Food prices set to come back down soon, supermarket chiefs promise

Retail bosses under pressure as food inflation proves more ‘sticky’ than expected

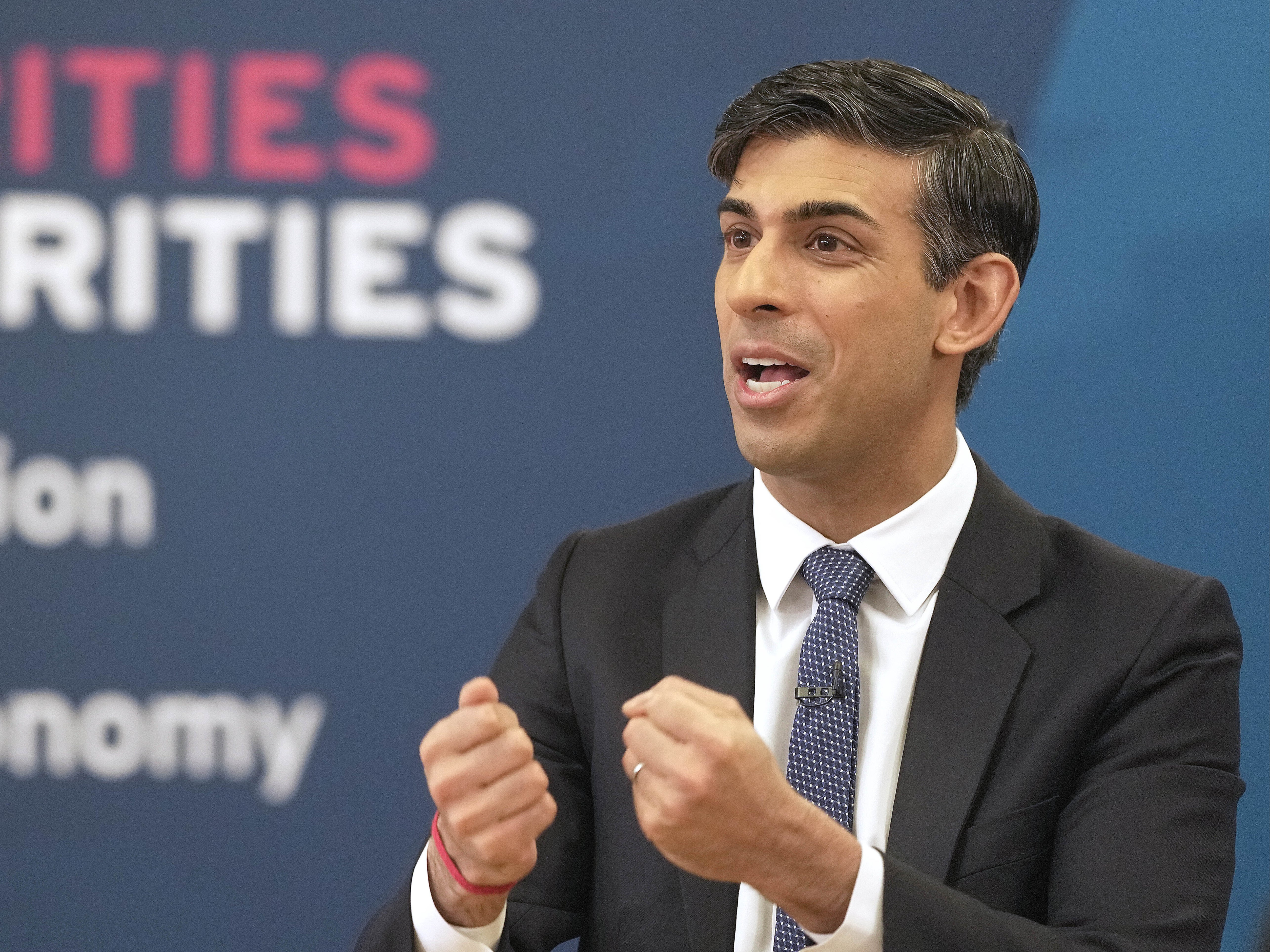

Supermarket bosses are said to have told Rishi Sunak’s government that food price inflation has already peaked and costs to the consumer will start to fall in the coming months.

It comes after the Bank of England food price pressures had proved more “sticky” than expected as UK inflation remains “stubbornly high”.

Top supermarkets assured chief secretary to the Treasury John Glen and other officials that food inflation was “past the peak” and that prices would come down soon, The Times reported.

Sector chiefs appear to have assured government that they are not profiteering from Britain’s cost of living crisis.

“Supermarkets in Britain are highly competitive but the wholesale price of goods has increased significantly due to energy and labour costs,” a government source told the newspaper.

Ministers and the central Bank are concerned that food price inflation has proved more stubborn despite falling wholesale energy prices.

Downing Street was reportedly so worried about soaring grocery prices that it looked at France’s move to cap the price of some basics, but the approach is not thought to be under consideration.

The prices of food and drinks has risen at fastest rate in over 45 years, increasing year-on-year to 19.2 per cent in March – up from 18.2 per cent the previous month.

Liberal Democrat leader Ed Davey has calling for the Competition and Markets Authority (CMA) to launch an inquiry into unfair “profiteering” by supermarkets.

Announcing another interest rate rise on Thursday, the Bank of England said there was no evidence of profiteering from the supermarkets – but warned that food inflation wouldn’t come down as quickly as expected.

Stubborn food price inflation has put pressure on the Bank’s 2 per cent inflation target, as Russia’s war in Ukraine and poor harvests in some European countries have helped ramp up pressures.

Andrew Bailey, the Bank’s governor, said there had been a “very big underlying shock” to food prices. “It appears to be taking longer for food price pressures to work their way through the system this time than we had expected.”

The supermarkets are said to have urged government to help bring down prices by cutting the regulatory burden around packaging and other areas.

It comes as the latest Office for National Statistics (ONS) figures show the UK economy only marginally grew over the first quarter of the year, by only 0.1 per cent. But the economy shrunk by 0.3 per cent in March, driven by falls for the retail and wholesale sector.

The ONS said “exceptionally wet” weather was partly to blame for March’s slump, with strikes also a factor behind the sluggish performance.

It comes as the Bank of England revised its growth estimates upward and forecast that Britain would avoid recession this year. The Bank raised the base interest rate to 4.5 per cent from 4.25 per cent – the 12th time in a row that rates have risen.

Inflation, which hit 10.1 per cent in March, is expected to drop “sharply” from April this year, but there are “considerable uncertainties” over how quickly it will decline.

The Bank thinks it could drop to 5.2 per cent by the end of the year, which would mean the Sunak government narrowly reaches its target of halving inflation by the close of 2023.

Chancellor Jeremy Hunt said it is not “automatic” that the government will reach its inflation target, one of the five big pledges to the electorate.

“There has never been anything automatic about hitting it,” said Mr Hunt. “That is why it is so important, if we’re going to bring certainty back to family finance, stop prices rising, that we stick to our plan to halve it.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments