Hamish McRae: The clouds may not be as dark as the OECD thinks, but not by much

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The "R" word is now front stage, at least as far as the UK is concerned. The OECD report this week was much more negative about UK prospects than anything we have seen yet. It makes the Bank of England's latest Inflation Report, which we all thought was pretty pessimistic, appear almost cheerful. If the OECD is right, then it won't just be the economy that is in a mess. Public finances will be far worse than anything yet contemplated, there will have to be spending cuts and I could see this government unable to hang on under any leader till the full lift of this Parliament in 2010.

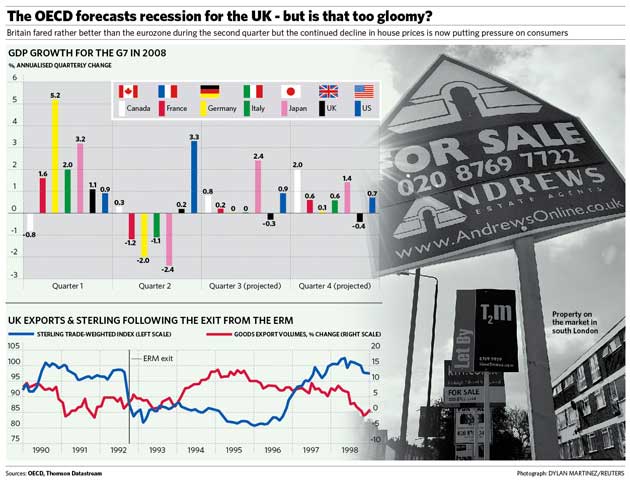

So is it right? My instinct is that it is too gloomy about the rest of this year but maybe not too gloomy about what will happen in 2009. To remind you of its point that the UK had a worse outlook than any other G7 economy for the rest of this year, the OECD forecasts for the G7 are shown on a quarterly basis in the first graph. The thing that stands out is the sharp deterioration from the first half of this year to the second, the sharpest of the G7. The eurozone as a whole contracted in the second quarter but is expected to resume growth now. We grew a little according to the first estimates of GDP, though a revision showed the economy to be flat.

The reasoning behind the OECD judgement seem to be that the UK will be more affected by its housing crash than most other economies – Spain may be harder hit but it is not a member of the G7. While our residential construction sector is relatively small, our personal-debt burden is particularly high and our consumers have been relying more on home equity withdrawal to fund their spending than those of other countries. In theory this makes sense. In practice, though, consumers may prove more resilient than the economy models might suggest. Evidence from the US, which suffered an earlier housing downturn than the UK, suggests that consumption can be sustained for a long time provided people are confident of retaining their jobs. While our labour market has undoubtedly softened, it has not tanked – or at least not yet.

The latest forward-looking data on the economy, the services purchasing managers' index, actually improved in August and of course the fall in sterling will eventually help support export demand. So I suppose you could say that we will be looking to consumers to sustain demand for the rest of this year and then hope that exporters will take up the slack next.

There is, however, a problem with this. It is the likely lag between the fall in the pound and the impact on aggregate demand. When there is a sharp exchange-rate movement, such as we have just seen, there are some sectors that respond very quickly. These include tourism, which is very sensitive to exchange rates: witness the way the fall in sterling against the euro encouraged many people who might have popped over to the Continent for their holidays to stay at home. But others take much longer.

The best example we have of the lag between a fall in sterling and a rise in exports is what happened in the early 1990s, as the other graph from Capital Economics shows. The point here is that it took two years from the fall of sterling to result in a big rise in exports. Exports only came through when European demand recovered from the recession; Europe was and remains our largest market. This time I am reasonably confident that we will do rather better, partly because the fall in sterling has come earlier in the cycle and partly because we will be able to reduce interest rates. But next year will undoubtedly be very difficult, more so than this, even factoring in several interest rate reductions.

So when will they start to come through? Well, don't expect them today. The Bank's monetary committee is almost certain to hold rates, as indeed will the European Central Bank. There is also a rational reason for delaying action next month too because the Bank would be wise to wait until the Pre-Budget Report, out some time in October. Until you know what is happening to fiscal policy, it makes sense not to change monetary policy. But, come November, given continuing declines in commodity prices, you could see a way to that next cut in rates. That may not happen then, but this timing is plausible if the Bank can see any signs of a sustained downward movement in inflation.

Through next year, we can expect a series of cuts. As this commodity price surge moves out of the base, the month-on-month inflation numbers will look much better. True, the fall in sterling will add to import costs but there wasn't any surge in inflation following the 1992 devaluation. Then, depressed demand stopped higher import prices being passed on to consumers and we can expect the same to happen now. There is even a possibility of inflation undershooting the target next year, an outturn that is barely on most people's radar at the moment. We can cope with that problem as and when it comes.

The trouble is that even rates at 4 per cent or below are not of themselves going to do much to stimulate the economy, for two reasons.

The first is that, if house prices are falling at about 10 per cent a year, it makes little difference that borrowing costs have fallen from, say, 6 per cent to 4 per cent. The second reason is that availability of finance will remain constrained, even when interest rates fall.

As far as the former is concerned, there is discouraging experience from Japan in the 1990s. Zero rates there did not revive the economy, partly because asset prices kept falling and partly because the banks were so stuffed with bad debts that they did not have the funds available to take on new debts, even sound ones.

There is something of that problem now, though the breakdown in the banking mechanism stems more from the ending of the mechanism where banks can securitise their mortgages and sell them on, rather than them having bad debts on their books. The other main difference is that we do have some inflation, whereas Japan in the early 1990s did not. So we should not assume that the other G7 countries, including the UK, will have a similar lost decade with hardly any growth at all. We can, to some extent, inflate our way out of the debt burden; indeed we already are doing that.

We will hear a great deal more about the latter problem in the coming months. There is the immediate issue as to whether the Bank's Special Liquidity Scheme should be extended to new mortgages but, behind that, there is the even bigger one about the ability of the banks to provide adequate funds not just for the housing market but for the business community. You don't want banks showering money on would-be borrowers as has been the case, but equally you don't want credit-worthy projects not being funded because of structural problems within the banking system. Quite how this will be resolved, or can be resolved, is really most unclear.

Meanwhile, the sensible thing to focus on is the mood of consumers. If, despite Alistair Darling's strictures and the OECD's gloom, consumption remains stable and even grows a little, it is hard to see a deep recession. A long period of very slow growth looks much more likely.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments