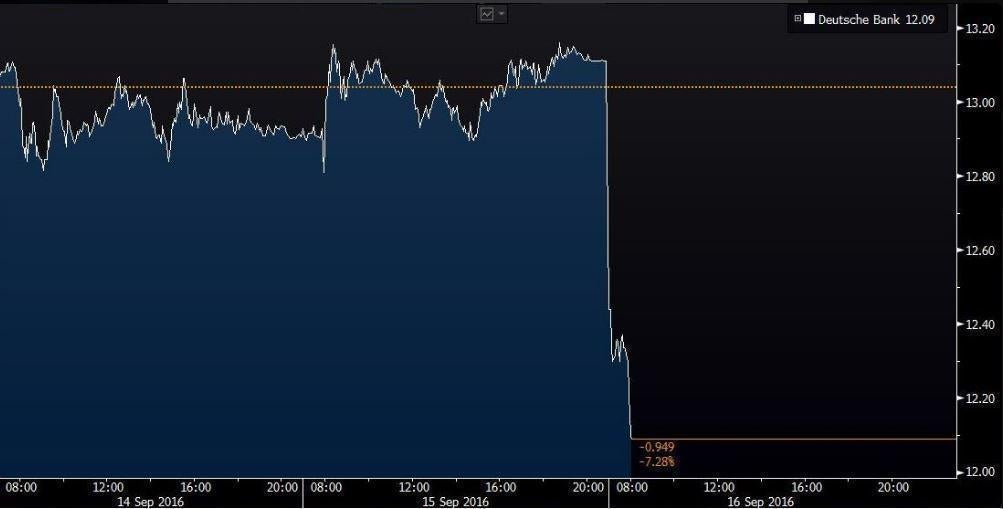

Deutsche Bank shares plunge 8% after it refuses to pay £10.6bn fine

Deutsche Bank said it had no intentions of paying the £10.6bn fine sought by the US Department of Justice

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Deutsche Bank shares slumped after receiving a $14 billion (£10.6 bn) claim from the US Justice Department to settle an investigation into the firm’s sale of residential mortgage-backed securities, a figure the German lender said it’s not willing to pay.

“Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited,” the company said in a statement early Friday in Frankfurt.

“The negotiations are only just beginning. The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts.”

Chief Executive Officer John Cryan, 55, has struggled to boost profitability by selling risky assets and eliminating jobs as unresolved legal probes and claims add to concerns that the lender will be forced to raise capital.

Reaching a mortgage deal would clear a major hurdle for Deutsche Bank, which has paid more than $9 billion in fines and settlements since the start of 2008, according to data compiled by Bloomberg.

“While this number seems very large, it’s obviously a first negotiation point,” Chris Wheeler, an analyst at Atlantic Equities, told Francine Lacqua on Bloomberg Television. “There’s going to be an awful lot of management time spent on it to get to a sensible number.”

Deutsche Bank dropped as much as 8.2 per cent and was down 6.7 per cent at €12.22 (£10.41) at 11:23 am in Frankfurt.

Other European lenders probed in relation to residential mortgage-backed securities also declined, with UBS Group down 2.2 per cent and Credit Suisse slipping 4.4 per cent.

Royal Bank of Scotland dipped 2.9 per cent, while Barclays fell 1.8 per cent.

The bank’s €1.75bn (£1.49bn) of 6 per cent additional Tier 1 bonds, the first notes to take losses, fell 5 cents to 78 cents on the euro, the biggest drop since the UK voted to leave the EU. Deutsche Bank’s £650m of 7.125 percent notes fell 5 pence to 81 pence on the pound, also a record fall.

“They are dropping like a stone,” said Tomas Kinmonth, a credit strategist at ABN Amro Bank in Amsterdam. “The fine, even if reduced, could surpass all provisions held by the bank.”

DOJ Negotiations

Germany’s largest lender confirmed that it had started negotiations with the Justice Department to settle civil claims the US may consider over the bank’s issuing and underwriting of residential mortgage-backed securities from 2005 to 2007. The Wall Street Journal reported the $14bn claim on Thursday.

Bank of America paid $17bn to reach a settlement in a similar case in 2014, the biggest such accord to date. Goldman Sachs agreed to a $5.1bn settlement with the US earlier this year, including a $2.4bn civil penalty and $875m in cash payments, to resolve US allegations that it failed to properly vet mortgage-backed securities before selling them to investors as high-quality debt.

The settlement included an admission of wrongdoing.

The Justice Department, in concluding previous investigations into the sale of mortgage-backed securities that soured during the financial crisis, typically has presented initial penalties higher than what banks ultimately paid, people familiar with those negotiations have said. The sides may negotiate over the final tab, as well as what conduct the bank will acknowledge and whether individuals will be sanctioned.

‘Pushing Back’

Justice Department spokesman Peter Carr declined to comment on the negotiations.

JPMorgan Chase & Co. analysts wrote in a note to clients earlier Thursday that a settlement of about $2.4bn “would be taken very positively,” and that an agreement exceeding $4bn would pose questions about Deutsche Bank’s capital positions and force it to “build additional litigation reserves.” The lender’s common equity Tier 1 ratio, a key measure of financial strength, was at 10.8 per cent at the end of June.

“In defense of protecting its shareholders’ money, Cryan is well within his rights in negotiating a more equitable and just settlement with the US government, and calling this one a punishment that’s several orders of magnitude greater than the crime,” said Tony Plath, a finance professor at the University of North Carolina. Plath expects a final settlement of about $4bn to $5bn.

Settlement Goal

Cryan has said that he aims to settle major outstanding legal issues as soon as possible as part of his wider overhaul. Deutsche Bank had 5.5bn euros set aside for settlements and fines at the end of June, with Chief Financial Officer Marcus Schenck saying in July that the lender will probably face “material” litigation charges in the second half.

In addition to the US mortgage investigation, Deutsche Bank faces litigation and regulatory probes relating to issues such as foreign-currency rate manipulation and precious metals trading. The German bank is a party to 47 civil actions concerning the setting of interbank lending benchmarks, according to its 2015 annual report published in March.

“Obviously I don’t like this amount, it’s too high and it seems that with every settlement, the DOJ wants to get more from European companies,” said Andreas Domke, a portfolio manager at Allianz Global Investors, which owns shares in the lender. “It’s good that Deutsche Bank is pushing back.”

© 2016 Bloomberg L.P

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments