Martin Lewis reveals how much mortgages will rise after interest rate hike

Bank hikes rates for eighth consecutive time putting futher squeeze on cost of living crisis

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Mortgage holders will see their yearly costs increase by more than £400 after the Bank of England hiked interest rates to 3 per cent, Martin Lewis has said.

The Money Saving Expert said tracker deals will rise by roughly £40 per month (£480/year) for every £100,000 worth of mortgage.

That means someone with a £300,000 mortgage will pay £1,440 extra per year. “Existing fixes won’t change, but when they end new deals will be far costlier,” Mr Lewis said.

Mr Lewis also advised savers to switch banks if they fail to pass on gains from the interest rise.

“Top paying easy access savings accounts will likely rise but it can take a month,” he said. “Most big bank savings will continue to pay diddly squat, so ditch & switch.”

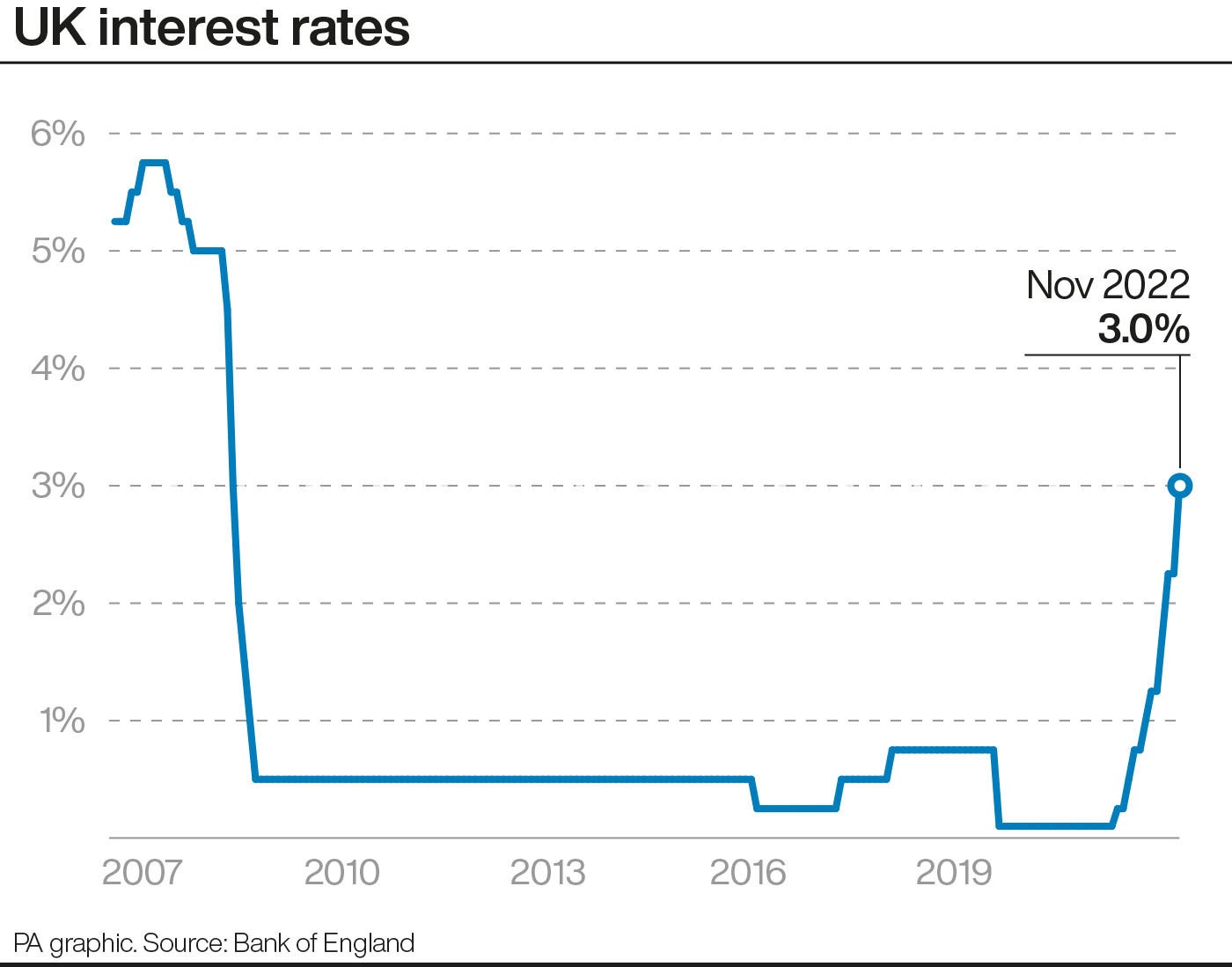

His comments came after the UK’s central bank increased the interest base rate level by 0.75 per cent to 3 per cent.

The Bank’s move was the biggest hike since 1989 and the eighth consecutive time interest rates have risen as officials try to tackle soaring inflation.

Inflation - or higher prices - is being driven by sky-high energy bills fuelled by Vladimir Putin’s war in Ukraine and the recovery from the Covid pandemic.

In a statement on Thursday, the Bank warned that the UK could be facing the longest period of recession since reliable records began.

The economy could fall into eight consecutive quarters of negative growth if current market expectations prove correct.

That would mark the longest period of uninterrupted decline that the nation has experienced for around a century.

However, it would be a milder recession than in previous times, it said.

From its highest to lowest point, gross domestic product (GDP) is expected to drop 2.9 per cent, a much smaller decrease than the 6.3 per cent drop seen during the 2008 financial crisis.

The Bank also predicted inflation would peak at around 11 per cent at the end of this year, while the unemployment rate could hit 6.4 per cent by the end of 2025.

Decision makers also warned that more rate hikes were likely to come, however, they do not expect a rise as high as the 5.2 per cent that the market has forecast for the final quarter of next year.

"The majority of the committee judges that, should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in the Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than prices into financial markets," the Bank said on Thursday.

The Bank also warned there were uncertainties ahead and said that if inflation looks to be more persistent than the current outlook, it would "respond forcefully".

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments