Hamish McRae: West will be shaped by growth markets

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Group of Twenty meeting of finance ministers and central bank governors this weekend has seen the usual assurances that countries will continue to have responsible economic policies, in this instance in refraining from competitive devaluation of their currencies. But for me the more interesting aspect of the meeting was not what was said, but rather what it was and where it was.

This was a meeting of the G20, a body in which the old world is numerically outranked by the new world, and it was taking place in Moscow, capital of one of the Brics. That would have been unthinkable 20 years ago. Now we regard it as normal, for we have absorbed the reality that we are living in a world where economic power is more balanced between the West and the Rest than at any time since, gosh, the middle of the 19th century.

If you want a second event that characterises the shift of power represented at the G20, on Tuesday our Prime Minister will go to India to lead the largest overseas trade mission since the 1970s. Biggest trade mission goes to India, rather than the US or Germany? Well, yes, because that is where the opportunities lie.

The shift of power to China has been so widely discussed that I'm not sure there is much to add here, except perhaps to note that another milestone was passed last year when China's total trade, adding exports and imports together, exceeded that of the US. What seems more interesting is to look forward to the likely extent of the shift this decade and in particular to the other growth markets, which though smaller individually are cumulatively larger.

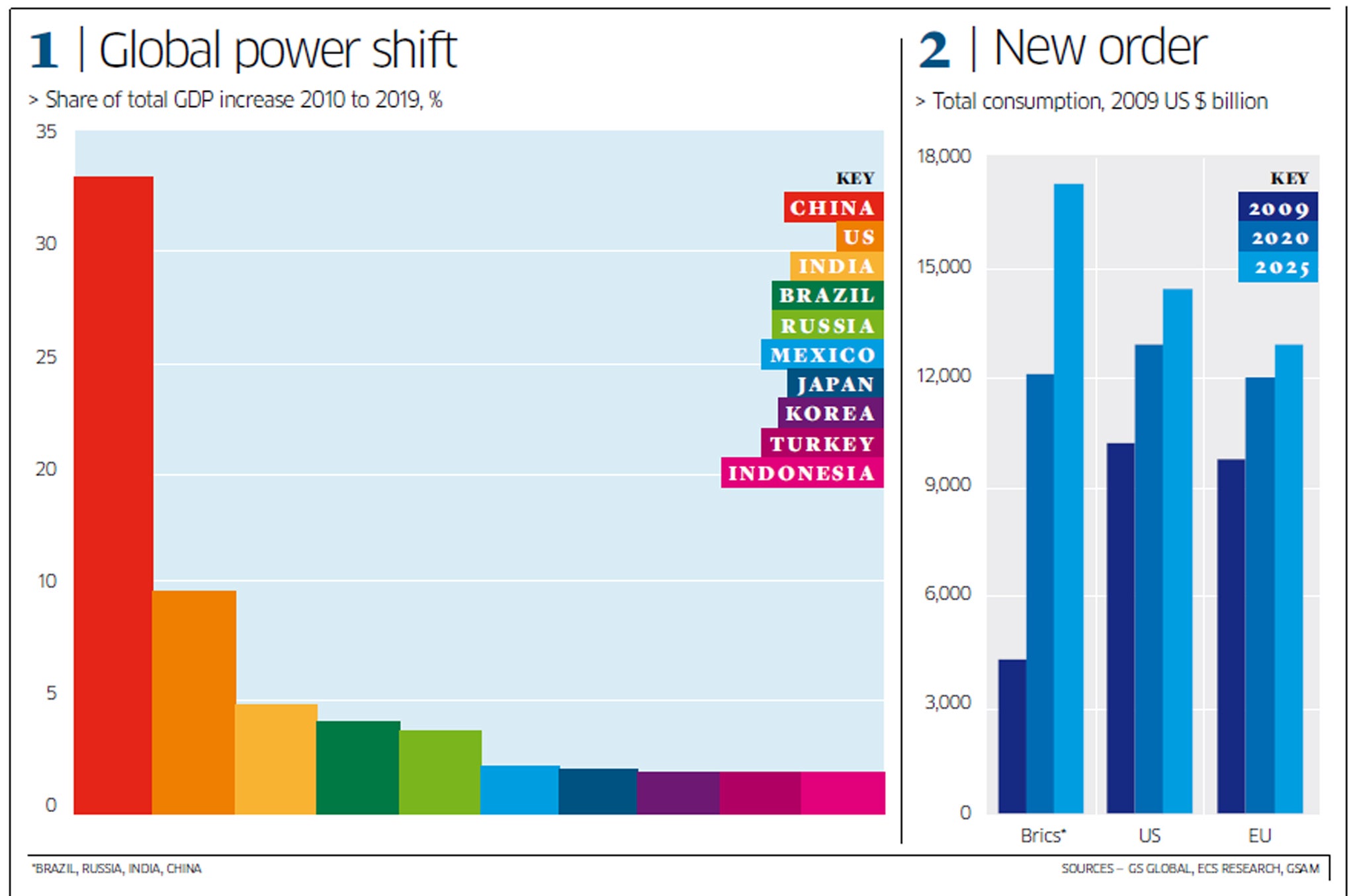

You can catch a feeling for this in the main graph. I have been looking back at some work by Jim O'Neill at Goldman Sachs Asset Management done in 2011 and showing the way the Bric story had broadened into a wider story about growth in general. The graph shows the top 10 countries that are likely to add most to global demand this decade. I find it pretty stunning, not least because there are only two fully developed countries in the list – the US and Japan – and not one single EU member. But the other message is that this is not just a China story, or even an India/Brazil/Russia one; the other growth markets, such as Mexico, Turkey and Indonesia, are massively important, too.

On the other chart you can see how this growth performance changes the relative pecking order between the US, the EU and the Brics. When the recession struck in 2009 the consumption of the Brics was still a lot smaller than that of either the US or Europe. In 2020 it will be roughly the same size, and by 2025 it is likely to be much larger.

These are just projections, and they may of course turn out to be wrong. The point worth making, however, is that the shift of power to these growth markets has tended to be even faster than originally forecast, and looking forward they are as likely to understate the shift of power as to overstate it.

This leads into two types of question. One is: "What can we do to justify our present standard of living?" Or even: "What can we sell to these countries that they cannot make for themselves?" That is something that I have dealt with in these columns and doubtless will deal with again. There is, however, another one, which is something like this: "In what ways will the attitudes of this fast-growing world shape our attitudes?"

The thinking behind this is that we will have to come to terms with a loss of influence, and that will be uncomfortable for us. As far as the G20 is concerned, I suppose the basic message is that these growth economies rely far less than we do on credit-driven growth. The total debt level of the most indebted of the Brics, which is China, is about half the level of the most indebted of the G7, which is Germany. I am told that 70 per cent of the homes in China are bought for cash.

There are other differences in economic policy and attitudes. Inflation has been allowed to climb in the emerging world to a greater extent than it has, at least in recent years, in the developed world. Maybe now we are going to have to accept higher levels of inflation; not a happy thought, because inflation redistributes wealth towards the canny and the strong and away from the financially unsophisticated and the weak. We will not like accepting the higher levels of inequality that are evident in China, India and elsewhere, though we have already made our own problems of inequality much worse.

We have a knee-jerk reaction that because an idea is coming out of China, India or elsewhere, it is wrong. There are surely things we can learn, or rather relearn, such as the need for individuals to save for their future rather than rely on the state to do so for them – which it is manifestly failing to do. The outlook surely is one of convergence. Just as some aspects of economic management in the emerging world will shape economic management in the West, our economic systems will shape those of the emerging world.

But one thing is sure: we will have to learn to rebalance our economies to producing what these fast-growing markets want to buy. That is why this mission to India is of such huge importance. It is symbolic of the changed relationship between India and the UK, but it is also practical, for in the developed world only the US is likely to be a consistent driver of economic growth. We already have reasonable access to the US; where we have been weak is in developing access to those growth markets in the main chart – China of course, but focus on the others too.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments