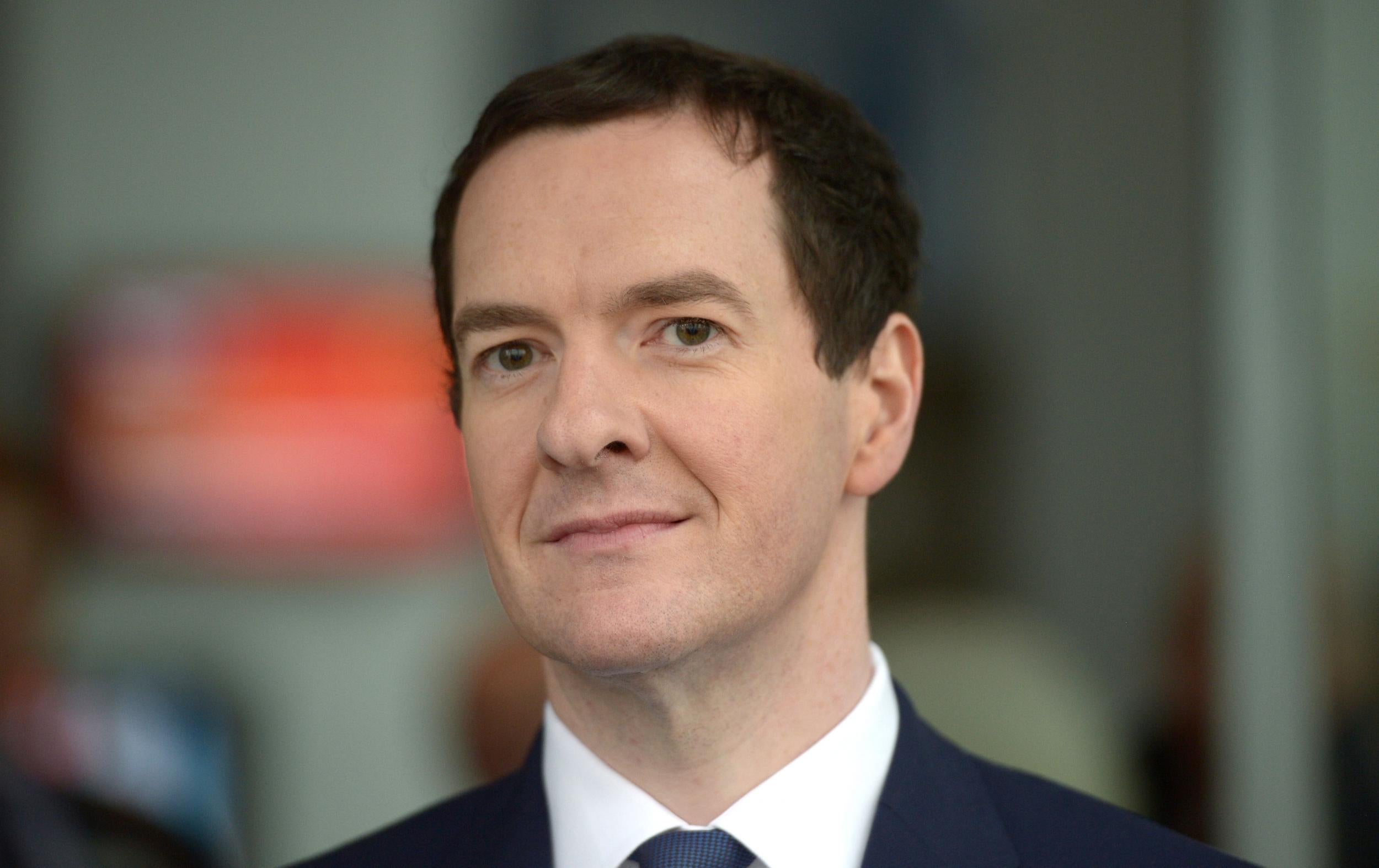

George Osborne warns mortgage holders: Be prepared for interest rates rise this year

Chancellor says the first rise in interest rates since 2007 would signal that the UK economy was 'normalising'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne has hinted that interest rates could soon rise and warned that the UK must be prepared for the prospect of the first increase since 2007.

The Chancellor insisted that any change would be for the independent Bank of England to decide and said it would be “wholly inappropriate” for him to pressure the Bank’s governor Mark Carney.

But he pointed to the interest rate rise in the US last month and said a similar rise in the UK would signal a stronger economy and indicate that it is “normalising”.

Interest rates have been kept at their record low of 0.5 per cent since 2009, meaning many recent homeowners have yet to experience even a small rate rise in their mortgage payments.

Mr Osborne, who warned on Thursday that the UK economy faced a “dangerous cocktail” of external threats said: “I’ll make this point: of course just before Christmas the US saw a rise in interest rates - the Federal Reserve put interest rates up. That was the beginning of the exit from the very, very low interest rates and ultra-loose monetary policy that was put in place during the crash.

"Of course there will come a point where that happens in Britain - a decision made by our independent central bank."

He added: “We’ve got to make sure in our country, and this is the responsibility of the Government not the Bank of England solely, that of course we are ready for whatever the interest rate environment is, that this time, for example… we monitor overall levels of indebtedness in our economy, that we take action to deal with particular booms or asset price bubbles, and things like buy-to-let mortgages.

"We have got to be ready, but ultimately if and when interest rates go up, that will be a sign of a stronger economy that is normalising after the extraordinary crisis of seven or eight years ago."

In a speech in Cardiff, Mr Osborne told business leaders that the British economy is moving into a “mission critical” year.

External threats posed by China’s unsteady stock market, instability in the Middle East and plummeting oil prices means there can be no “let up” in the squeeze on spending.

“Anyone who thinks it's mission accomplished with the British economy is making a grave mistake.

“Last year was the worst for global growth since the crash and this year opens with a dangerous cocktail of new threats. For Britain, the only antidote to that is confronting complacency and sticking to the course we've charted.

“I worry about a creeping complacency in the national debate about our economy. A sense that the hard work at home is complete and that we're immune from the risks abroad.”

“That is good for consumers and business customers here in Britain, bad news for the oil and gas industry, worrying for the creditors who have lent to it, and a massive problem for the countries that depend on it.

“Meanwhile the political developments in the Middle East, with Saudi Arabia and Iran, concern us all.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments