Google fails to act against bitcoin scams using fake newspaper adverts, campaigners say

Pressure builds on search giant to tackle sharp rise in investment fraud as scammers advertise freely next to search results

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Google has been accused of failing to act for months against cryptocurrency scams using fake articles purporting to be published by a national newspaper.

Campaigners said the search giant had not stopped fraudsters from advertising non-existent investments in bitcoin and other cryptocurrencies, despite repeated warnings about the scams.

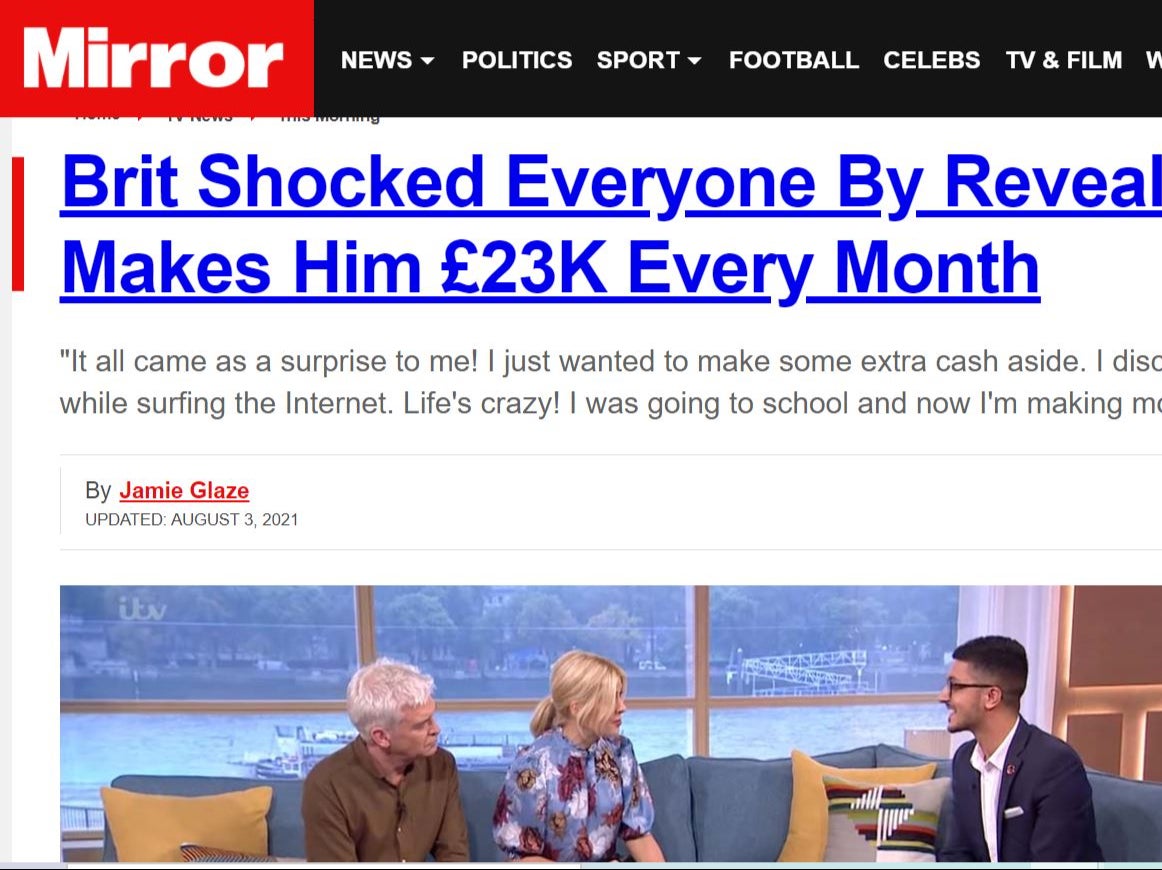

One advert, which showed up at the top of the page when users search Google for investment-related queries, links to a fake Daily Mirror article, claiming to be an interview with Britain's youngest millionaire detailing how he made his fortune.

The headline reads: "Brit shocked everyone by revealing the app which makes him £23k a month." When users click though they are taken to a site which promises they can earn millions by using an algorithm that automatically trades crypto markets.

The ad uses a screenshot of Philip Schofield and Holly Willoughby conducting an interview on This Morning.

Celebrity images are routinely being used by scammers to attempt to give unsuspecting consumers false reassurance that adverts can be trusted.

Martin Lewis, founder of Money Saving Expert, has issued warnings after his face was used in fake adverts on Facebook claiming to offer risky binary trading, PPI reclaim services and bitcoin.

BBC consumer finance journalist Paul Lewis tweeted last month that he had seen his face in fake news articles about cryptocurrencies which appeared on Yahoo search results.

He wrote: "I have never bought cryptocurrency and advise everyone against doing so. You can lose all your money."

Mark Taber, a campaigner against online fraud, said he had repeatedly reported the Mirror fake scam to Google.

He has also reported hundreds of other scams to the Financial Conduct Authority so far this year but says the regulator has only acted to warn consumers in a small minority of cases and when it has done so it has acted to late.

"This fake Mirror article bitcoin scam using Holly Willoughby has been ever present on Google Ads for months,” Mr Taber said.

"I have reported it repeatedly but no effective action has been taken to stop it from reappearing time after time. This suggests Google is either unwilling or unable to enforce its own policies."

Google said it had taken “appropriate action” against sites that had been reported to it, but did not specify what that action was in this case.

A spokesperson for the company said: “Google has always had strict policies around the type of content that is allowed to serve as ads on our platform. We quickly remove any ads that violate these policies.”

The companies which register web addresses for sites running the bitcoin scam adverts did, in some cases, take those sites down.

However, the same content was simply copied and pasted onto a new address. New domains can be registered anonymously within minutes, often with the same provider.

In July, the fake Mirror article was found on the-bitcoin.net which was registered in March through Namecheap, a domain name provider.

When Mr Taber informed Namecheap that its service had been used by scammers, the company took the site down. It reappeared shortly afterwards on the-crypto-news.co.uk, also registered through Namecheap. The company also took down this website.

On Tuesday, the same scam was found next to Google search results for 'compare high return investments'. it had been moved to a new web address registered through a different domain registration provider.

A spokesperson for Namecheap said that it was "completely false" to suggest that the company profited when its services were used by scammers.

"For context, last year we investigated over 1.2 million fraud cases.

"Out of all of these reported fraud cases, Namecheap was able to verify abuse for roughly 65,000 complaints. We found an additional 24,000 verified cases of abuse that we identified through our own internal proactive anti-fraud efforts."

Namecheap recently allowed customers to pay for registering domain using cryptocurrency, which allows transactions to be kept anonymous.

Google says that it verifies the identity of advertisers on its platform who are promoting financial products but it declined to say whether it reported suspected scams to the police.

Mr Taber said the latest bitcoin scam as further evidence of the the need to ensure that the government cracks down on online advertising in the Online Safety Bill which is working its way through parliament.

The government has claimed that the bill will “lead the way in ensuring internet safety for all” but it does not include measures to protect millions of people from the growing threat of scams and fraud.

Police data shows that reports of investment frauds, where savers are convinced to put their money into high-risk or non-existent investments, have more than trebled in the past five years. Meanwhile, convictions are rare, with police forces complaining that their resources to investigate fraud are stretched.

Convictions under the Fraud Act slumped to their lowest level since 2007 last year with just one in 700 reported cases now being successfully prosecuted.

The number of convictions has fallen every year since 2011, from a peak of 9,095 to a low of 3,453 in 2020.

Debbie Barton, financial crime prevention expert at wealth manager Quilter, said the figures should ring alarm bells for government ministers.

“From dubious cryptocurrency and forex trading schemes to non-existent investment bonds, fraud lurks everywhere, particularly online and on social media.

“Yet instead of seeing an uptick in the number of fraud convictions to match the rapid increase in reports to Action Fraud, we’ve seen the opposite. Fraud convictions have dropped off a cliff since 2011 to reach levels not seen since the Act was first introduced.

Ms Barton and Mr Taber both argued that tech giants like Google and Facebook must take more legal responsibility for the advertising which generates most of their multi-billion-dollar profits.

“A good start to protect the public would be for the government to include further [typpes of fraud] in the Online Safety Bill so that technology companies have a legal duty to tackle harm caused on their sites, and have to take up the slack in monitoring the online world for scams.”

While a publisher of a newspaper is liable for the contents of adverts Google - which generates more money from advertising than any other company in the world - is currently not being held accountable in the same way.

The search giant argues that it is a platform, not a publisher, and so is not responsible in the same way.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments