The charts that show how Chinese growth is trending down – and might be even worse than we’re being told

Economists say growth is being pumped up by unsustainable credit growth again and that rebalancing is not happening.

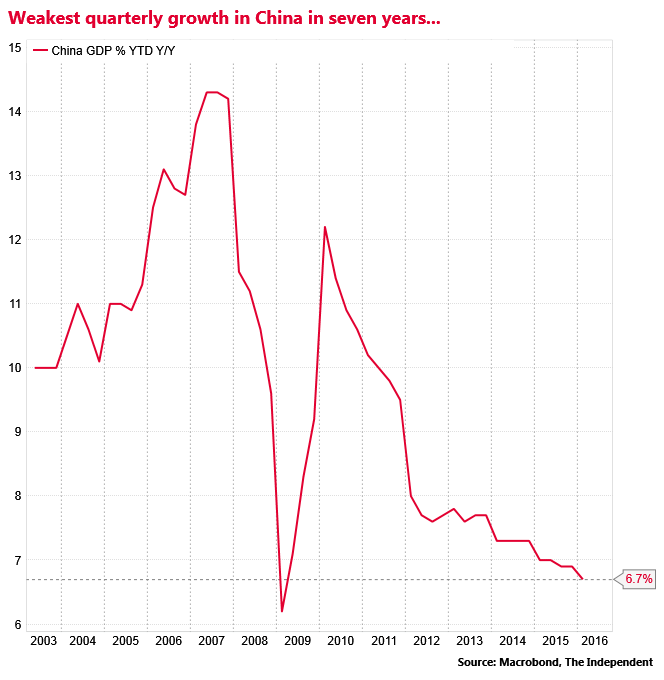

China’s official statistics agency reported this morning that the world’s second largest economy is growing at its weakest quarterly rate in seven years.

Chinese GDP expanded at an annual rate of 6.7 per cent in the first quarter of 2016. Expansion has not been so slow since the first quarter of 2009 when the global economy was in crisis and the country’s GDP grew by just 6.1 per cent:

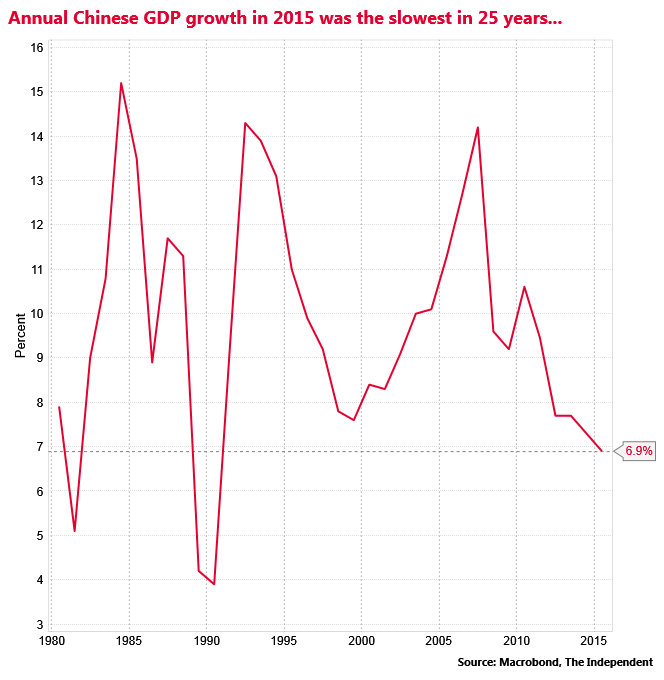

The economy’s slowdown seems to be getting worse.

China’s growth over the whole of 2015 was 6.9 per cent, the slowest since 1990 when growth dipped to just 3.9 per cent:

Yet today’s figures were in line with the consensus of most economists.

And they mean the Beijing government seems to be still on track to meet its own target of 6.5-7 per cent GDP growth for 2016.

So should we be relieved?

Not so fast.

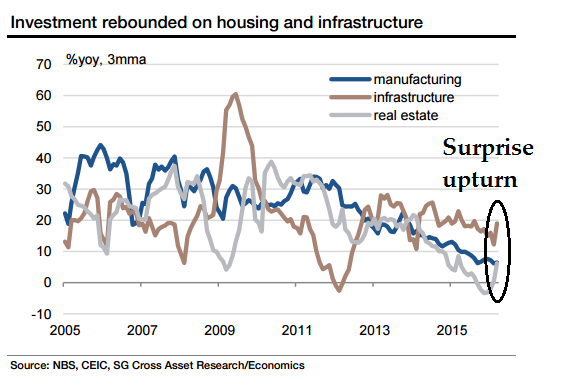

As is widely known, China needs to transition from a growth model based on massive investment and construction, fuelled by state-directed bank lending, to one based on household consumption and services.

But the latest data shows that this rebalancing is still tentative at best and might even be desribed as having stalled. Service sector growth slowed from 8.2 per cent to a disappointing 7.6 per cent. And there were big upside surprises in infrastructure and real estate output:

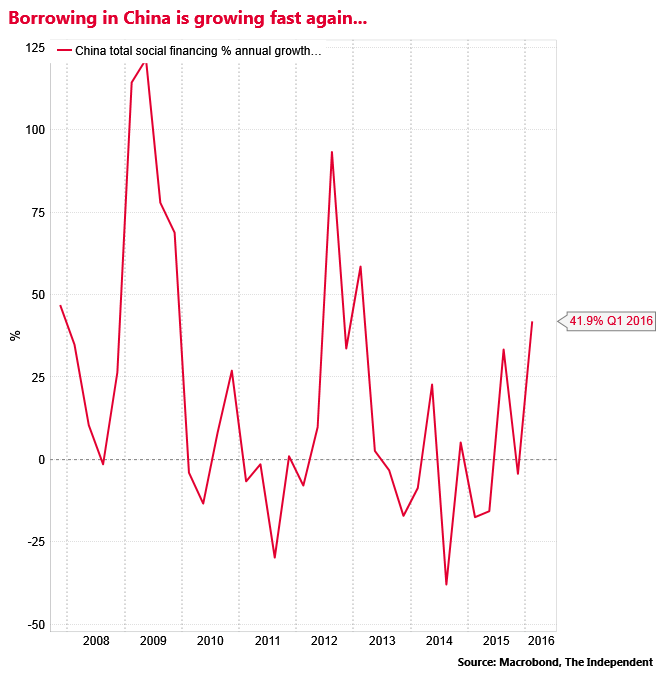

Economists say this reflects the Chinese government's loosening of credit via state-owned banks over the past year in response to fears of a hard economic landing. Total new credit advanced in the economy was RMB6.6 trillion in the first quarter, up 42 per cent on a year earlier:

“This looks like an old-styled credit-backed investment-driven recovery… The Chinese government was clearly giving growth all the attention in Q1, and now the question is how long it will maintain this undoubtedly unsustainable model.” said Wei Yao and Claire Huang of the French bank Societe Generale.

Worse, many economists continue to doubt the veracity of the Chinese GDP figures.

The economic consultancy Capital Economics produce a “proxy” GDP reading for China’s GDP based on statistical measures that are harder for the Beijing authorities to manipulate, such as electricity use and rail freight volumes.

And this indicator suggests the true rate of GDP growth in the Chinese economy is closer to 4 per cent:

The silver lining? On this metric, according to Capital Economics, China’s growth slowdown does seem to have “bottomed out”. So things may be worse than we thought in China but they may not be getting worse in the way we might be led to think.

Why does any of this matter? Because China is still the single biggest contributor to global GDP growth. If China slows down very rapidly - or crashes - we will all feel it.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments