The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

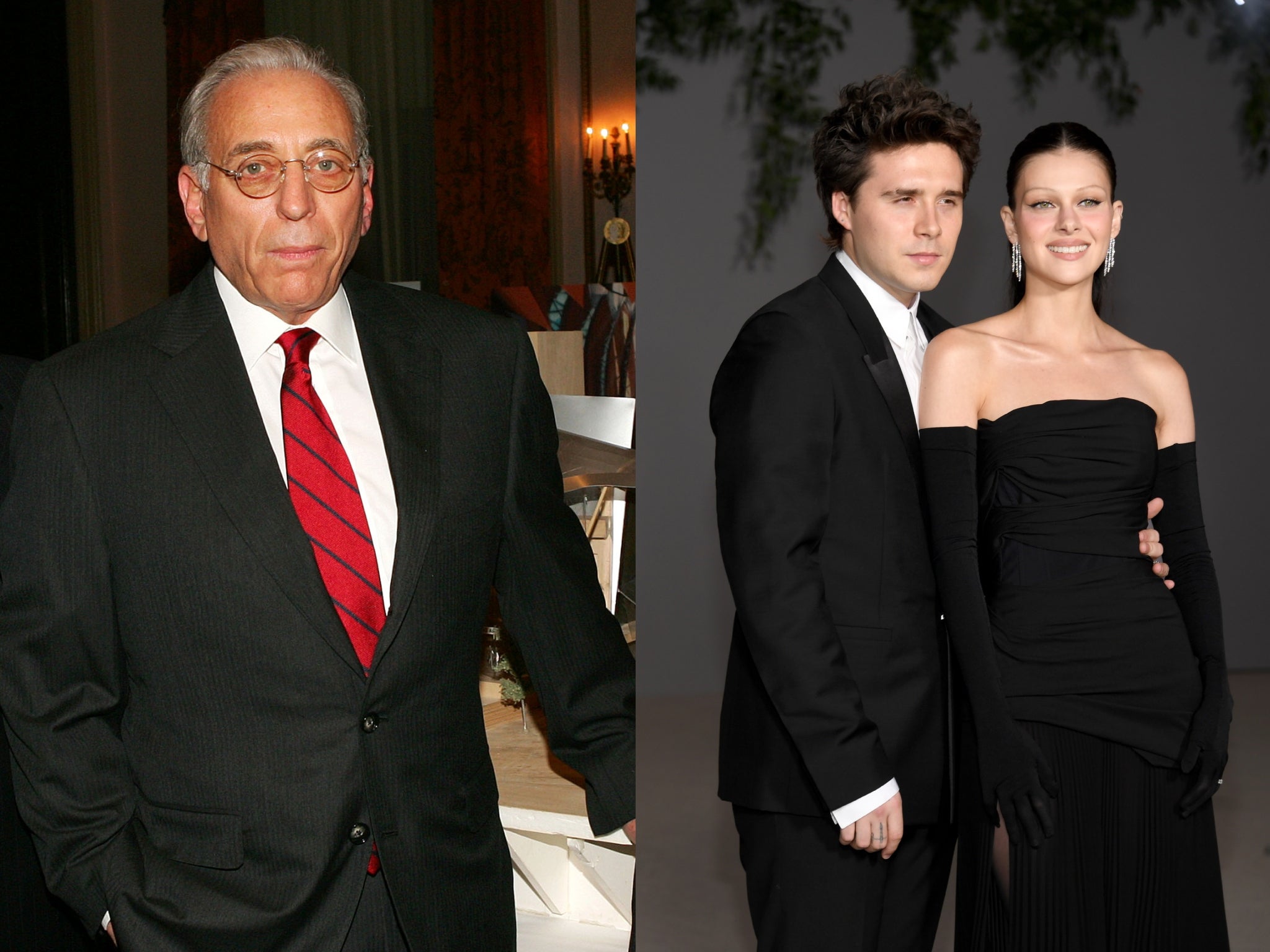

Nelson Peltz sells Disney stake weeks after Brooklyn Beckham’s billionaire father-in-law lost takeover battle

Peltz criticised the board for their failure to vet former CEO Bob Chapek

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Hedgefund billionaire Nelson Peltz sold his entire stake in Disney after his bid to shake up Disney’s board was soundly defeated, according to reports.

The father of actor Nicola Peltz-Beckham, married to Brooklyn Beckham, reportedly sold his stock at “close to $120 dollars a share,” to make about $1 billion on the sale, CNBC reported.

The share price indicates he made the sale in the aftermath of an April shareholder meeting in which he failed to take control of the company’s board.

Hedgefund Trian Partners, which is funded by Peltz, nominated Peltz himself to win a seat on the board. However, their bid was soundly defeated by other shareholders at the annual meeting on April 3.

The vote came following complaints from Peltz claiming the board had failed to do its job with regards to CEO succession planning in not vetting former parks boss Bob Chapek - who was current CEO Bob Iger’s favourite to succeed him in 2020.

Iger was brought back in as CEO in November 2022 after Chapek was ousted.

Following last month’s vote, Peltz vowed to continue his critique if the board failed to deliver.

“I hope this is not a redo of last year where we pulled out, gave management a chance and the stock went down,” he told CNBC.

He added: “Whether we stay [invested in Disney] or not, we don’t make those kinds of announcements.”

Peltz’s Trian Partners wanted to oust two directors, Maria Elena Lagomasino and Michael Froman, citing sustained share underperformance accordin to CNBC.

However, it was reported that Peltz lost to Lagomasino by a 2-to-1 margin, and the company’s entire slate of board nominees were reelected.

Peltz, who is Brooklyn Beckham’s father-in-law is regarded as an activist investor, meaning that he invests in companies considered undervalued and then lobbies for change within them.

Bob Iger has led the Walt Disney Company for a 17-year term as CEO, leading the multi-billion dollar kingdom through a pandemic, scandals, the rise of online streaming, and more recently, his own successor.

Bob Chapek was passed the mantle by Mr Iger in 2020, who quickly swooped back in less than three years later after a string of film flops and poor management costing the organisation millions of dollars.

Mr Iger does plan to step down - hopefully more permanently - in the coming years.

According to Vanity Fair, the entertainment giant has narrowed down Iger’s list of successors to four candidates, with plans in place to hand over in 2026 – and crucially avoid a repeat of the 2022 disaster that saw Iger return to pick up the pieces within just three years.

The people tapped as candidates for the CEO position are Dana Walden, Alan Bergman, Jimmy Pitaro, and Josh D’Amaro.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments