FCA warning that young are borrowing to eat shames Britain

What puzzles is why, at a time when the Government peddles a destructive nationalism, anyone would think people should be proud of a country that has so forsaken its young people, its future, that they have to go to rip-off lenders just to put food on the table

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.“There is a pronounced build-up of indebtedness among the younger age group. We should not think this is reckless borrowing. This is directed at essential living costs.”

So said Andrew Bailey, the chief executive of the Financial Conduct Authority in an interview with the BBC. Translation: he’s worried about young people getting in hock to rip-off lenders so they can eat.

There is a huge and growing “wealth gap” between the young and the old in Britain, and it disproportionately impacts upon those from disadvantaged backgrounds; people who don’t have the option of calling on the “bank of mum and dad” when things get tight.

We know the causes of this, and they are many. The old have benefited handsomely from rising asset prices, chiefly housing, and often enjoy copper-bottomed pensions that have all but vanished, at least from the private sector.

In many cases they fatten their retirement incomes through the (rising) amount they take in from the members of generation rent that live in their buy-to-let properties.

Jobs are hard to come by for the young; well-paying ones all the more so. The gig economy that many work in cheats them of the limited cover provided by the national minimum wage, not to mention the bags full of other sweeties older workers enjoy as standard.

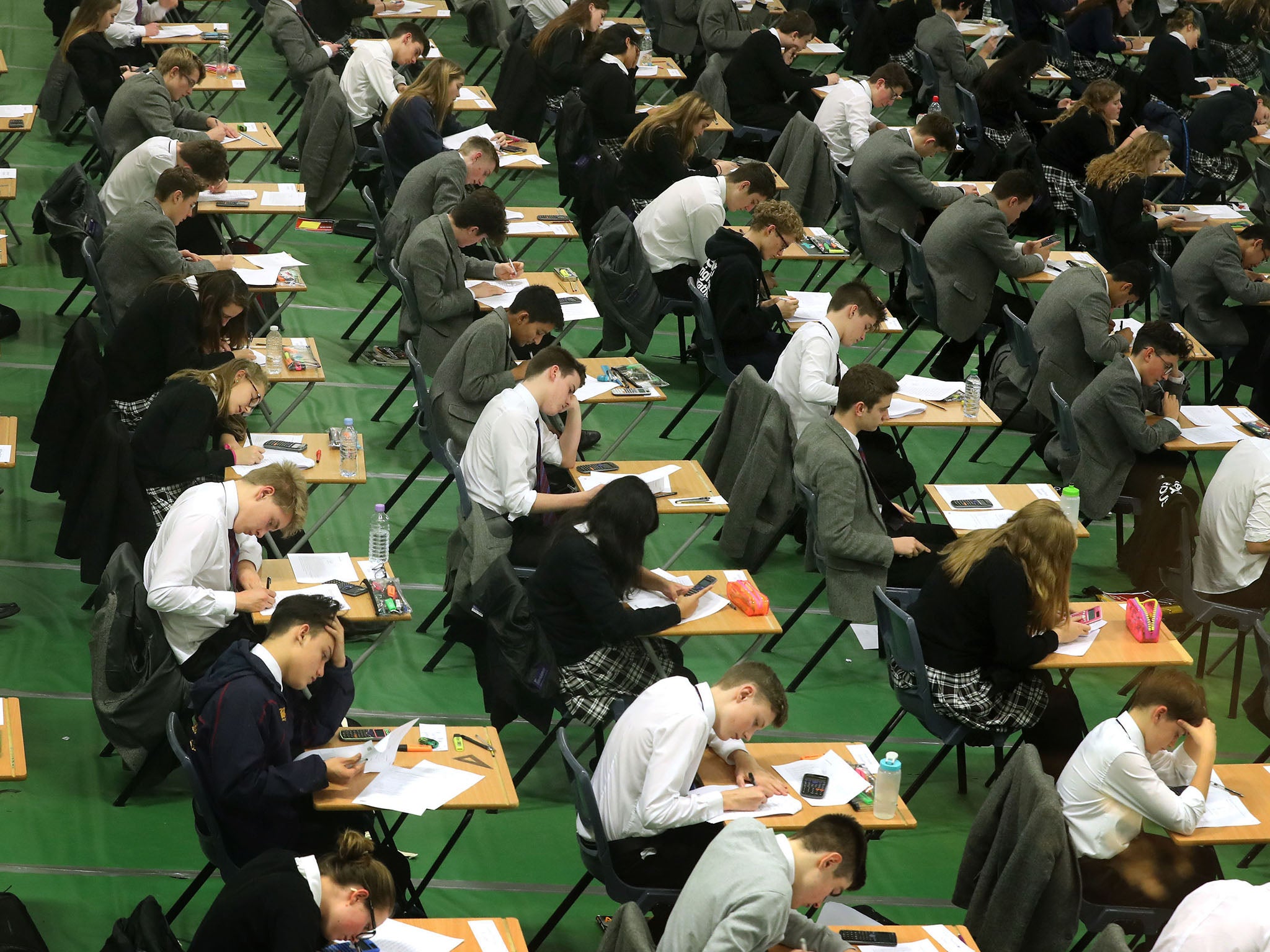

Benefits have been protected for the old, removed from the young, who have had the burden of austerity placed upon their shoulders. Education, that might serve as a route out of poverty, and once did, has become ruinously expensive, an activity that will end up with their incurring yet more debt. Mountains of the stuff.

Inflation is rising. Wages are not.

Identifying these, and the other causes of the problem that faces young Britons, is one thing. The question is what are we going to do about something that should shame us all?

Mr Bailey opined that young Britons borrowing to eat is not a crisis “in a macroeconomic sense”. What that means is that he doesn’t think it is serious enough to bring the country down in economic flames. We have Brexit for that.

However, he admitted, having listened to some of the heartbreaking stories you will hear from debt charities, that that’s not really the point. While it might not be a problem in a macroeonomic sense, it is still a problem, something that needs addressing as a matter of urgency.

Mr Bailey is trying to help. He has voiced concerns about some of the activities engaged in by the providers of high cost credit, which is where you ultimately end up if you’re young, hard-up and don’t have a credit history.

Some steps have already been taken to rein them in, such as capping the amount payday lenders can charge and ensuring that people who get into difficulties don’t have to pay back more than twice what they borrow.

Work is ongoing into the activities of other lenders, in other sectors, such as credit card providers and banks.

Mr Bailey said that there still needs to be a free flow of credit, and about that he is right. But credit can become a crutch that can kill you when it breaks. So more needs to be done.

Unfortunately, there is only so much that Mr Bailey can do. He can provide pills to treat the worst of the symptoms, but curing the disease is beyond his power.

That is the job of government.

Prime Minister Theresa May, so hapless in so many ways, deserves some credit for at least recognising that the country has an issue when it comes to “intergenerational fairness”. Her conception of the “British Dream” is narrow, and small. But she seems to have cottoned on to the problem of the young being shut out of it.

The trouble is, while she’s talked a lot, her Government has done precious little towards addressing the issue.

Many of its leading members prefer wrapping themselves in Union flags, while accusing those who disagree with their obnoxious nationalism, their baying of “Brexit, Brexit, Brexit”, of failing to show sufficient pride in Britain, of lacking what they see as patriotism.

What puzzles is why anyone would think people should be proud of a country that has so forsaken its young people, its future, that they have to borrow money from rip-off lenders just to be able to put food on the table.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments