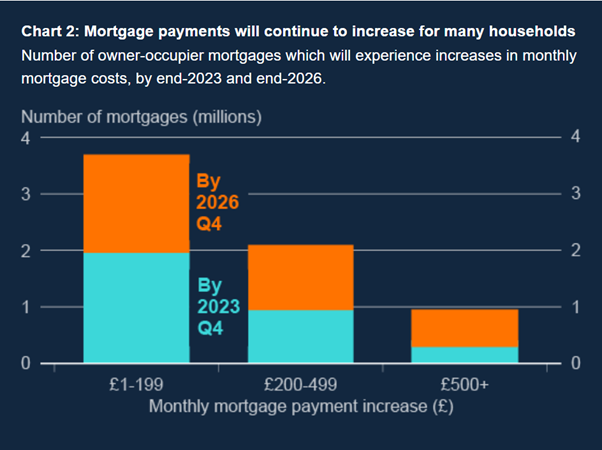

£500 a month rise in mortgage payments for 1 million households by 2026, Bank of England warns

The average household will see their monthly interest payments go up by about £220 if they are refinancing during the second half of this year

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Homeowners have been warned to prepare for a “huge” fall in disposable income after the Bank of England said rising interest rates could cost one million borrowers an extra £500 a month by 2026.

The average homeowner is facing an increase in monthly mortgage payments of around £220 when renewing their fixed-rate deals, while another half a million households could see payments climb by £750 a month or more, the Bank said.

The Resolution Foundation think tank said such rises would result in “huge income falls”, warning that households remortgaging next year would pay an extra £3,000 a year on average.

The Institute for Fiscal Studies (IFS) said higher mortgage payments would only “add to the squeeze” for people already struggling with soaring food and energy bills.

The warnings came a day after mortgage rates surpassed the peak seen in the wake of Liz Truss’s disastrous mini-Budget last autumn – rising to the highest level since the financial crisis.

Average two-year fixed-rate deals reached 6.66 per cent on Tuesday, according to figures from Moneyfacts, after the Bank of England’s recent interest rate hikes pushed up the cost of borrowing. By Wednesday the figure had climbed again, hitting 6.7 per cent.

That is higher than the 6.65 per cent seen on 20 October 2022 following the turmoil that followed Ms Truss and Kwasi Kwarteng’s Budget. Rates now stand at a level not seen since August 2008 at the height of the global financial crisis.

Two UK lenders, Santander and Nationwide Building Society, said customers moving to new deals were being hit by an average increase in payments of around £200 a month.

Bank of England governor Andrew Bailey said there “will be consequences” of higher interest rates on borrowers.

He said there was “no question” the central bank’s policy choices would have an impact on households, but said “we have to do it” – referring to the possible need to raise interest rates again.

Around 4.5 million people with a fixed-rate mortgage have seen an increase in their monthly repayments since interest rates started to rise in late 2021, an analysis by the Bank found.

A further four million households on a typical two-year or five-year fixed deal will likely see their payments go up by the end of 2026.

Buy-to-let landlords are also being impacted by higher mortgage rates, which has caused some to sell up or pass on higher costs to renters, the Bank said.

Resolution Foundation research director James Smith said the current “mortgage crunch” would be different to previous crises as fewer people own their homes with a mortgage.

“However, those that are affected are likely to experience huge income falls, with people having to re-mortgage next year facing higher interest payments of around £3,000 on average,” he added.

And IFS economist Thomas Wernham said those who needed to remortgage could see their disposable incomes fall by over 8 per cent, or almost £3,200 a year, as a result of the higher payments.

“Those in their thirties, who have the largest mortgages in general, will see the biggest hits to their incomes,” he said.

But deputy governor of the Bank of England Sir Jon Cunliffe cautioned there were “big differences” between the situation today and during the financial crisis 15 years ago. “The amount of household debt being carried is much lower now than it was at the time of the financial crisis, so households are not over-levered as they were before,” Sir John said.

And he added: “That’s one of the reasons why we think that the proportion of households in distress will be considerably smaller.

“I think it’s clear that inflation hits the poorest off in society worse, and that’s one of the reasons why we need to get it under control.”

But shadow chancellor Rachel Reeves said households were being hit by a “Tory mortgage bombshell”.

“Thirteen years of Tory economic failure stretch far and wide – our broken housing market, insecure economy, soaring prices and broken public services,” she said.

Ms Reeves added that Labour would “build a stronger economy” with “financial and economic security first”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments