A rate rise may be due here, but cheap money could cost Europe dear

Economic View

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It is decision time for the European Central Bank and for the Bank of England. What should they do about quantitative easing (in the case of the ECB) and what about interest rates (in the case of the Bank)?

For us it is reasonably straightforward. There is a strong practical case for the Bank to make the first increase in rates. The two people on the Monetary Policy Committee whose judgement I would most trust, Martin Weale and Ian McCafferty, have both voted for an increase at previous meetings and will surely be doing so again. The great risk is that by delaying now, the increases will have to be sharper (and more damaging) in the future.

In a couple of years’ time I expect their judgement will be seen to have been justified. But it seems unlikely they will carry the majority and there are two respectable arguments for delay. One is that there may be some slight easing of growth in the UK, the other that the situation in what is unfortunately still our largest export market, continental Europe, is dire. There is a less respectable argument for delay, which is that the headline figure for current inflation is well below the target. The job of the MPC is to look through the present data and think about inflation in two or three years’ time, something that it failed to do during the middle 2000s when it helped create the conditions for the housing bubble. Nevertheless, a delay of the increase until early next year is not going to do a huge amount of damage.

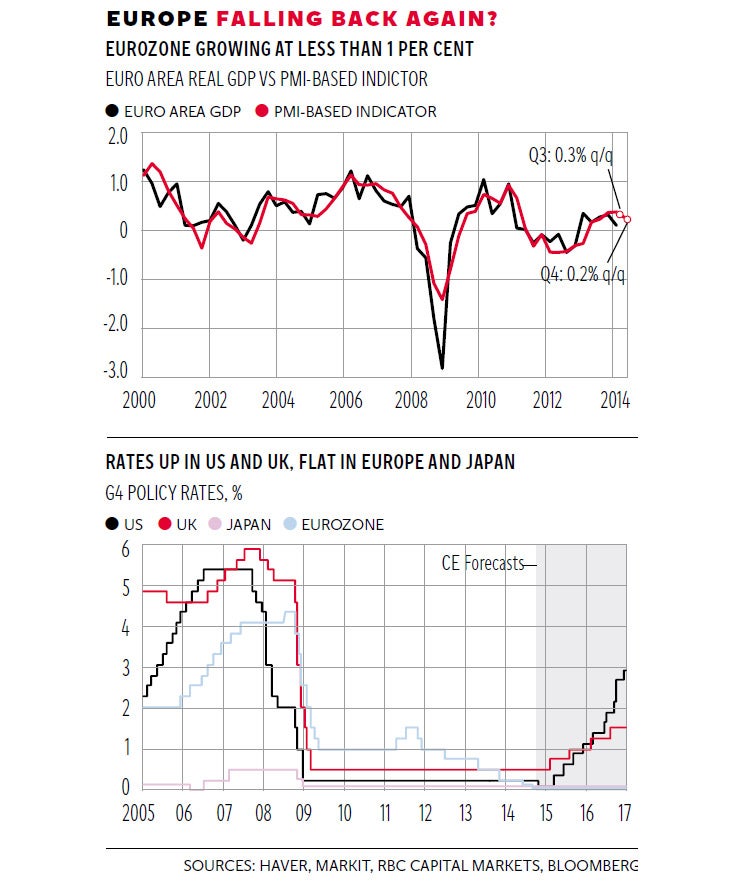

What is happening in Europe, however, becomes more worrying by the day. There was a batch of purchasing manager indices out yesterday, which were consistent with quarterly growth of around 0.2 per cent, or annual growth of 0.8 per cent – see top graph. These come on top of sharply worse economic forecasts from the European Commission earlier this week. The overall PMIs conceal a growing divergence within the eurozone, with on the one hand Germany still growing, albeit slowly, and Spain picking up at last, and on the other, stagnation in France and contraction in Italy.

We are back to the situation where different parts of the eurozone need different interest rates. Germany arguably needs higher interest rates, and German savers certainly do. One German bank, Deutsche Skatbank, a medium-sized one in east Germany, has introduced an interest rate of minus 0.25 per cent for some customers, blaming the ECB. Better to leave the stuff under the mattress.

On the other hand France and Italy need some kind of boost, and while in both countries the problems are to some extent self-inflicted, you can make an argument for some kind of monetary stimulus. Much of the trouble is that the two governments are failing to push through structural reforms, in contrast to what has happened in Spain, but that is a separate issue.

So what will happen?

We will have to wait so see what the ECB does but it has been interesting to see stories emerging of opposition to its president, Mario Draghi, running on the wires. There is a lot of concern, particularly in Germany, that he has stretched the limits of his mandate, and nudged the ECB towards direct funding of national deficits. While you could justify that when it seemed the euro would collapse, it is harder to do so now. Quite what will happen is far from clear, but one outcome is that money will remain virtually free in Europe at an official level for years to come.

You can see on the bottom graph what has happened to official interest rates over the past decade, together with some projections from Capital Economics of what might happen over the next two years. The US and UK start climbing next year, with US policy rates reaching 3 per cent by the end of 2017. But rates remain flat in both the eurozone and Japan. In that sense at least Europe is the new Japan.

You can dig more deeply into interest rate projections, comparing what people say they expect to the rates that the markets predict: what people actually do with their money. You can also play around with the idea that even when rates here do go up, the general level will be lower than it was in the past. But for most of us the rule of thumb that rates will go up in the English-speaking world but not in continental Europe or Japan should be enough to go on.

Now think through the consequences of this. If money is to continue to receive a near-zero (or even negative) return across the eurozone, what effect will that have? Funds for investment will be very cheap, if you can get them, but if the Japanese experience is any guide, that will result in poor quality investment decisions. If continental consumers are anything like Japanese ones, it may also encourage savers to save even more, as they will need a larger pool of funds for any given retirement income.

Or they may shift their money into other assets that will earn a more reasonable return. European equity markets are still on lower price-earnings ratios than the US or Japan. The German Dax index has been volatile over the past few months and is now a couple of percentage points down on the year to date, but it is up on a year ago. Or they may shift their money out of Europe and into the US. The dollar is trading at a five-year high on its trade-weighted average. The big point here is that the prospect of zero interest rates and quite probably some further form of QE is likely to meet increasing pushback from European savers, and may start to have negative, not positive, consequences for the European economy as a whole.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments