Hamish McRae: America's fiscal position is even worse – will it lose its AAA rating?

Economic Life

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Don't worry about Britain losing its AAA credit rating, but do worry about the rise in country debt here and indeed in pretty much every developed country in the world.

There is a cheap reply to the possibility that the UK may be downgraded following the "negative" outlook registered by the S&P ratings agency. It is that Lehman Brothers had a AAA rating until a few weeks before it collapsed. There is a slightly more thoughtful response which is to note that the reason for the negative outlook is that UK debt may reach 100 per cent of GDP unless we take action. But the fiscal position of the US looks even worse, for on present trends they may go well above that. So will it lose its AAA rating too?

Ratings still matter a bit despite the humiliation of the agencies, though I suspect they will matter less and less as investors will increasingly rely on their own research about the likelihood that debts will be met. And of course it is embarrassing. But the real significance will, I think, be that the markets will focus much more attention on the long-term fiscal position of different counties and charge a significant premium for political risk.

At the moment, country risk assessment is hopelessly crude. A couple of years back Ireland, Italy and Greece could borrow at almost the same cost as Germany. Now they have to pay much more. While the markets could be forgiven for missing the scale of Ireland's problems, the weak position of Greece and Italy should surely have been evident. Or to take another example, the US had "safe haven" status until recently, despite the inherent weaknesses in its fiscal position. Now that is just starting to be questioned – expect it to be questioned more and more.

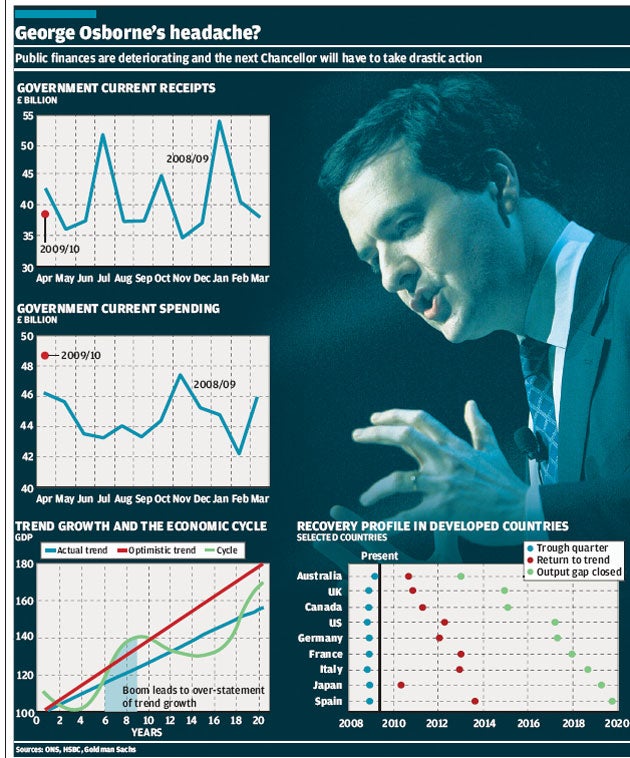

So how will the UK's risk profile really stack up? The starting point of course is the level of national debt relative to GDP, which for the moment is quite low at below 50 per cent. But things can whistle out of control very fast and that is starting to happen, as yesterday's figures for the first month of the new fiscal year demonstrated. As you can see from the top two graphs, tax receipts are way below last year and spending way above. Last April receipts were £42.9bn; this year they were only £38.8bn. Current spending last year was £46.3bn; this year it was £48.8bn. So we are down £10bn on current spending on the month, and remember that under Gordon Brown's fiscal rule we would only borrow for investment. The current budget would be balanced over the economic cycle.

That leads into a discussion about sustainability. How quickly can the current budget be brought back to balance depends on what you think is happening to the economic cycle and to our long-term trend growth. The cycle we can pitch at eight-to-10 years: we cannot know precisely when the next peak of output will come, but let's say some time between 2017 and 2020. So, at some stage between then and now, we should be running a current budget surplus, as we did in the early years with Gordon Brown as Chancellor during the run up to the 2000 peak. Our problem was that he did not do so during the boom years in the run up to the 2008 peak.

That was a mistake partly out of hubris. Do you remember how he kept changing the calculation of the cycle to fit his figures? But there was also a genuine issue about the sustainable growth rate of the UK economy and in particular that during the boom years there is a natural tendency to over-estimate the long-term growth potential. You can see this is a stylised form (it does not refer to any particular country) in the next graph, taken from a paper by Stephen King of HSBC – and an Independent columnist on Mondays. The green line is the actual growth of GDP. During the boom, the shaded years, you think that the red line is your long-term growth path, when actually it is only the blue line. As a result fiscal projections are vastly over-optimistic. His conclusions are: "Fiscal austerity will place a huge constraint on any future recovery. The UK and US have the biggest problems. Fiscal frailties threaten currency crises, price instability and default."

Dire stuff. He is absolutely right to stress that this is a global problem and I suppose my own concern is that governments will not be able to make enough progress on getting their debts under control before the next downturn. So when that happens they will have no ammunition left to fire. It may seem a bit ridiculous to be worrying about the next downturn when we have not even begun to get out of this one.

Still, people are not stupid and if the past two years have taught us anything, it is that there is a strong economic cycle that we do not fully understand and certainly are not clever enough to eliminate.

We can, however, do some sums and the final graph shows some work by Goldman Sachs on the possible recovery profile for a number of developed countries. Here Goldman Sachs is looking at the trends in the economies rather than the trend in public finances, but it would follow that the quicker you can get the economy back to trend growth the better chance you have of getting public finances under control.

Australia is in the best position (followed actually by New Zealand, not shown). It went a little later into the cycle (blue blobs show the bottom); it should be back to its trend growth some time next year (red blobs); and by 2013 it will have made up the ground it has lost during the recession (green blobs).

The UK is not in quite as good a position, not returning to trend until the end of next year and not regaining lost ground until 2015. The US is in a worse position still and that of the big Continental nations don't bear thinking about. Japan is perhaps the most interesting, though. It gets back to its trend growth very soon. But it has lost so much output during the recession that it will be 2020 before it has got back to where it ought to be – that is assuming that the next downturn has not struck by then.

It is small comfort that Goldman thinks (and I am included to agree) that the UK is in not too bad a position in relative terms. The truth is that the entire developed world is in a mess. The task for our next Chancellor, which I suppose will be George Osborne, will be to get the finances back towards adequate shape before the next election in, say, 2014. That won't be enough time to fix things, for as Alistair Darling acknowledges, the fiscal position cannot be corrected in the life of one parliament. But a start has to be made, because if it isn't, it won't just be the loss of AAA status for Her Majesty's Government. It will be the sort of dire outcomes noted by HSBC above.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments