David Blanchflower: Why we won’t have real pay growth until 2016 at the earliest

The level of slack in the UK labour market remains substantial

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.I was especially struck last week by the claim in the Bank of England Monetary Policy Committee’s Inflation Report that “pay growth is projected to rise to close to 4 per cent by late 2016”. It isn’t going to. The MPC is unthinkingly assuming what is called mean reversion. They have no credible model of wage determination. This is just simple (and inevitably wrong) mechanics.

The MPC is simply assuming that wage growth will return to the levels it had pre-recession. Growth in Average Weekly Earnings averaged 4.3 per cent from March 2001 through December 2007. Pay growth averaged 4.3 per cent in the private sector and 4.4 per cent in the public sector over this period. Over the same time period Consumer Price Index (CPI) inflation averaged 1.7 per cent, so the assumption then is average real wage growth will soon be over 2 per cent, despite the fact that over the past four years it has fallen by 2 per cent per annum.

Quite the turnaround. Given the likelihood of low public sector wage growth the MPC must be assuming private sector wage growth of at least 6 per cent. Over the last two years AWE growth in the private sector has averaged 1.3 per cent.

One major concern is that the wage growth pre-recession was unwarranted so lower wage growth now is inevitable to catch-up for the overly generous pay raises awarded pre the disaster. Other advanced countries didn’t have real wage growth approaching such high levels. They certainly don’t seem to be justified by relative productivity differences.

The MPC forecast for wages was published on the same day as the ONS released its latest data on the labour market which didn’t exactly square with their claims. The national statistic on wages and earnings is Average Weekly Earnings. It covers workers in firms that have twenty workers or more, which excludes 91 per cent of all UK firms. I kid you not. This sample exclusion matters given the rise in low paid, zero hours contracts jobs, which are likely dominantly in small firms, who we know still can’t get access to credit.

The AWE growth for the economy as a whole was 1 per cent in September, which because of the sample exclusions is inevitably an upwardly biased estimate of earnings growth in the UK economy. CPI inflation was 1.2 per cent and Retail Price Index (RPI) inflation, which is the usual measure used in the labour market, grew by 1.6 per cent. So, however you look at it, real earnings continued to fall. In fact, the level of the AWE was £481 in September, below the level six months earlier in April of £482.

But there was more. Each quarter the ONS also reports wage data from a random sample of employees using the Labour Force Survey which is used to calculate the unemployment rate. This has the benefit that it includes workers in both big and small firms. Some responses are given by proxy but there is no obvious reason to believe this upwardly biases estimates. It had some telling findings. Average gross weekly earnings of full-time workers in the LFS rose by only 0.7 per cent overall but fell by 0.5 per cent in the private sector. Nominal earnings, not adjusted for buying power because of rising prices, fell in manufacturing, construction, transport and storage and professional, scientific and technical activities. They also fell in the East and West Midlands, the East, Wales, Northern Ireland and Scotland. Take these industries and regions out and earnings went up a lot!

Why is wage growth still so low? The answer is essentially threefold. First, there is the possibility that firms will move abroad if wages were to rise. There is also the fear and the actuality that workers from Eastern Europe will come to the UK, attracted by a rise in earnings in the UK relative to what they can earn at home. Over the last year the number of workers from the A10 Accession countries employed in the UK rose by 210,000. Second, public sector pay freezes help to keep pay growth down in the private sector. Third, the level of slack in the UK labour market remains substantial.

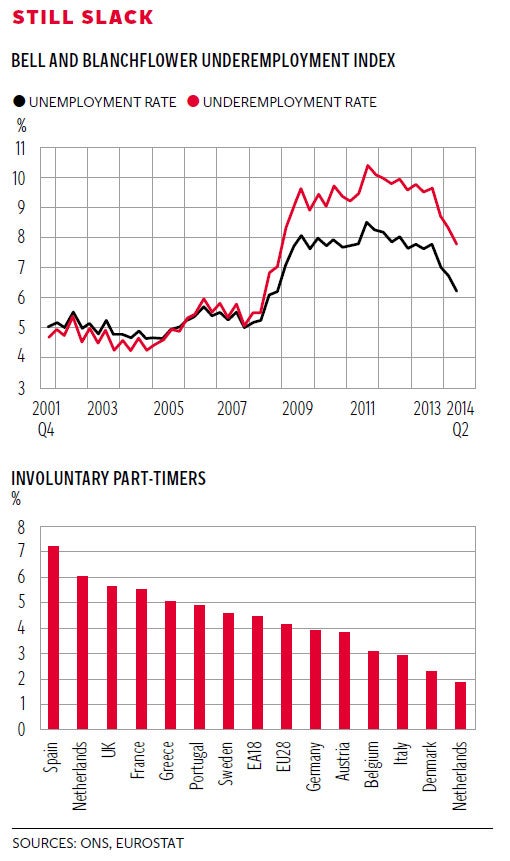

Prior to the Great Recession the unemployment rate was a sufficient statistic to describe the working of the labour market; now it is insufficient. As it came down that meant the labour market was tightening as the economy moved toward full-employment and then wages would rise. Recently the unemployment rate has fallen down to 6 per cent, down from 8 per cent in early 2010 but there has been no rise in pay. This has largely to do with the rise in underemployment, where workers are forced to take jobs that have fewer hours than they would like. David Bell and I published our underemployment index this week, which is plotted in the first chart. It shows that for Q2 2014 the unemployment rate was 6.2 per cent but our underemployment rate was 7.8 per cent. This is calculated by adding on the extra hours workers would like to work at the going wage rate. It is equivalent to adding another half a million on to the 2 million unemployed we have now. In the period from 2001 through 2008 there was no difference at all between the underemployment and unemployment rates.

Other countries don’t have the data to produce a desired hours series but they do have data on the numbers of part-time workers who would like a full-time job. This is up in the UK from around 700,000 at the beginning of 2008 to 1,340,000 in the latest count, down from a high of nearly 1.5 million in the summer of 2013. It turns out that other countries have also seen this phenomenon of rising involuntary part-time employment. The US has seen a rise in the numbers of what they call part-time for economic reasons from around 4 million at the start of 2006 to 9 million at the end of 2010.

The numbers have fallen back to 7 million but have done so more slowly than unemployment has. The second chart shows the extent of part-time wanting full-time for Q2 2014 in Europe is especially high in the UK. It is third among the major EU countries, behind only Spain and Ireland but above France and Italy. This all matters because there is growing evidence from around the world that the underemployed as well as the unemployed and potential and actual migrants are holding down wages. Wage growth of 4 per cent is a chimera on the horizon. As a result it is hard to see rate rises before late 2016 at the earliest.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments