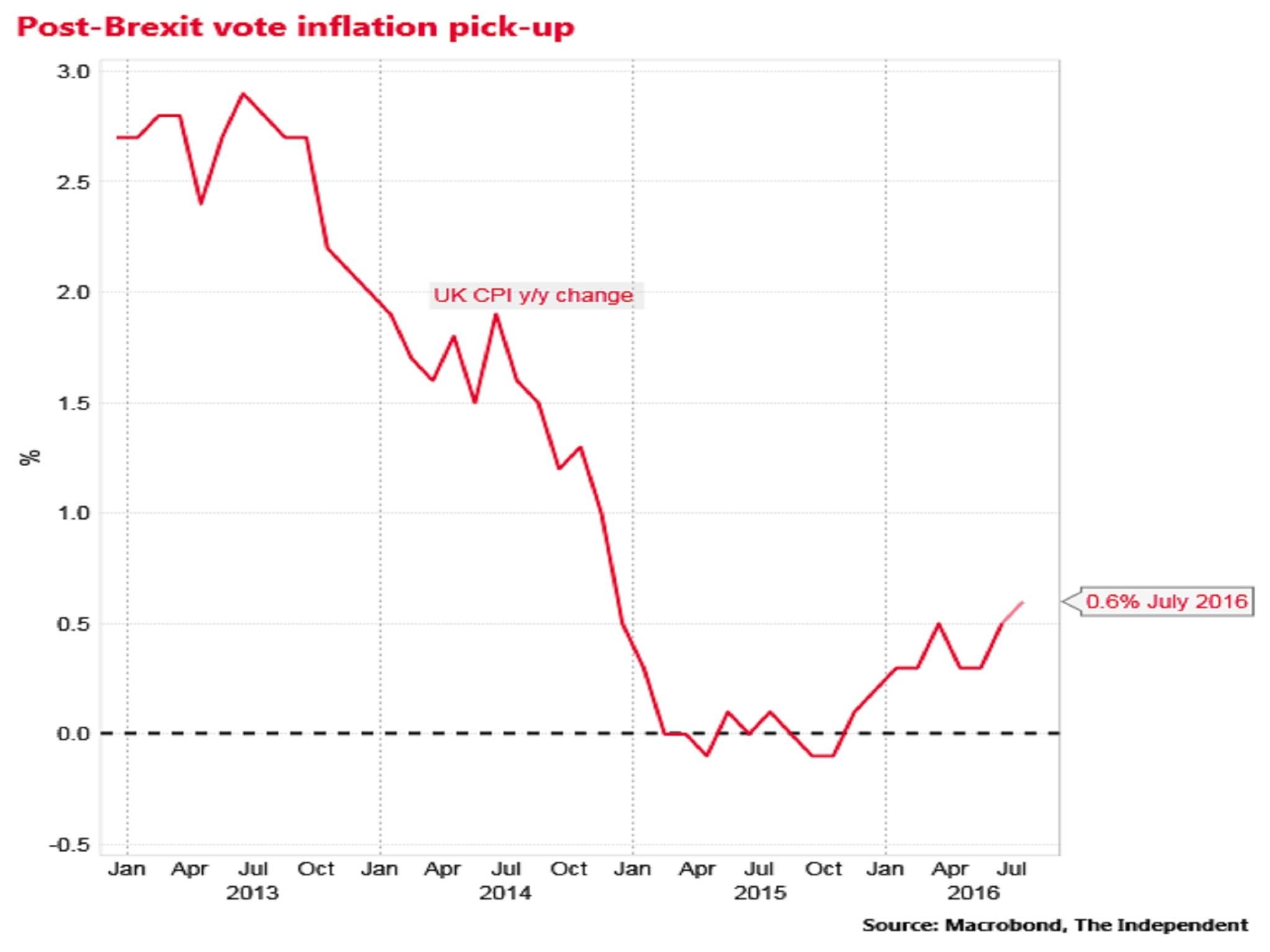

Inflation rises in wake of Brexit vote

The annual rate of CPI hit 0.6 per cent in July, up from 0.5 per cent in June - and analysts predict further increases due to post-referendum sterling fall

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Consumer price inflation picked up in the wake of the UK’s Brexit vote, hitting its highest rate since November 2014.

The Office for National Statistics said the annual rate of CPI inflation was 0.6 per cent, up from 0.5 per cent in June and slightly higher than City of London analysts had been expecting.

Inflation returning

A separate ONS measure of "factory gate" output inflation rose at an annual rate of 0.3 per cent in July, the biggest increase since June 2014, and breaking two years of declines.

Factory input prices, including materials and fuels, jumped by 4.3 per cent year on year, the first increase since September 2013.

This suggests the record fall in sterling in the wake of the June referendum vote is already pushing up the import costs of domestic manufacturers, which is likely to feed through into higher UK consumer prices in the coming months.

Input costs on the up

Samuel Tombs of Pantheon said he expected the consumer price inflation rate to hit 3 per cent next year, above the Bank of England's official 2 per cent target.

"Inflation’s pick-up ... will gain strong momentum in 2017, when sterling’s depreciation will boost core goods inflation" he said.

The data instantly sent the pound up around half a cent against the dollar to $1.2988, although most analysts still expect the Bank of England to cut interest rates again later this year.

“Today’s numbers are unlikely to unseat the Bank of England’s resolve in regards to using monetary policy to try to mitigate some of the negative economic impact from the Brexit shock,” said Andy Scott of HiFX.

Earlier this month the Bank cut its base rate to 0.25 per cent and unveiled a new £170bn programme of monetary stimulus.

The ONS said the main drivers of the increase in the consumer price inflation rate in July were rising prices of motor fuels, alcoholic drinks and accommodation services.

"It looks probable that consumer purchasing power will be significantly diluted over the coming months as inflation trends higher and earnings growth is limited" said Howard Archer of IHS Global Insight.

“Companies may well look to clamp down on workers’ pay as they strive to save costs in a more difficult environment and as imported input prices are lifted by the weakened pound.”

Despite the CPI rate up-tick, the ONS measure of “core” inflation, which strips out relatively volatile energy and food prices, eased from 1.4 per cent to 1.3 per cent in July.

The ONS's latest house price index report today showed average prices rose 8.7 per cent in the year to June, up from 8.5 per cent in the year to May.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments