Hamish McRae on global cycles: The trick is to position ourselves to cope with the downturns

In terms of unemployment this recent recession was not as serious as the previous ones

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The world economy, taken as a whole, looks in reasonable shape. Some parts are booming and some struggling, but that has always been the case. Indeed it should be welcomed, because if the different parts of the world economy are moving at different paces, that gives an overall stability that synchronised booms and busts by definition absolutely do not. But we all feel an unease, here and elsewhere – and not just because of the events in Scotland. The question is whether this is natural and healthy caution, or something more substantial.

The caution is reflected in the debate over interest rates at the Bank of England, as shown in the MPC minutes which were released yesterday. Leave aside the little issue of the timing of the first rise in rates; the tone was suitably cautious, particularly over what is happening across the Channel: “Accumulating evidence of the weakness in the euro area had been the most significant development during the month.”

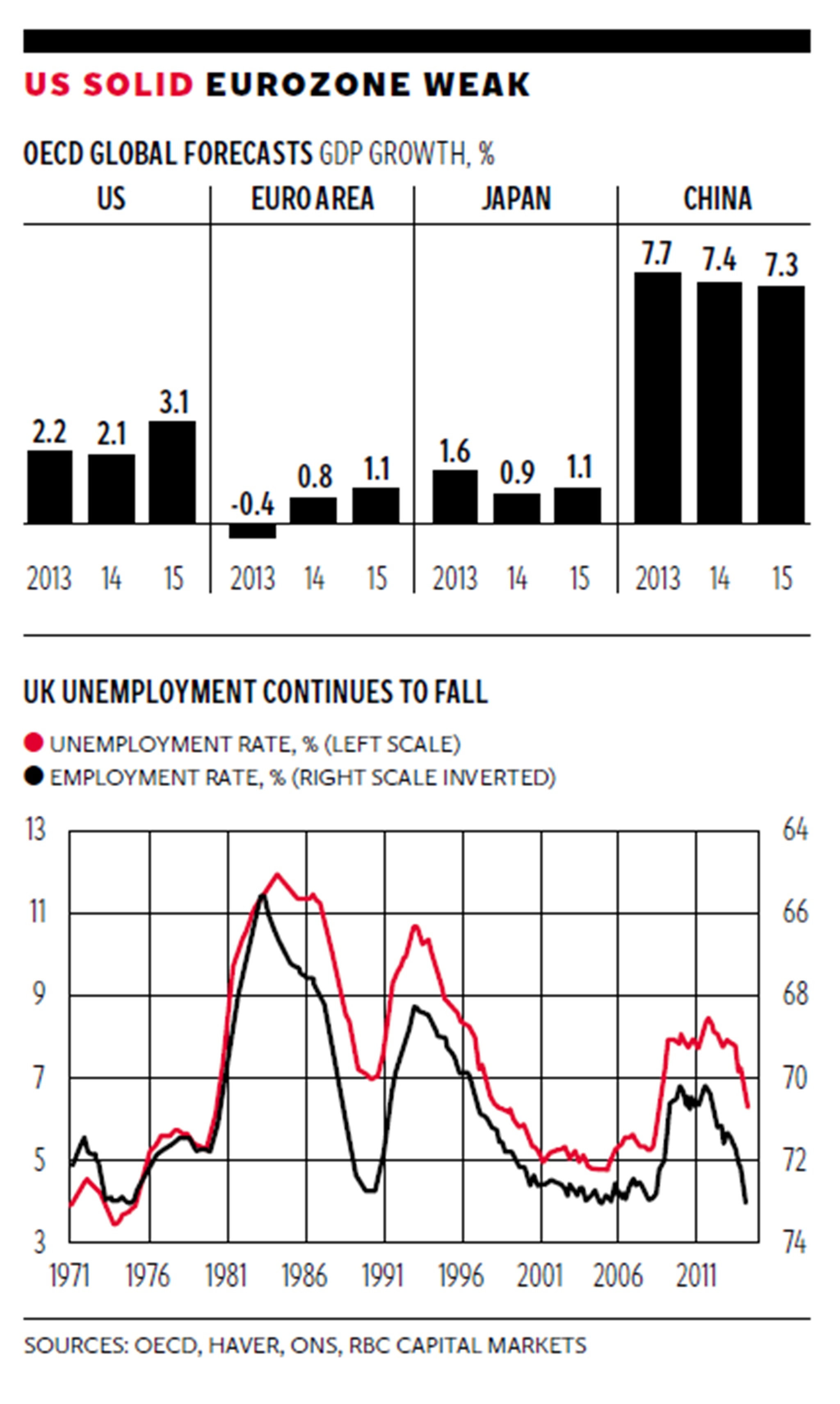

There has been similar caution in new forecasts from the OECD, out earlier this week. It thinks that the eurozone will overall show some growth this year, 0.8 per cent, but as you can see from the top graph it does not expect much improvement in 2015. As recently as May it was forecasting 1.2 per cent eurozone growth this year, which did seem to some of us a bit unrealistic, and I would not be surprised if this new forecast proves over-optimistic too. But to balance that, look at the prospects for the US: growth of more than 3 per cent next year, which though a little lower than its previous expectations, will sustain a decent-enough recovery. Taken as a whole, the solid growth in the US offsets the flat outlook for Europe. While we should not expect much from Japan, note how China is expected to keep the steady growth of around 7 per cent a year.

Come back to the UK and it is clear we are in the English-speaking world of growth rather than the continental or Japanese world of stagnation. The Office for National Statistics has revised up its estimates for growth and we may well end up this year with growth nearer to 4 per cent than 3 per cent. That would be consistent with the consumption figures and also with the employment stats.

The bottom graph shows what has happened to UK unemployment and employment right back to 1971. The latest monthly rate for unemployment, as measured on the International Labour Organization basis, was down to 5.9 per cent for the latest month, pulling the three-month average down to 6.2 per cent. We are now pretty much at the top end of the post-1971 scale for employment (the graph is inverted) but still some way off the bottom end for unemployment. It is plausible that our overall employment rate could rise well above the early 1970s peak, thanks to greater flexible working opportunities and the rise in self-employment. So there is probably still some slack in the labour market, though individual pockets of shortages have, as usual at this stage of the cycle, begun to appear.

The cycle: ah. That surely is the thing that screams out from that graph: those two huge peaks in unemployment in the early 1980s and early 90s, and the nasty, though not so huge, peak in the recent downturn. In terms of unemployment this recent recession was not as serious as the previous ones, which must partly be a result of our better labour market policies; but the fact remains that we seem to be locked into a world of cycles. That leads to a debate about the durability of the present expansion: how long can it continue?

This of course is not just a question for the UK; it is one for the entire developed world. We are all prisoners of the same global cycle and the trick is to put yourself in the best possible position to cope with the downturn when it comes. I think that what we are likely to face in the next year or so will be a mid-cycle pause. I suspect that it is fears of this that account for the slightly edgy feeling now, but we have our own specific justifications for edginess, too.

What should we look for to help us judge the dangers of the mid-cycle pause, if that is indeed what it is?

The simple, if unoriginal answer is to look at the US. Here there are negatives and positives. Among the negatives are the extent to which the recovery has relied on ultra-cheap money, and the uneven nature of the recovery. I would add the extended equity market valuations. Among the positives are the little-noticed correction of the US fiscal position and the competence of the Federal Reserve. There is not a lot of mileage in going into the minutiae of Janet Yellen’s comments at every press conference – it does not really matter whether the Fed is slightly more or less hawkish or dovish, except to the markets. What we can reasonably assume is that the Fed will be sensible. Indeed Fed competence is a key underpinning of the stock market strength as well as Fed cash.

Of the rest, it is hard to see either Europe or Japan adding to instability, over and above their present contribution. We have a world economy that is able to grow despite the weak performance in two of its major regions. They might contribute to the mid-cycle pause, and it would be a concern if the eurozone really does experience a triple-dip next year. But stagnation is more likely. Conceivably a sharp fall in growth in China could destabilise the world, but it would bring some benefits in the shape of lower energy prices. If this is right, then there are plenty of reasons to expect a global slowdown, but no real evidence yet that would point to this expansion phase being seriously truncated. But let’s keep worrying.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments