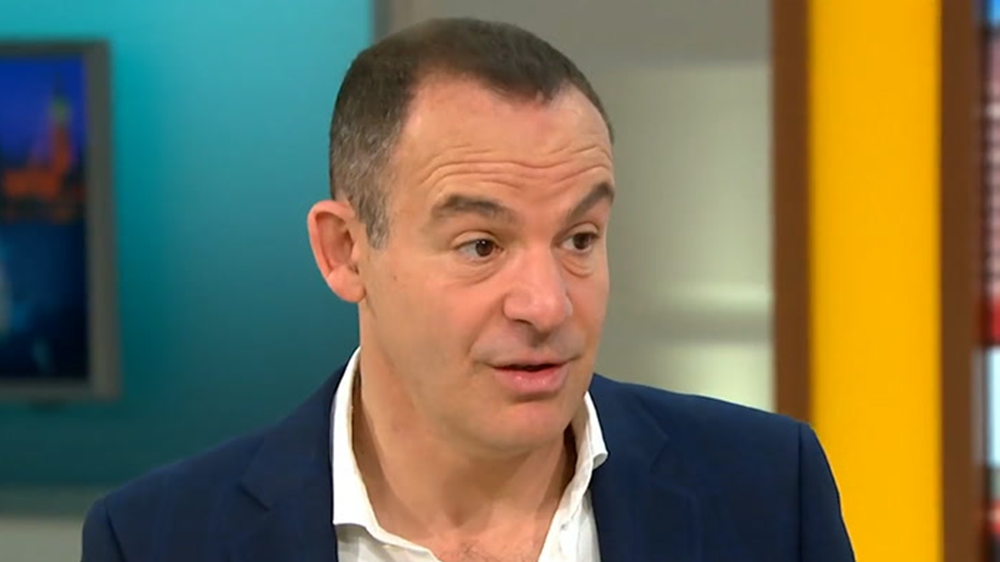

Martin Lewis reveals best ways to boost pension - and how to get ‘hidden pay rise’

Money Saving Expert guru shares wisdom on pensions with pointers on how to maximise your pot

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Money Saving Expert founder Martin Lewis has shared his top tips for saving for your pension, including how to get a “hidden pay rise”.

In his weekly email, the finance guru set out some recommendations for the time of life he said is often “misunderstood” and his pointers can help savers avoid common own goals such as leaving money to a former partner.

“Saving for retirement is crucial,” Mr Lewis said. “Yet pensions are often bad-mouthed, under-managed and ill-understood.”

Pensions can come in three forms. State pensions are income from the government once you are 66 or above; private pensions are tax free savings you can use from 55-years-old; and company pensions are contributed to while one is at work to build up a pot of cash.

Below we look at some of the Money Saving Expert’s best advice on how to make the best out of your retirement.

Here are eight of Martin Lewis’s top pensions advice

1. Pensions are saved from pre-tax income

Pensions maintain 100 per cent of their value and will not be taxed in the way other savings and investments can be.

2. You could have hidden money in lost pensions

Lost pensions are a key touchpoint for Mr Lewis. It is possible to keep track of your old and potentially lost savings through Money Saving Expert’s pension tracing service. It has been reported that UK residents have £27 billion in lost or old pensions and many have thousands that they could access.

3. A rule of thumb for putting money away

Mr Lewis gives a rule of thumb for what percentage of your salary to put into a pension: Take your age when you started saving in a pension - and halve it.

He writes: “The real takeaway is start as early as possible with whatever you can, as you’ve longer for the gains to compound.”

4. Know your life expectancy

Knowing roughly how long you are going to live can help one with pacing their pension savings and living within a budget. For a 65 year-old man, the UK life expectancy is currently 85 and for women of the same age there is a life expectancy of 88.

5. Look out for this ‘final salary’ clause

Some employers give a pension based on the percentage of one’s final pay cheque. This can catch out some older employees who have reduced hours. Mr Lewis advises looking into this before cutting down on hours.

6. Missing national insurance

It is possible that you might be missing state pension amounts due to a career break or time out of work. It is possible to apply for credits towards your national insurance to reimburse you for time you have been forced out of work.

7. How to get a ‘hidden pay rise’

Always opt-in to auto-enrolement pensions which is an easy way to get extra cash from your company. Sometimes this takes looking into but is often done automatically.

8. Don’t leave your pension to your ex

Number one on Mr Lewis’s list was to review your will after a divorce or break up. You cannot put your pension savings into a will but if you die before taking your private or company pension then your trustees will decide what to do with it.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments