Once interest rates are on the move again, how fast will they rise?

Economic View: Fed chair, Janet Yellen, is expected to announce a rise in rates in the final quarter of 2015

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It is a huge question, not least for the next UK government: how fast will interest rates rise here and elsewhere in the developed world? For a start, the cost of funding will be a crucial element in the next government’s fiscal planning, for the faster rates go up the tougher it will be to meet the various promises that are being made. The interest on the national debt is one element of spending over which governments have virtually no control.

In world terms however, the outlook for UK interest rates is a second-order issue. The first-order issues are what will happen to US rates, and what the European Central Bank will do to keep the eurozone afloat. So, first, some thoughts about the US and Europe. For the US the overarching question is when will the Fed move? For Europe, has a corner really been turned?

For the Fed, it is either June or September, and after last night’s statement most commentators are leaning towards the latter. Actually, as Janet Yellen has said more than once, the decision will be shaped by what happens to the economy. Here we have, as always, conflicting signals, with a weak first quarter but strong forward data pointing to a rebound in the second quarter. I don’t think we should rule out June, but the consensus has moved to September.

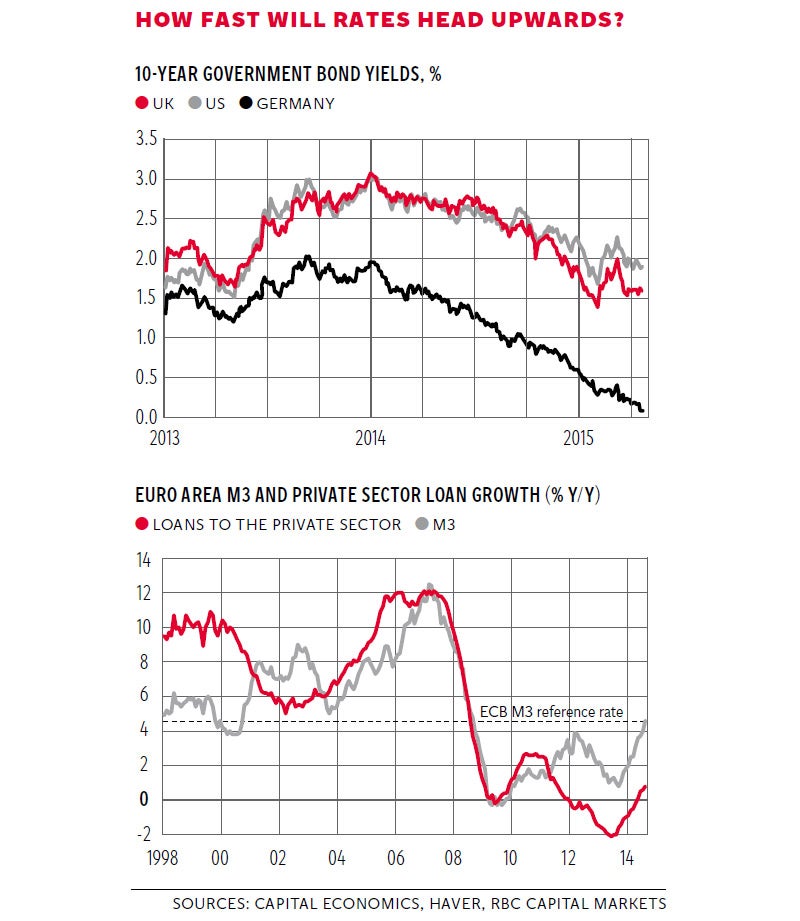

Let’s assume it will be September; what, then, will the likely profile of rate increases be? Again, that will depend on the data, but the yields on Treasury securities suggest that it will be unusually gradual and cautious. You can see in the top graph how yields on 10-year Treasuries have come steadily down since the beginning of the year, which would be consistent with this expectation of a very slow rise in rates. In the past few days, however, they have nudged back up, reaching 2.05 per cent. Yields on UK gilts have pretty much followed Treasuries, whereas German bund yields have been on a different planet, seemingly plunging ever-lower – until the past few days.

It is always bit ridiculous to try to call huge turning points in the market, because even if you are broadly right you are likely to be precisely wrong. But it is plausible that we have just seen the bottom for German government bond yields earlier this month. They have been negative up to about eight years: it costs you money to lend to the German government for shorter dates than that. This is so inherently absurd that this cannot last long: an artificial outcome of the ECB’s quantitative easing programme. Ten-year yields did not go negative, quite, but went below 0.05 per cent for a few minutes on 17 April. Now they are up to 0.28 per cent, still I think ludicrously low, but a step back towards sanity. It may well turn out that the middle of April 2015 was the great turning point in the European bond market, with yields never to go as low again in our lifetimes.

Of course there is no prospect of the ECB raising interest rates any time soon. But another landmark has been passed and you can see that in the second graph. European bank lending to the private sector has gone positive. There is no point in having cheap money if banks are unable to lend or borrowers unwilling to borrow. Loans to the private sector in Europe were running up between 6 per cent and 12 per cent a year through the decade before the financial crisis. Then lending collapsed in Europe as it did elsewhere, but whereas it has recovered in both the US and UK, it fell back again in 2013 in Europe. Money supply growth has recovered a bit but it is only now that lending has picked up.

This matters because, to generalise, European companies are relatively more dependent on the banks to finance them than are US or UK companies. Seen in macro-economic terms, this rise in lending is an essential precursor to any rise in interest rates. Of course the problem for the ECB is that some parts of Europe, notably Germany, probably need higher interest rates. There is a hint of a bubble beginning to inflate in parts of the property market, for example in Berlin. European shares have boomed this year and a Bloomberg survey of investors now puts European assets ahead of US ones as the choice for American investors. There will be no early expectation of such an increase when the Fed starts to increase rates this autumn and the Bank of England duly follows. But in another 18 months’ time it is quite plausible that we will see the first rise in eurozone rates.

The Bank of England duly follows? Stand back a bit from the detail of the Monetary Policy Committee, the hawks and doves, and ask yourself: should an economy growing decently, with a housing boom, and unemployment down below 6 per cent, keep interest rates near zero? That cannot be right. True, inflation has been depressed by the one-off fall in the oil price. True, wage and salary increases are muted. But all our experience tells us that policy needs to act before alarm bells go off, not after. The rise in US rates this autumn will give cover and the markets, insofar as they think anything, think that the UK will increase rates within six months of the US. So if they move in September, we go in November or February. (Rates usually move when the Bank of England’s inflation report is published because there is a wodge of data to support the judgement.) Some of us expected the move much earlier and had it not been for the oil price fall that would have happened.

When the cost of borrowing for us goes up, so too will the cost of borrowing for the government, but how fast? The Bank of England view is that the slope will be gentle and you don’t want to bet against it. But the idea that money will stay cheap through the life of the next parliament is a dangerous one. Common sense says money is too cheap, and eventually, even in the crazy world of financial markets, common sense will win out.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments