The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Kinsu: The app trying to shake up insurance with a kinder, more socially responsible approach

Each policy purchased helps one rough sleeper off the streets through a partnership with homelessness charity Streetlink

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Meerkats, Pavarotti lookalikes, James Corden. It seems insurers will go to any lengths in order to distract from what they’re actually selling.

Such advertising gimmicks devalue what insurance is about, according to Chris Sharpe, co-founder of new insurance app Kinsu. He aims to change the way people feel about an industry that, it’s fair to say, has an image problem.

Sharpe and co-founder Russell Merrett are two former senior Hiscox executives now trying to shake up the insurance world with a more honest way of doing things that has social responsibility at its core.

“No grey areas, no bullsh*t”, is the company’s simple tagline.

“The big issues with insurance are that it’s misleading, it’s difficult, it’s confusing and it’s ugly,” says Sharpe.

“Insurance companies have got these 90s websites that ask 50 questions about what shape is the roof, what’s in your drawers, what colour your underwear is, it’s horrible. It sort of sucks the life out of you.”

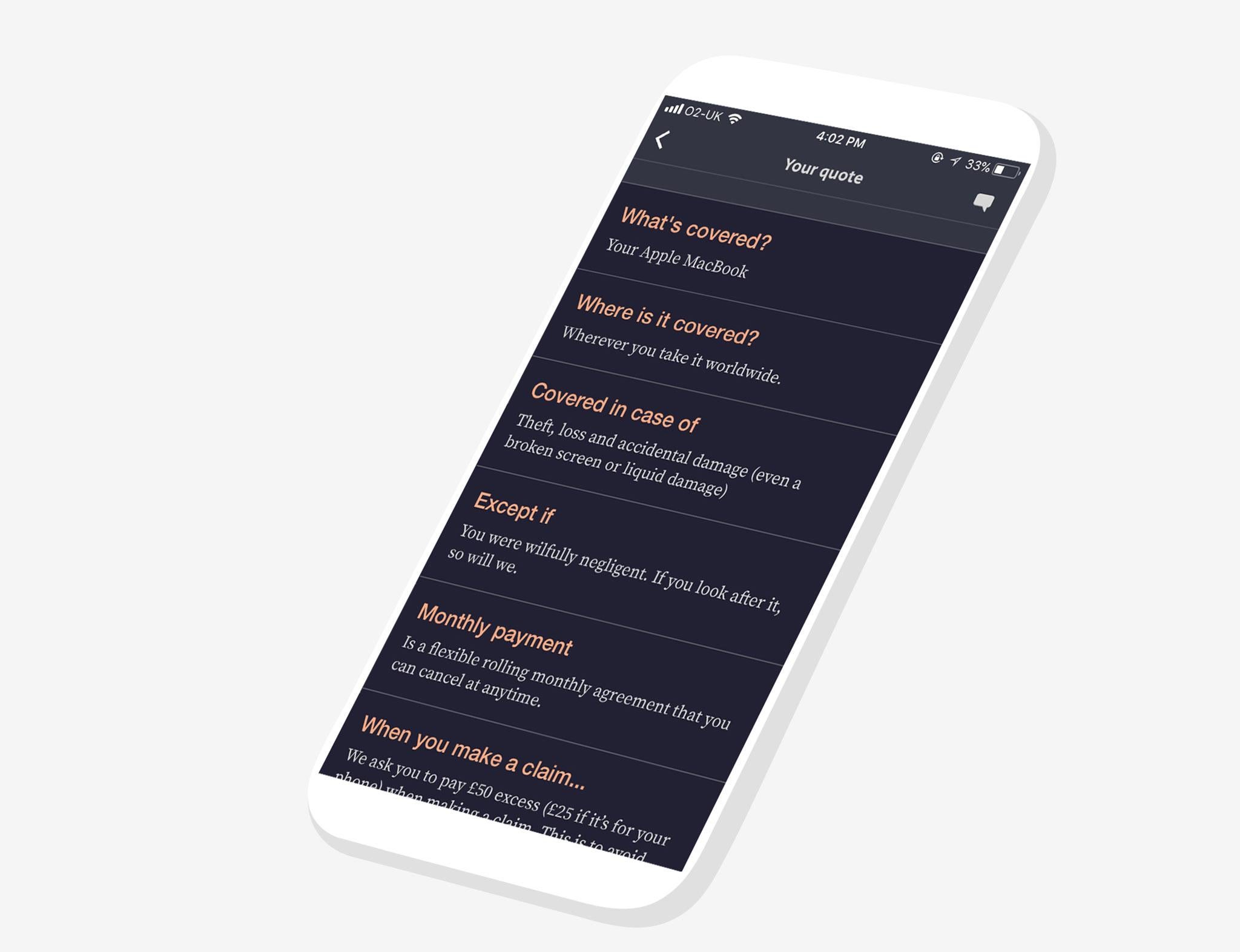

Kinsu has been designed to be as easy to use as possible, with a slick app, a policy document that’s brief, with no insurance jargon, and that clearly demonstrates what’s covered and what’s not. “It does everything that people think their current policy does. Everything it’s supposed to do,” says Sharpe.

That means covering everything in your home if you want it to, without having to list each item. And your stuff is covered wherever you take it. There’s no fixed contract and you can cancel any time.

They are starting with gadgets and contents insurance and will look to quickly expand their offering once they’ve built a customer base.

Kinsu’s founders are aware that people will question whether two insiders can become disruptors. “We can’t get away from the fact that we’ve spent the best part of 25 years in the industry,” says Merrett.

Sharpe “nearly wept” when someone in the Kinsu office said the suit he was wearing made him look like an insurance salesman, he says.

But the pair are a long way from the 'Man from the Pru' stereotype. Sharpe set up Hiscox’s Bermuda office with just three people and a whiteboard. “It was like doing a startup but with a big friendly giant giving us loads of money,” he says.

He left in part because he became “myopically obsessed” with the job. That meant having breakfast in with Americans in Bermuda shorts, followed by a day at the office and then dinner with the same Americans, “who wanted to do Jagermeister shots and dance badly in the local club”.

“I'd have to do that 5 days a week,” he says.

He then had something of an epiphany while travelling: “I realised, ‘oh my god there's a whole world out there’ and I wanted to go and devour it all. So I did.”

He lived in India, had a baby, got married in Las Vegas, “did loads of art projects, photography, philanthropy, made some films”, and, after several years not thinking about insurance, decided to come back with a different outlook.

The founders say an ethical approach is central to their new mission. Each policy helps one rough sleeper off the streets through the charity Streetlink and Kinsu has set up a foundation which is exploring further partnerships.

“Streetlink do such an amazing job and the connection with Kinsu was obvious,” says Sharpe. “We’re looking to help people protect their homes and these guys are trying to help people find homes and get back into homes.”

The company has also been certified as a B Corp, which means it has signed up to a list of socially responsible aims, and means they have a broader definition of success than just shareholder value.

The aim is to bring back the “essence of shared community,” that defines insurance, Sharpe says. “It’s the premiums of many paying for losses of the few. There’s an elegance to it.”

Kinsu wants to avoid what Merrett calls the “EasyJet pricing model” where customers are lured in by low cost and then many of the useful parts of the insurance have to be added on afterwards.

The company won’t be selling itself as the cheapest option although it will be highly competitive, Merrett says. The pair managed to get a good deal with their underwriters who they say really believe in what they are doing. Unrivalled connections in the insurance world probably helped.

The Kinsu app soft launched on the App Store last month and is due for a full launch early next year.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments