Eurozone crisis: Politics triumphed over experience with Greece. The country will still default

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It is hard to know what to think about Greece. Some things are quite clear. It cannot pay its debts. Its costs are too high to be competitive compared with most of the eurozone and its neighbour, Turkey. And its economy is held back by the difficulties it has to push through structural reforms.

Were this a typical similarly indebted country there would be an established programme to put the country back on its feet. It is the tried formula applied by the International Monetary Fund for scores of countries since the Second World War. The details naturally vary from country to country but there are typically four elements: debt relief, fiscal consolidation, structural reform, and usually devaluation. The IMF approves the programme, lends the country some money to tide it over, which in turn unlocks access to commercial funding. Investment comes in and the economy recovers.

It has not happened like that with Greece, for the rescue programme was flawed. The IMF was not in lead position, for the eurozone authorities played that role. So the two bail-outs, both of which have failed, were poorly constructed. Debt relief was inadequate, fiscal consolidation too vicious, structural reform too weak and, crucially, there was no devaluation. The result was that instead of creating the conditions for a solid recovery, the programme led to a 25 per cent contraction of the Greek economy, and a debt repayment schedule that stretches to 2054.

What is upsetting is that failure was inevitable. Many of us said or wrote that at the time. You did not have to be very clever to see that. But common sense was pushed aside by the political objectives of avoiding a formal default of a eurozone country and keeping the eurozone intact. Political will trumped economic experience. It has taken a populist government to say this cannot go on, albeit in a rather incoherent way.

So what will happen?

There are two ways of looking at this. One is to take the sequential decision-making process and try to call how the different sides will react. This is game theory stuff and you can construct a flow-chart showing the various outcomes if the different parties jump one way or another. There are three main outcomes: Greece is bailed out again, does not default and remains within the eurozone; Greece is not bailed out, formally defaults, but ways are found to keep it in the eurozone; Greece defaults and leaves the euro.

There is nothing wrong with this approach and a lot of people in the world of finance are using a matrix on these lines to try both to assess the odds of the different outcomes and to clarify the consequences. These odds change. Thus every time there is a gruff comment from Wolfgang Schäuble, the German Finance Minister, or a flamboyant one from Yanis Varoufakis, his Greek opposite number, the markets jump in response. You can look at the markets and deduce from them what smart money thinks at any one moment is likely to happen.

The trouble with this is that smart money is actually quite dumb. In 2006 the yield on 10-year Greek government debt was below 5 per cent; in early 2012 it peaked at 35 per cent; it then fell back to around 6 per cent last year – and is now 13.5 per cent. This would seem to say that Greece is less than half as likely to default now than it was in 2012, but nearly double as likely as it was last year. But these swings are so great that I don’t think it makes a lot of sense to read anything into them.

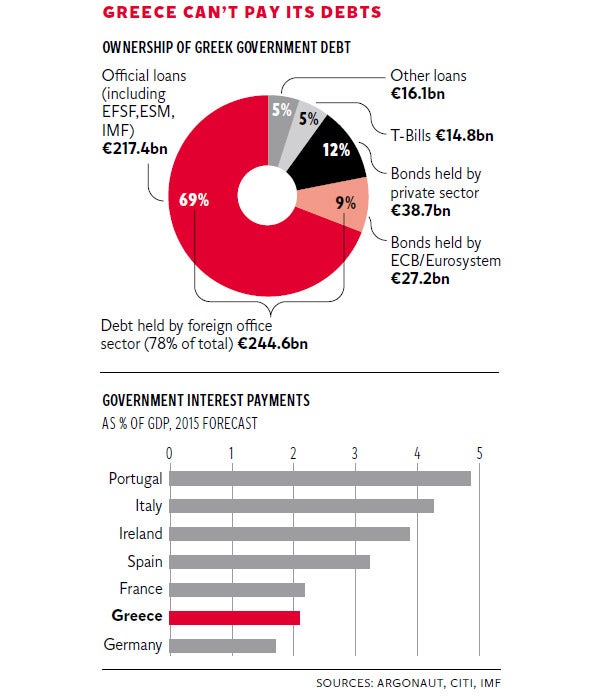

In any case, more than three quarters of the Greek national debt is held by the official bodies that bailed it out and by the European Central Bank. As you can see from the pie chart, the private sector only holds 12 per cent of the country’s debt. So a default is not really much of a concern for the private sector. The people who will lose money are other European taxpayers, with small further losses carried by shareholders of the IMF, including ourselves. I’m sure that’s going to happen. It is just a question of when. But to reach that conclusion I have not gone through a sequential analysis of the negotiations, as suggested in the first approach above. I have used the second approach, starting with the maths and then making an intuitive judgement as to how these things usually pan out.

The maths say there will be a default. I can’t find a single developed country that has accumulated a national debt of 175 per cent of GDP in peacetime and not defaulted. War debts are somewhat different. So that will happen probably this year, maybe in the next few weeks. The question is how other European nations react. That is harder to call. The other chart shows that, thanks to the bail-out conditions, the government interest payments are not that large relative to GDP. Indeed they are lower than those of Portugal, Italy, Ireland and Spain.

When the formal default happens, and given the way Europe works, this could be postponed for a couple of years, there will be great resentment among European taxpayers. It will be at that moment that continued membership of the eurozone comes into question. My own instinct is that there will be a huge political effort to separate the formal default from eurozone membership, probably with capital controls on Greek balances. Greek euros will not be as good as German ones. Political will may be strong enough to maintain Greece’s use of the euro for the time being. So this will be a two-stage thing: first the default, then some sort of move to two-tier euro, north and south. It won’t work in the long-run but I have been surprised by the pain that electorates have been prepared to accept in order to retain euro membership.

It is impossible to see the detail or to get the timing right. But the proposition of Greeks repaying debts incurred by a long-deposed government right though to 2054 is not a viable one.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments