Hamish McRae: My instincts say the Bank has no reason to be so pessimistic

Economic Life

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.There are many times when the official forecasters are far too optimistic and we have had plenty of experience of that. But rather less frequently they feel so humiliated by their previous failures that they start to be over-pessimistic – and as far as the Bank of England is concerned, we may be reaching that stage now. To be frank, I don't have very good reasons for believing that, but intuition says the Bank is too gloomy, and when reason and intuition clash, the latter is usually the better guide.

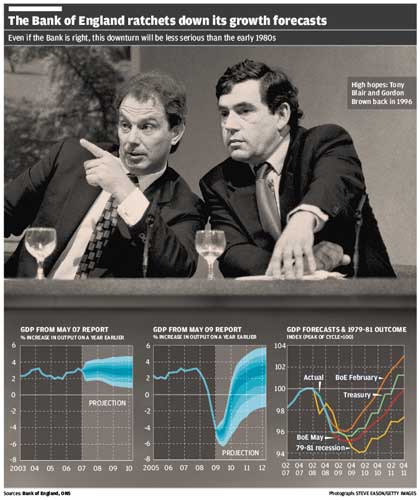

It certainly was two years ago. When the Bank published its Inflation Report in May 2007, it saw little possibility of a recession in the next few years. You can see its predictions in the first fan chart, taken from that report. The fan covered 80 per cent of the possible outcomes, with 10 per cent chances of the outcome being either above or below the range. In other words there was only a 10 per cent chance of growth dipping below 0.75 per cent this year. We now know that this was tragically, absurdly, almost comically wrong.

It is harsh to say that, so I thought I had better look back at what I wrote then. My commentary on the report itself focused on the failure of the Bank to control asset inflation, in contrast to its success in controlling current inflation. The column ended: "What is the Bank – or indeed any central bank – more interested in keeping reasonably stable: the price of goods and services or the price of assets? I would say both. Excessive swings in both types of inflation are tremendously destructive socially, and eventually in economic terms too. The Bank, like most other central banks, has been very successful at the former task and an utter failure at the latter."

We know now that the house price boom was a catastrophe, helping to stoke unsustainable growth in consumption. But what of the Bank's growth forecasts? I did not comment on those in that piece as I had done so in the previous Independent on Sunday. Working from the very similar fan chart of the February Inflation Report, I wrote: "Two features are worth noting. One is that the central band is anchored firmly between 2.75 and 3 per cent. If achieved, that would be pretty good. The other is that the Bank gives only a 10 per cent possibility of growth falling below 0.75 per cent. That seems to me to be a bit low."

The phrasing was soft, too soft actually, but you see the point. Even to an outsider, it was clear that the Bank was not giving sufficient credence to the possibility of a recession around 2009, particularly in view of the wider concerns. Thus I noted that "a lot of us feel a certain unease about the future. Maybe this is simply the result of fears that the long boom might not carry on much longer..."

My conclusion was that, if the Bank were right, my fears of the ending of the long boom would be unwarranted. My instinct was to worry, but I could not see the rational reason for doing so. But there was a more general concern: "The danger of an unfettered Brown plus a weak Chancellor who does his bidding? Rationally we should not be concerned for we do pretty much know that economic policy will remain within the present framework. We can quarrel with the detail, the bossiness, the fiddling and the self-congratulation, but the big picture must surely be all right, mustn't it? Reason says yes but instinct says no. Let's hope reason prevails."

Well, reason didn't prevail over instinct – though I don't think any of us could quite believe what a catastrophe the Prime Minister would be. But I wish I had trusted my instinct more, both about the ending of the long boom and the danger of Gordon Brown without Tony Blair to control him, and phrased those comments more strongly. So let's trust instinct now and see where that leads. Have a look first at the Bank's new fan chart and then at the predicted profiles of this recovery vis-à-vis the early 1980s one. What the Bank suggests is a slowish pull out of recession, but with wide boundaries. Its centre point, while more gloomy than the forecast of last February, is still not quite as bad a slump as occurred in the early 1980s.

Next year, as we start to pull up out of recession, we will have a new government. Let's assume it will be a Cameron one, but let's also assume that the present government will be able to survive until early 2010. The big question then seems to me to be whether that transition will enable a faster climb back to reasonable growth. There will be a tug-of-war. On the one hand there will be the sense of relief akin to that which greeted the accession of the Blair government in 1997. On the other, the true calamity of public finances will be evident. The new government will be taking office under the least favourable economic circumstances since 1979. It will either be faced with the tough decision as to how quickly it should correct the deficit, or that decision will have been taken for it by the financial markets during the winter. If long-term interest rates move up sharply through the winter, it will be vital to set an unambiguous path towards a balanced budget. The danger is that the path may be too steep, either from political choice or because it is forced upon it by the markets.

But let's assume that the new government achieves some authority and the markets give it time to establish a steady correction of the deficit. What then?

Here I think we can start to be reasonably optimistic. The recovery profile could be more like the early 1990s than the early 1980s. There is the advantage of the relatively weak pound, which, however annoying for British holidaymakers, does support UK producers of goods and services. There will be some sort of turning point in house prices during the next couple of years, and that will support both domestic demand and the loan books of the lenders. If the general recovery in share prices is sustained, that will help company balance sheets, because they will have better access to risk capital and smaller pension fund deficits. Further, the current account deficit is already closing fast, and by 2010 we could be back to balance, a situation that has not occurred since 1997, and household savings will be back to sustainable levels.

In short, there is a decent chance that, two years from now, growth will not only be re-established, but turn out above the mid-point of the Bank's latest projections. Reason says the Bank's caution is completely justified and the recovery will be weak. Instinct says that while things won't be great, for the UK, at least, a start will have been made to correct the excesses of the past few years. Of course the uncertainties appear unusually great, but the fact that people think that is actually a positive sign. Think back two years. The uncertainties did not appear great at all to most financial experts, and those people were utterly and embarrassingly wrong.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments