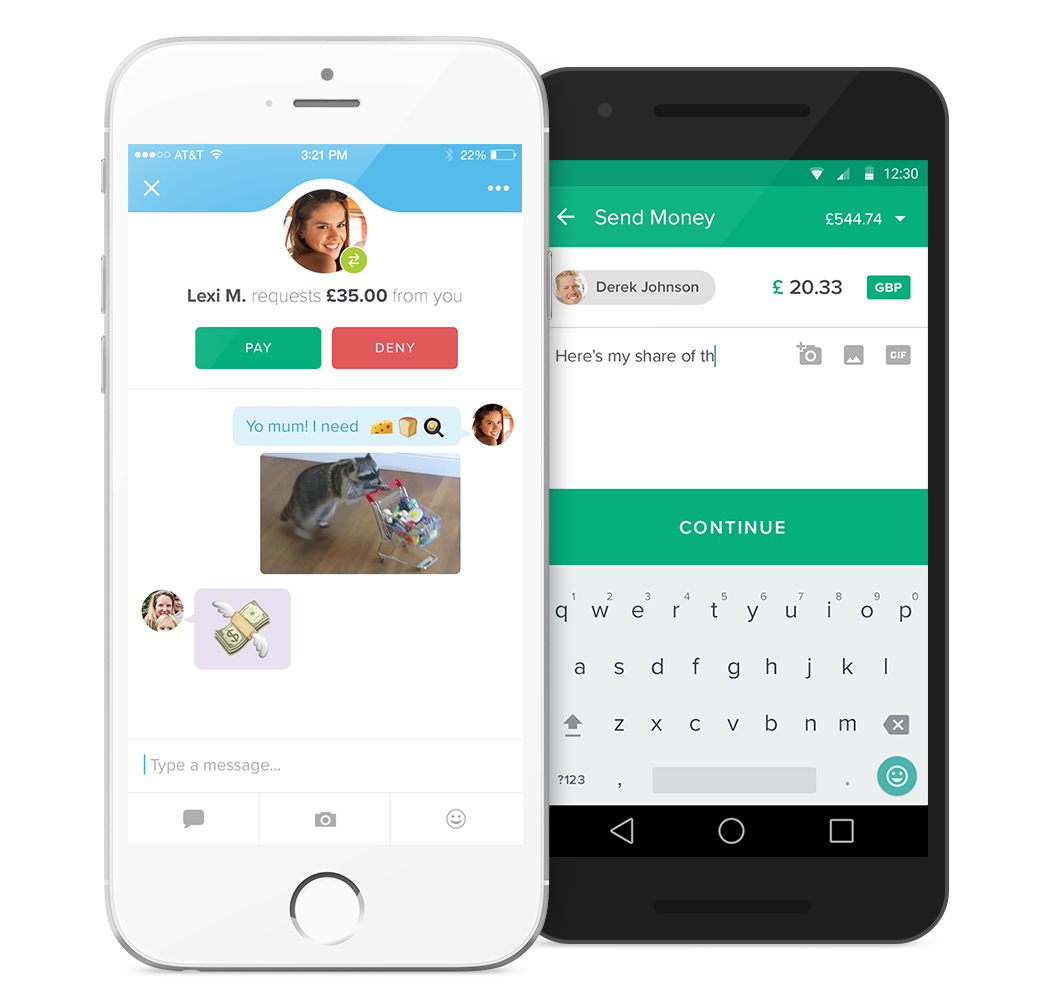

Barclays backs new iPhone and Android app that lets users send each other money using a bitcoin network

Circle offers its users the opportunity to send written messages, emojis and animated “GIF” videos, along with their money transfers

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Barclays has become the first big UK bank to back social payment app Circle, a US digital payment company which uses bitcoin to transfer central bank currencies across popular messaging platforms and other media, as it launched in the UK on Wednesday.

It is the first time the Financial Conduct Authority, Britain’s top financial regulator, has granted an electronic money licence to a digital currency company in a move described as a “major milestone” by Britain’s Treasury.

The licence will allow the Boston-based start-up, which is backed by $76 million in venture capital and counts Goldman Sachs and Digital Currency Group among its investors, to hold users’ money and facilitate domestic and international payments.

UK consumers will be able to send and receive cross border payments with instant conversion between pound sterling and US dollars free of charge from Wednesday.

The app will also offer the possibility of sending written messages emojis and animated video together with the money transfers.

“The internet empowers all of us to share content and media, express ourselves, and message our friends and family for free, regardless of borders, instantly and securely in many fun, delightful ways. Why is sharing money so different ?” Jeremy Allaire, Circle co-founder said in a blog post.

For payments transferred to countries where Circle hasn't yet launched, the company uses the bitcoin blockchain – a public ledger where bitcoins are verified and recorded – to transfer currencies in and out of the national denomination.

Barclays will provide the infrastructure that allows transfers from any UK bank account in and out of Circle.

“Circle’s decision to launch in the UK and the firm’s new partnership with Barclays are major milestones. Together they prove our decision to introduce the most progressive, forward-looking regulatory regime is paying off and cements our status as the world’s fintech capital,” Harriett Baldwin, the UK Treasury minister said.

A spokesperson for Barclays said it is supporting the positive uses of blockchain that can benefit consumers and society. Using the blockchain means that money can be exchanged without using a bank clearing system.

Circle is available in over 150 countries on iOS and Android. It will soon allow transfers in and out of euros, when it launches in the rest of Europe later in the year.

Additional reporting by Reuters

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments