Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

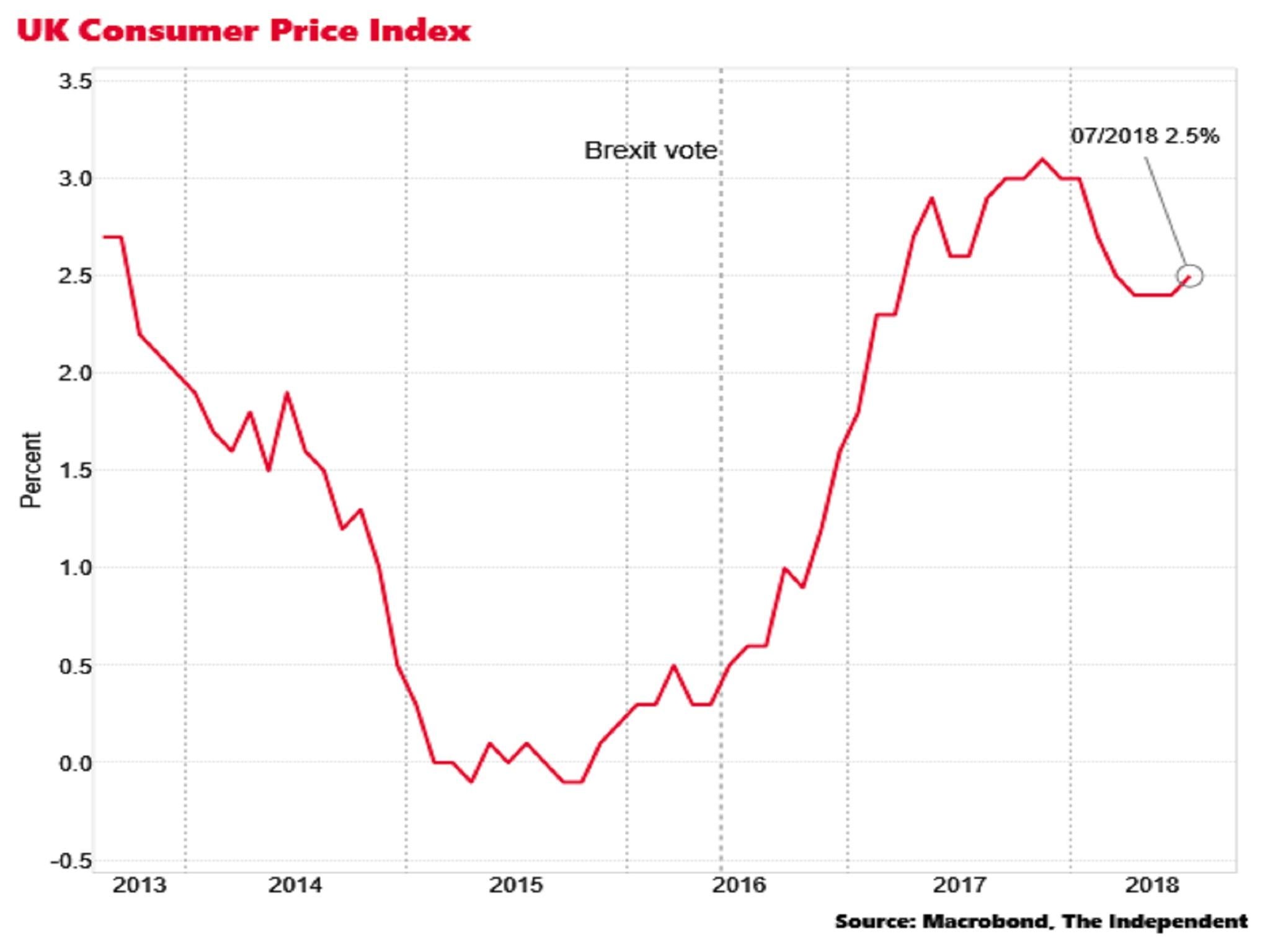

Your support makes all the difference.Inflation rose to 2.5 per cent last month – the first increase in the rate in 2018.

The Office for National Statistics (ONS) reported that the Consumer Price Index (CPI) rose by 2.4 per cent year on year in June, with the increase in line with expectations from City of London analysts.

CPI inflation peaked at 3.1 per cent in November 2017, driven up mainly by higher import costs stemming from the slump in sterling in the wake of the June 2016 Brexit vote. But the rate declined sharply in the first quarter of 2018, until July’s rise.

Core inflation, which excludes volatile food and fuel prices, was 1.9 per cent in July, unchanged from June and again in line with analysts’ expectations.

The latest reading will help settle nerves at the Bank of England, which raised interest rates to 0.75 per cent on 2 August, based on the forecast that inflationary pressures are building in the UK economy.

The increase in the CPI rate in July was driven by higher prices for transport and fuel.

There was some downward pressure from clothing and footwear.

However, many analysts said that the underlying rate of inflation was declining, despite the July increase.

“Our analysis of the prices of the 135,000 goods and services included in the CPI basket suggests that this increase was driven by idiosyncratic factors,” said Jason Lennard of the National Institute of Economic and Social Research.

“Trimmed mean inflation, which is a measure of core inflation that excludes a fraction of the most extreme price changes, fell by 0.2 percentage points to 1 per cent. Based on this analysis, CPI inflation is set to return to the 2 per cent target over the year ahead.”

Retail price inflation (RPI), which is not a national statistic due to well-known flaws in the calculation of the index but is still compiled by the ONS, dipped to 3.2 per cent in July, from 3.4 per cent previously.

The RPI is used by the government to calculate annual regulated train fare rises, meaning that fares will rise by 3.9% from January.

In July 2017 the RPI rate was 3.6 per cent, resulting in the biggest jump in fares in five years in 2018.

Transport secretary Chris Grayling on Wednesday said the rail industry should stop using RPI to guide train workers’ wage settlements and use the lower CPI instead, implying this would allow the government to peg regulated fare increases to the lower rate too.

The ONS separately reported that UK house price inflation dipped to 3 per cent in June, down from 3.5 per cent in May and the lowest rate since August 2013.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments