Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Manufacturing output contracted in July according to the Office for National Statistics, undershooting expectations and undermining the sense that the sector has emerged unscathed from the shock of the Brexit referendum result.

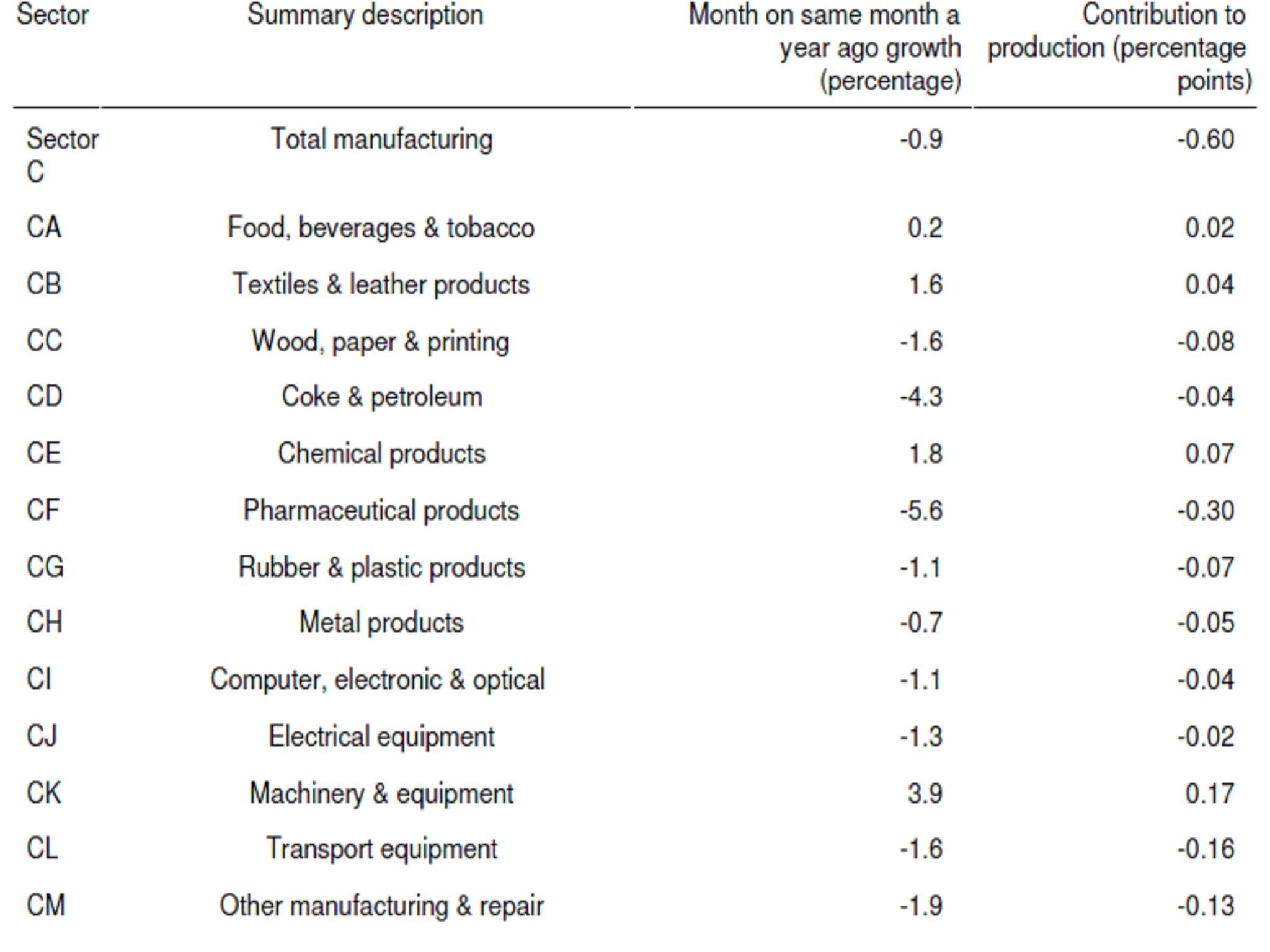

Output fell 0.9 per cent in the month, worse than the 0.4 per cent City analysts had expected.

Manufacturing setback

The news sent sterling down more than half a cent against the dollar to $1.3379, giving back some of the strong gains of yesterday.

Separately, the latest monthly GDP forecast from the National Institute for Economic and Social Research yesterday showed a slowdown in growth in the three months to August to 0.3 per cent.

NIESR said that the slowdown means the probability of technical recession before the end of 2017 “remains significantly elevated”.

Sterling weaker

Against the euro the pound was down a third of a cent at $1.1904.

The ONS reported that the biggest drag had been from pharmaceuticals, but electronics, transport equipment and wood production also fell. Nine of the 13 subsectors showed a contraction.

Weakness across the board

Confidence in manufacturing had been buoyed last week when the Purchasing Managers’ Index reading for August for the sector pointed to the biggest monthly jump in activity in 25 years, bouncing back from a record slump in July largely thanks in part to the 10 per cent depreciation of sterling in the wake of the 23 June vote.

And a host of City of London economists have been revising away their recession forecasts on the back of better-than-expected survey evidence in recent weeks.

Bets on another Bank of England interest rate cut later this year have also been scaled back.

Georgios Nikolaides of the EEF manufacturers’ organisation suggested the weak official July figure for manufacturing could reflect an unwinding of the huge surge in output in April, rather than a Brexit effect.

“Incoming data in the next few months will help us piece together a more complete picture about the impact of Brexit-related uncertainty on manufacturing activity levels,” he said.

Kate Davies of the ONS also cautioned against “reading too much into one month’s figures”.

Charlie Bean, a former deputy Governor of the Bank of England, said this morning that some of the sense of relief about the state of the economy in the wake of the Brexit result was premature.

“Some of the recent indicators have been greeted a little too enthusiastically. The picture is a bit more mixed,” he told a House of Lords committee.

“The underlying picture at the moment does not suggest the economy has just shrugged off the Brexit result ... It’s too early to draw a firm conclusion.”

The ONS estimates that in the three months to June manufacturing output surged by 1.8 per cent, its best quarterly growth performance since 2010, helping overall GDP to expand by 0.6 per cent.

Manufacturing accounts for around 10 per cent of UK output.

Ruth Gregory of Capital Economics said that the survey evidence from the sector pointed to “stagnation rather than outright contraction“ over July and August.

Overall industrial production – which includes oil and gas – rose 0.1 per cent in July according to the ONS, better than the 0.2 per cent decline City analysts had expected.

Oil and gas extraction jumped by 5.6 per cent, and the ONS said production had been boosted by continued output from the North Sea’s Buzzard field, which normally shuts for maintenance in July.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments