Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

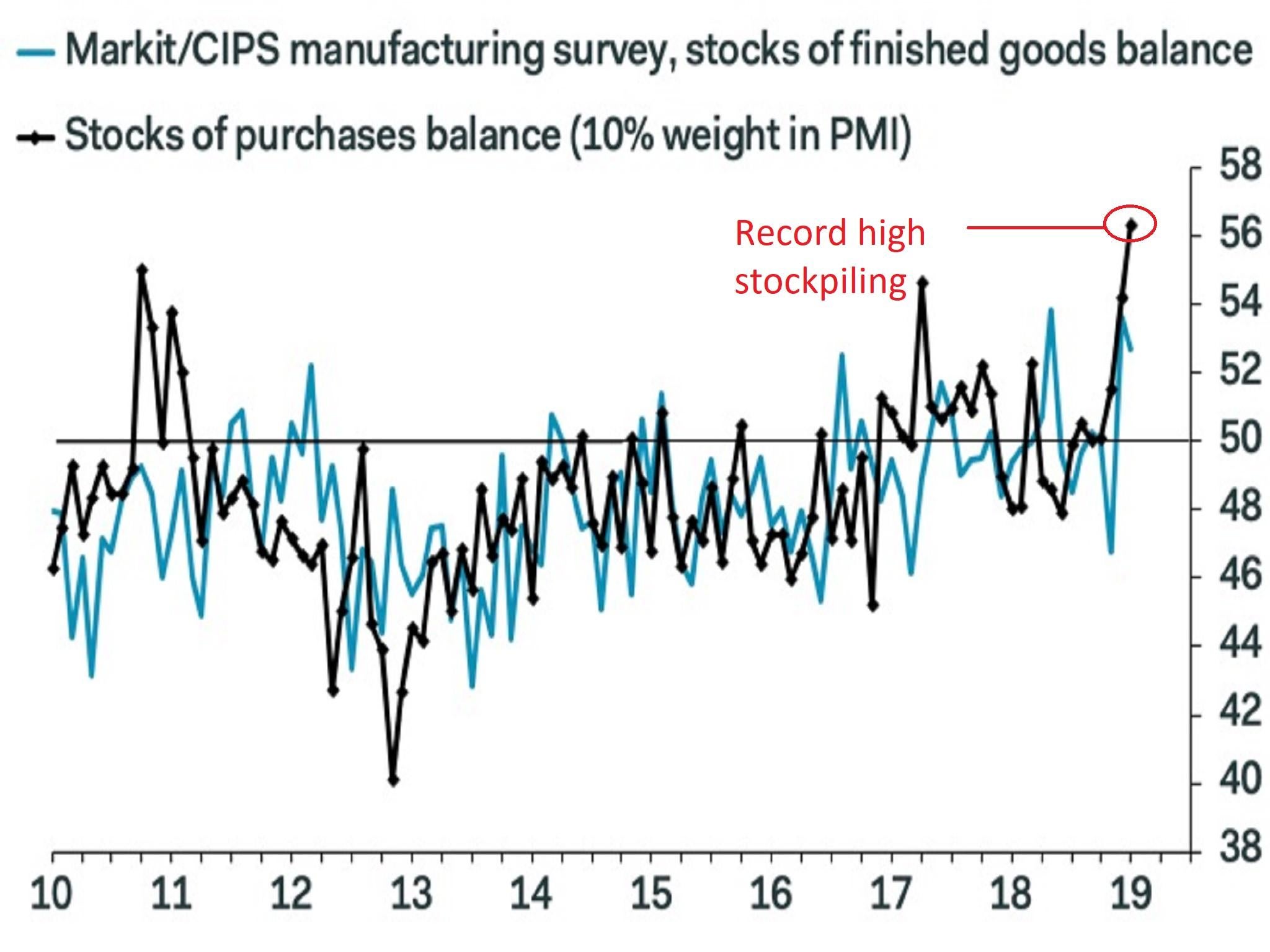

Your support makes all the difference.Manufacturers built their inventory at a record pace in January as fears grew of a no-deal Brexit in March and analysts warned of a “clear risk” of recession for the sector.

The Purchasing Managers’ Index (PMI) showed that stocks of inputs were up at the fastest pace in the 27-year history of the survey.

Firms are alarmed by the prospect of component delivery hold-ups due to port disruption in the event of a no-deal in March, something that would play havoc with their just-in-time supply chains.

The overall activity index came in at 52.9, down from 54.2 in December and below City analysts’ expectations.

The most recent official data showed that manufacturing output, which accounts for around 10 per cent of GDP, slumped in both October and November, putting the sector on course for contraction in the final quarter of 2018.

And the latest survey data suggests there could be a further contraction in the first quarter of 2019.

“The start of 2019 saw UK manufacturers continue their preparations for Brexit,” said Rob Dobson of IHS Markit, which compiles the PMI.

“Despite the temporary boost provided by clients’ prepurchases and efforts to build-up stocks, the underlying trends in output and new orders remained lacklustre at best. Based on its historical relationship against official data, the January survey is consistent with a further solid contraction of production volumes, meaning manufacturing will likely act as a drag on the economy in the first quarter....There is a clear risk of manufacturing sliding into recession.”

Brexit-driven inventory surge

“Component accumulation won’t boost GDP, because manufacturers primarily are stockpiling imports. In theory, the stockpiling of goods by overseas businesses could provide a short-lived boost to manufacturing output. But the renewed decline in the output index to just 51.4—its lowest level since July 2016 — suggests such support is intangibly small,” said Samuel Tombs of Pantheon.

A survey from the Institute of Directors on Friday suggested that 14 per cent of UK manufactrurers have shifted some resources overseas due to Brexit.

And the Society of Motor Manufacturers and Traders revealed earlier in the week that investment in the UK car industry fell by 50 per cent in 2018 due to uncertainty about the UK’s EU exit.

Last week the chief executive of Airbus warned that the company’s entire UK manufacturing operations in the UK could end up closed if the UK crashes out of the EU with no deal.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments