Google still owes the UK nearly £700m in unpaid taxes

Analysis suggests the firm should have paid significantly more than £135 million

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Google still owes the British Government hundreds of millions of pounds in unpaid taxes, according to a new analysis by The Independent.

This week the tech giant, the second most valuable company in the world with a worth of £500bn, agreed to pay £135m into the UK's coffers in back taxes for the years 2005 to 2011.

The deal prompted anger after it emerged Google had agreed to pay Italy €227m (£172m) in back taxes for 2009 to 2013 - even though Google's Italian business is a fraction of the size of its UK sales.

Our analysis suggests Google owes the UK six times more than it has agreed to pay.

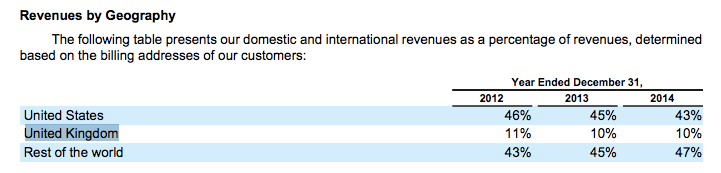

The UK is one of Google's major markets. It is the only country other than the US which Google considers big enough to report revenues for separately in its financial accounts.

For every £10 Google has made in revenue over the past decade, around £1 has come from the UK.

This week's tax inquiry is focused on the seven years between 2005-2011. During that period Google made $18bn (£11bn) in revenue from the UK, according to the annual financial reports the firm files in the US.

During those years, Google's global profit margin ranged from a low of 20 per cent in 2008 to a high of 29 per cent.

Assuming its profit margin in the UK was similar to its global profit margin, that suggests it made nearly £3bn in profit from the UK between 2005-2011.

UK corporation tax between 2005-2011 averaged nearly 29 per cent, which means Google should have paid around £800m in tax.

As this graphic shows, the company only paid £9m.

It was able to do this by using a legal but controversial tax avoidance scheme.

By re-routing the money it paid in the UK to lower tax havens in Ireland, the Netherlands and Bermuda, Google appeared to make far less from its UK business than its financial filings in the US shows it did.

Its reported revenues in the UK amounted to just £1.2bn between 2005-2011, rather than the £11bn suggested by its US accounts.

The second tactic Google used was to state it made no profit on its UK business.

According to its Companies House filings, Google UK lost £86m between 2005-2011 - a surprising figure given its global business made $25.5bn (£16.5bn) in profit during those years, and the UK made up 10-15 per cent of its business.

Some analysts, and Google itself, have argued that most of the company's costs are spent on the coders and designers based in the US, not on the marketing and sales teams who sell ads in the UK.

Therefore, it claims, the bulk of Google's tax bill should be paid in the US.

But without selling ads, Google would have no business. Around 90 per cent of Google's income comes from the ads it sells alongside its services - and the argument is harder to make when it has now paid Italy more than the UK.

Reports this week suggested the firm is also likely to pay French authorities more than it paid the UK.

Google told the The Independent: "After a six-year audit by the tax authority we are paying the amount of tax that HMRC agrees we should pay. Governments make tax law, the tax authorities enforce the law and Google complies with the law.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments