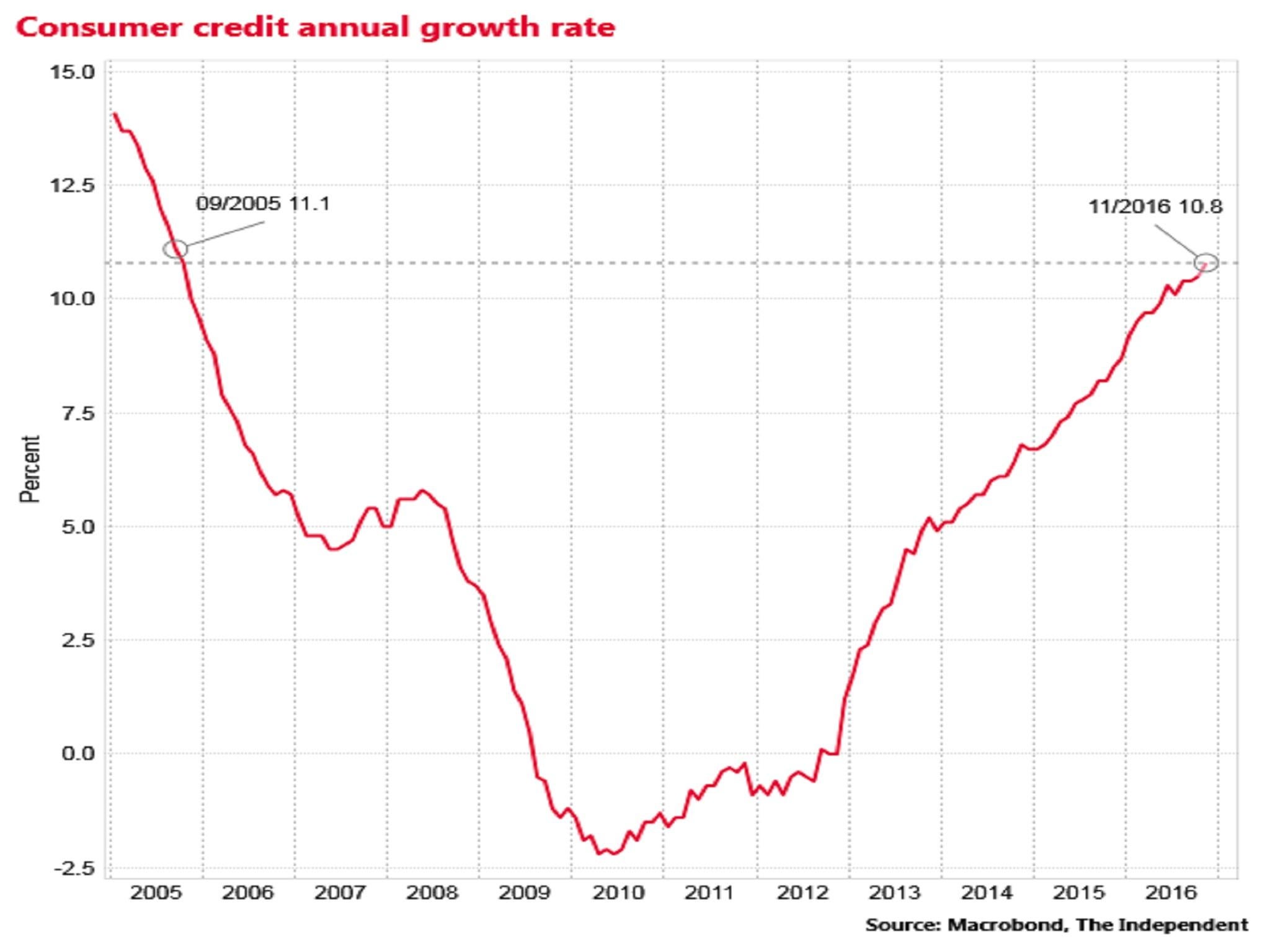

Consumer credit growth hits new 11-year high prompting warnings of 'unsustainable' expansion

Credit rose by a further £1.9bn in the month, taking the 12 month growth rate to 10.8 per cent.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The public continued to borrow heavily in November, according to the latest consumer credit official statistics from the Bank of England.

Credit rose by a further £1.9bn in the month, taking the twelve month growth rate to 10.8 per cent.

That is the fastest rate of growth seen since September 2005, and prompted warnings about the “unsustainable” rate of growth.

City of London analysts had pencilled in growth of around £1.6bn.

Credit card lending rose by £600m and “other loans and advances” – largely car loans and personal loans – rose by £1.4bn in November.

“Such rapid growth in unsecured credit is unsustainable over the medium-term, and the recent fall back in consumer confidence suggests that households will borrow more cautiously in 2017, subduing growth in consumption,” said Samuel Tombs of Pantheon.

New 11-year high

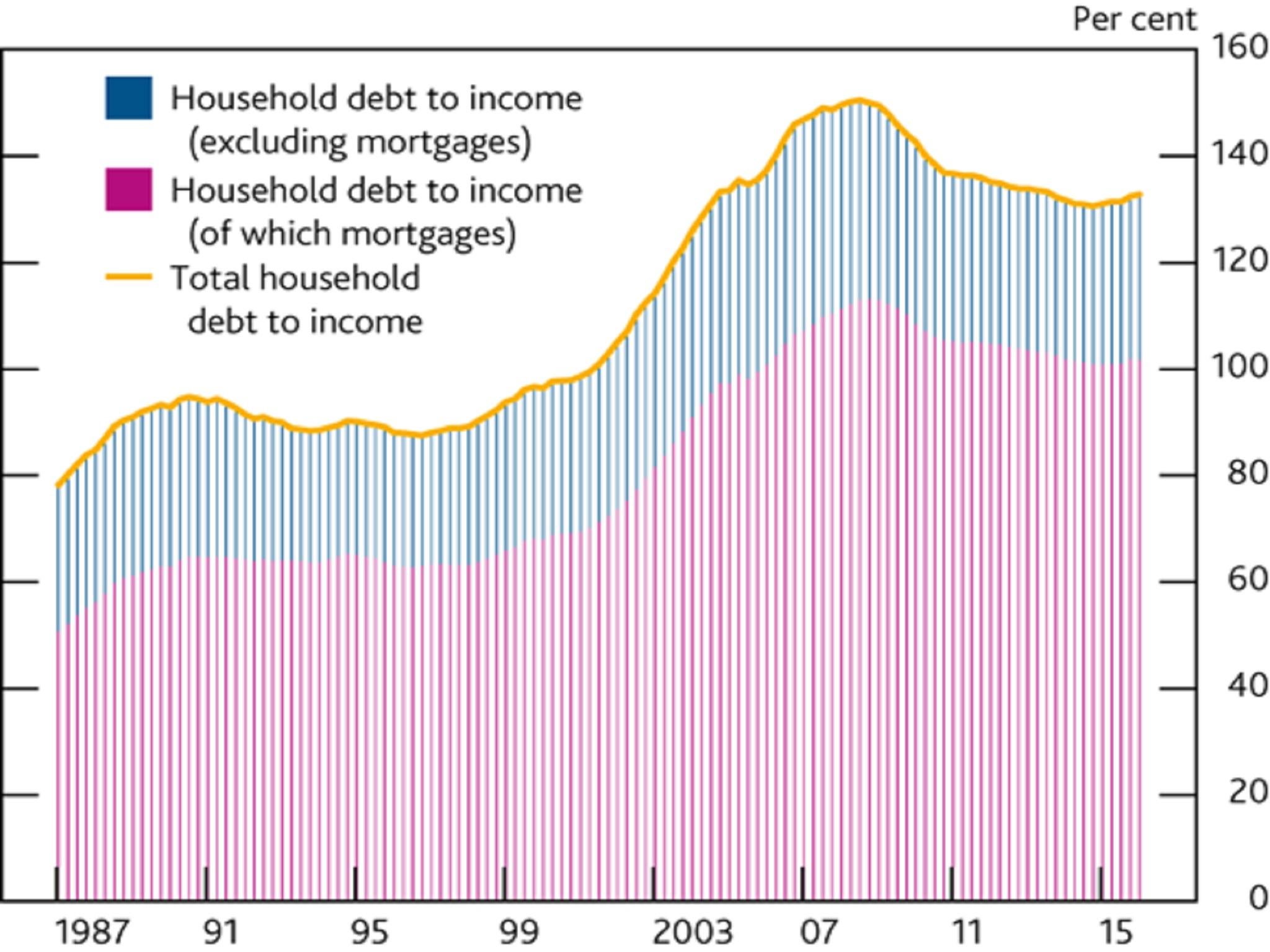

The household sector’s borrowing as a share of income increased sharply in the run-up to the global financial crisis, hitting 150 per cent, and then slumped in the 2008-09 recession.

The ratio has been creeping back up in recent years and the Bank of England warned in its November Financial Stability Report that the level of households' indebtedness “remains high” and cautioned that the ability of some households to service their debts “could be challenged” if unemployment rises.

Creeping back up: Household debt to income ratio

The bulk of UK household debt is in secured mortgages.

The bank reported that the number of new mortgages for house purchases rose by 67,505 in November, slightly ahead of City expectations of 67,400.

The overall economy has performed considerably better than expected by the City in the wake of last June’s Brexit vote, with the most recent report from the Office for National Statistics pointing to growth in the third quarter of 2016 of 0.6 per cent. the same as the previous quarter.

The biggest contribution to growth on the expenditure account was from households, where consumption rose by 0.7 per cent on the previous quarter.

Business investment, by contrast, made a negligible contribution to overall growth.

The Bank of England and the Office for Budget Responsibility have both forecast that GDP growth will slow drastically this year as businesses curtail investment due to the uncertainty over Brexit and as rising inflation, following the slump in the pound, hits real household disposable incomes.

The unemployment rate is seen rising to 5.5 per cent in 2017 by the OBR, up from 4.8 per cent today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments