Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The great British public is borrowing again.

And it’s credit cards, car finance schemes and personal loans and other forms of unsecured lending (rather than secured mortgages for house purchases) where the most exciting action is taking place.

That message is confirmed by the latest Bank of England Credit Conditions Review released today.

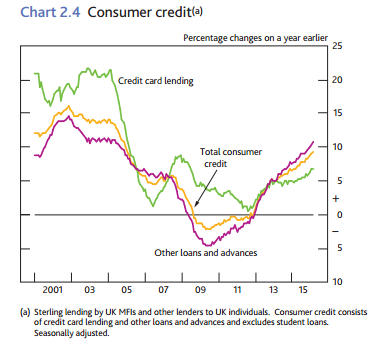

The annual growth rate of consumer credit picked up to 9.3 per cent in February – with personal loans accounting for the majority of the flow according to the Bank:

As the chart shows, the rates of growth are not quite yet back to the levels of 2003. But there was a sharp pick up in the growth rate starting in 2012/2013, which is showing no signs of petering out.

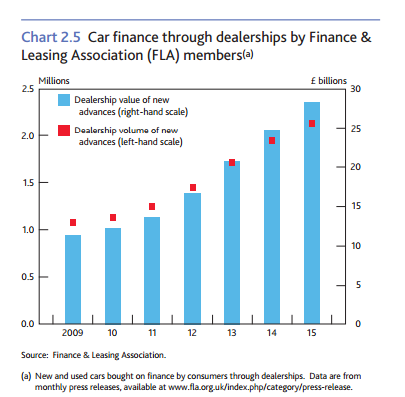

So what’s going on? New car loans – where dealerships lend the money to the customer to complete their purchase - are a big factor. The Bank draws attention to data from the Finance & Leasing Association showing that the value of new advances in 2015 was £28bn – double that of 2011:

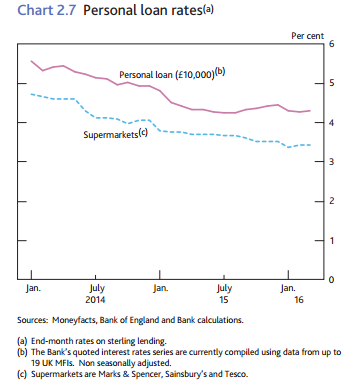

Why are people borrowing more? One factor according to the Bank is that it’s very cheap to do so. The average interest rate on unsecured personal loans has been trending down:

Loans from supermarkets have been particularly competitive.

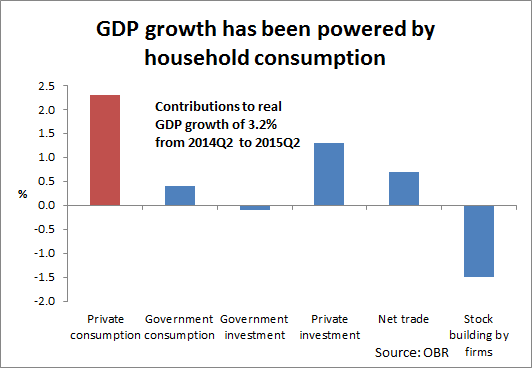

The surge in unsecured borrowing has helped propel overall household spending, which in turn has helped support overall GDP growth in recent years:

Economic growth is, of course, welcome. But how sustainable is it? One of the reasons the UK economy plunged into recession in 2008 was because of a sharp cut-back in spending by households, driven by a feeling that they had accumulated too much personal debt, including unsecured loans.

The Bank of England’s Financial Policy Committee noted strong consumer credit growth in its meeting last month, saying it will monitor the area and keep an eye on the “implications this has for the debt-servicing ability of the most vulnerable households and the resilience of lenders”.

In other words, if this gets out of hand the overall economy could crash again.

So will unsecured consumer borrowing carry on rising?

The latest forecast from the Office for Budget Responsibility suggests it will.

The Treasury’s watchdog expects total unsecured household borrowing (which includes student loans) to rise to £672bn by 2021, up from £440bn today.

As a share of GDP that implies a rise from 24 per cent to 29 per cent, taking this ratio higher than before the financial crisis:

It’s hard to know at what stage families start to panic about their unsecured debt positions. It interacts with other factors such as the level of secured mortgage borrowing and interest rates. It depends which households are taking on the unsecured debt.The rich might be able to cope - for the poor it might not take much for the elastic to snap.

It's not time to sound the alarm yet. But few economists would disagree that history teaches consumer credit growth is a metric that needs to be very carefully watched.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments