Hamish McRae: Planning for the inconceivable can ease pain of the inevitable

Economic Life: The central banks' pumping in money was an emergency measure, a short-term fix to cope with an extreme situation

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Contingency planning, that's what we have to do. The Governor of the Bank of England, no less, says so. Banks, companies, countries even – all have to plan for the possible break-up of the eurozone. And that, we have been assured this week by our Prime Minister and Chancellor, is what the UK is already doing.

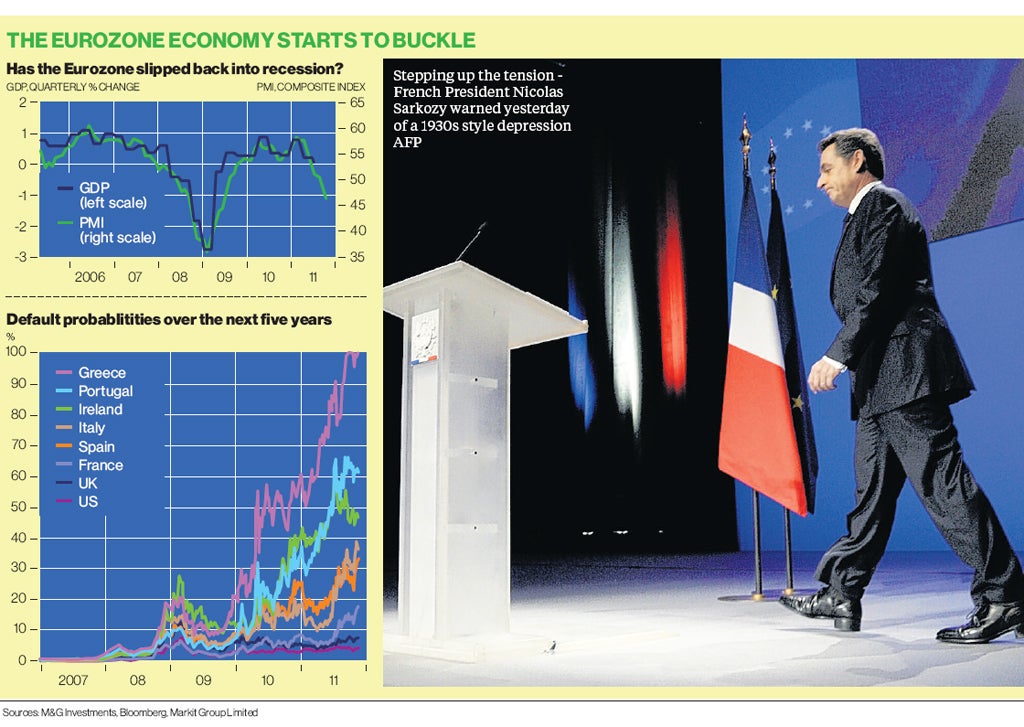

While the tensions between Angela Merkel and Nicolas Sarkozy were heightened yesterday by her insistence that countries should have a sinking fund and his contrasting apocalyptic warnings on the dangers of a 1930s depression, it is an extraordinary distance that we have come in a few months. To admit to thinking that the eurozone would break up was until recently regarded as almost heretical, not something one said in polite company. Now it seems to be the majority view among corporate treasurers that Greece and Portugal will probably leave the euro within two years, with a wider break-up expected later.

From a practical point of view, even if you don't expect this to happen, it is your fiduciary duty to plan for such an outcome if you are in charge of other people's money.

So that leads to two questions. First, does planning for such an outcome make that outcome more likely? And second, does it mean that when it does happen the effects will be less damaging?

I think the answer to both questions is yes. You can catch some feel for the rising risks and the impact this has on our financial system from a key passage in the Bank's new Financial Stability Report, out yesterday: "Sovereign and banking risks emanating from the euro area remain the most significant and immediate threat to UK financial stability. These risks have intensified materially... Capital market functioning has deteriorated and risky asset prices have fallen sharply. Risk capital has been reallocated, as investors have sought to reduce exposures to vulnerable euro-area countries and to riskier assets more broadly."

The Bank was worried about the effect on UK banks, but they are not really in the front line. The impact of these concerns on European banks has been even more serious. They have pared back their lending to each other, leaving many scrambling for funds every day and being forced both to cut back their lending and to go to the European Central Bank for support. But banks could only get euros from the ECB, not dollars. That was why the Federal Reserve, in concert with the other main central banks, agreed this week to pump dollars into the banking system.

The natural and correct response by European companies to fears that banks are cutting back their lending is to hoard cash. That is what they are doing; it is what British and American-based companies are doing too. But one effect of that is to cut back on stocks and on investment, with the result that the eurozone is now probably already in recession (see first graph). If companies freeze, the economy freezes. The action by the central banks partially unfreezes things and the share markets recognised that. It was classic textbook central banking stuff: pump in the money and if, when you do so, you act in concert you achieve much more impact. But it is an emergency measure to cope with an extreme situation, a short-term fix.

So the contingency plans that are being made in the event of a euro break-up do have the effect of making it more likely. Companies move funds away from weaker eurozone banks and indeed move them out of weaker countries altogether. Investors shun the bonds and are almost in the position of being told to do so. The second graph, showing the market estimates of the probability of default by various countries, comes from the Financial Stability Report. It has, so to speak, the seal of approval from the Bank of England. If you read in an official publication that Greece has as near as damn it a 100 per cent chance of default in the next five years, that is one thing: you knew it already. But if you also see that France has close to an 18 per cent chance of defaulting, that makes you think.

I know France and Spain both got bond issues away yesterday at what were seen as good rates. The details of who bought them will presumably emerge in the days ahead. But suppose you buy some French debt now, the eurozone breaks up entirely in five years' time and you are paid in devalued francs instead. In that case, your clients might reasonably ask whether you took into account the 18 per cent probability of a default when you made the purchase. Acceptance that the eurozone may break up inevitably increases the cost of credit to all eurozone sovereign borrowers, with the exception of Germany. If the cost of credit goes up as a result of such fears, the chance of break-up rises too.

And so to the second question: does contingency planning reduce the damage? Intuitively the answer is that it must do. It is not just that if people are prepared for something then it hurts less when it happens; the more prepared people are the better able they will be to take advantage of the opportunities created by the new situation. So when Greece leaves the eurozone the devaluation of its currency will create a tourist boom, for tourism is extremely sensitive to changes in exchange rates. There will also be a surge of inward investment and a rise in exports. Whether this immediate boost to the economy can be sustained will depend on the ability of the country to make the structural and other reforms that everyone agrees need to happen. So it is not a cure at all. Nevertheless, devaluation has the effect of spreading the pain more widely than pure austerity, as well as giving this short-term boost to demand.

If contingency planning can reduce the damage of a eurozone break-up are we right to be as worried as, for example, both the Prime Minister and the Governor seem to be? In the medium-term it is probably true that greater flexibility on currency and interest rates in Europe would boost overall economic performance. But that is another thing that we are not really allowed to say, or at least not yet: that once the initial disruption is over, European growth will be faster if currencies are able to adjust for differential inflation performance and countries have interest rates suited to local conditions.

Given how much opinion has moved, I wonder how long it will be before that sort of thought becomes as commonplace as accepting that something that was once deemed inconceivable now has to be planned for, albeit as a contingency.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments