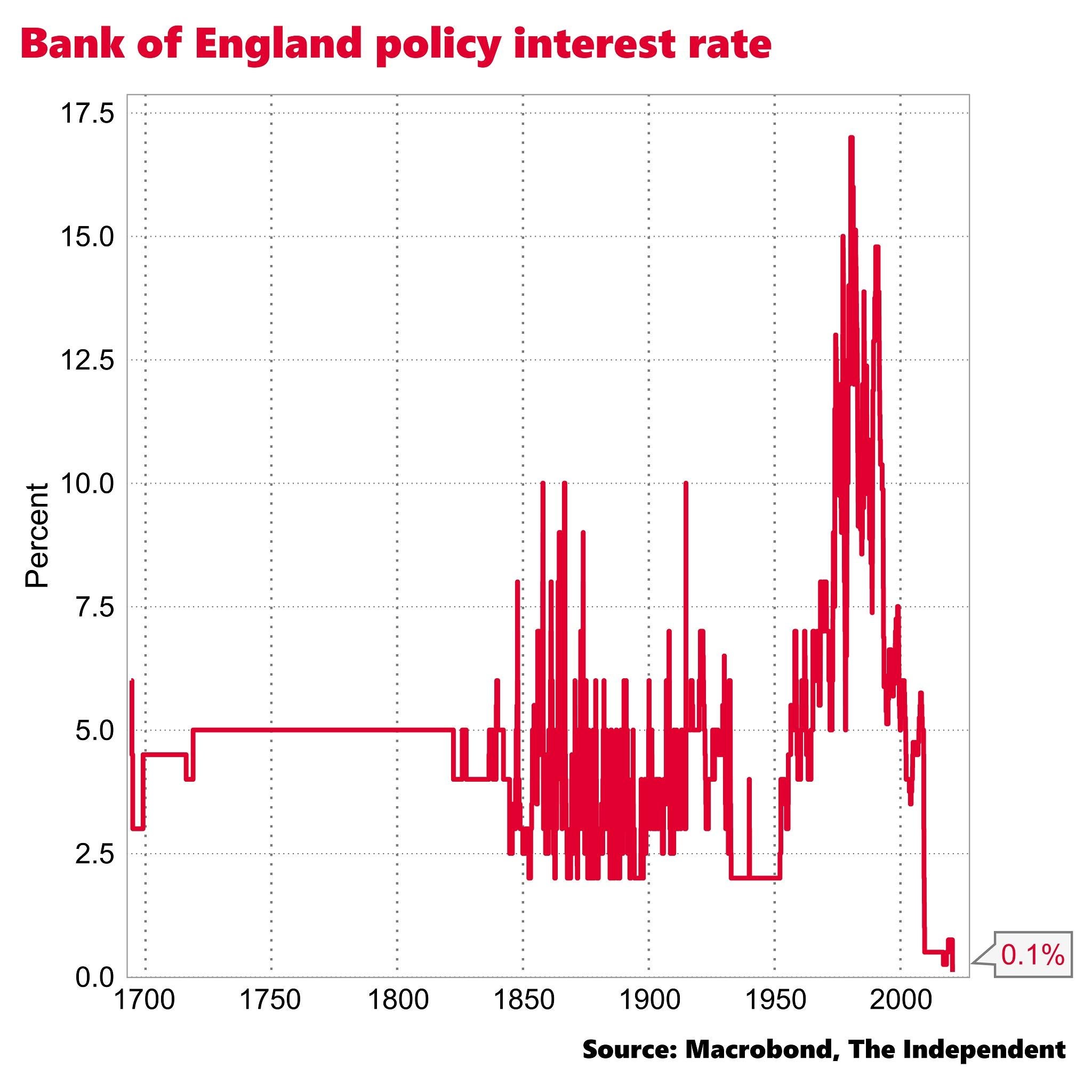

Coronavirus: Bank of England cuts rates to new historic low of 0.1%

The central bank will also buy £200bn more UK assets, restarting its quantitative easing policy

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Bank of England cut interest rates to a new historic low of 0.1 per cent on Thursday amid the UK’s spiralling coronavirus economic crisis.

The central bank will also buy £200bn more UK financial assets, restarting its quantitative easing policy, in an bid to calm British bond markets where were “bordering on disorderly”.

The bank’s Monetary Policy Committee voted unanimously for the emergency action to support the British economy at a special meeting.

Read more

The rates move follows a 0.5 per cent cut announced on 12 March by the bank, to coincide with the Budget, which took rates from 0.75 per cent to 0.25 per cent, the previous record low.

The new asset purchases, which will be mainly made up of UK government debt but will also include investment-grade corporate bonds, will take the bank’s stock of assets to £625bn, around 30 per cent of GDP.

Government debt – known as gilts – have fallen in price in recent days amid heavy selling by investors. The value of sterling also slumped by some 4 per cent against the dollar on Wednesday, hitting its lowest level since the collapse of 1985.

New record low

In a statement the bank attributed this to investors seeking the safety and liquidity of shorter term debt.

“Over recent days, and in common with a number of other advanced economy bond markets, conditions in the UK gilt market have deteriorated as investors have sought shorter-dated instruments that are closer substitutes for highly liquid central bank reserves,” it said.

In a conference call with journalists after the decision the bank’s new governor Andrew Bailey said that markets had been “bordering on disorderly”, persuading the bank to restart its asset purchases.

“We are in an absolutely unprecedented situation,” he said.

The bank said that the asset purchases will be completed “as soon as is operationally possible, consistent with improved market functioning”.

Sterling rose by around 1.16 per cent in the wake of the announcement to $1.1648, while UK Gilt yields, which move inversely to prices, fell around 25 basis points to 0.727 per cent.

On the shock from the lockdown enforced by the government to suppress the spread of Covid-19, the bank said it would be “sharp and large, but should be temporary”.

“The expanded bond-buying programme should help to ease some of the dysfunction in UK government debt markets and help the government to fund the huge spending messages,” said Luke Bartholomew of Aberdeen Standard Investments.

Some analysts have raised the question of whether the crisis could ultimately force the bank to push interest rates into negative territory like the European Central Bank and the Bank of Japan.

“Britain is now a whisker away from the negative interest rate club. Rates have never been this low in the more than 300-year history of the Bank of England. Purchases of government and corporate bonds have been ramped up. A desperate measure for a desperate situation,” said Tom Stevenson of Fidelity International.

Earlier this week the bank unveiled details of a scheme to buy debt from large distressed companies called the Covid-19 Corporate Financing Facility.

Mr Bailey urged struggling companies to seek help from the bank and private lenders rather than shedding staff.

Other central banks are also acting in the face of the global economic shock.

America’s central bank, the Federal Reserve, has also cut rates to historic lows of 0.25 per cent. On Wednesday the European Central Bank announced a new €750bn government bond-buying operation.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments