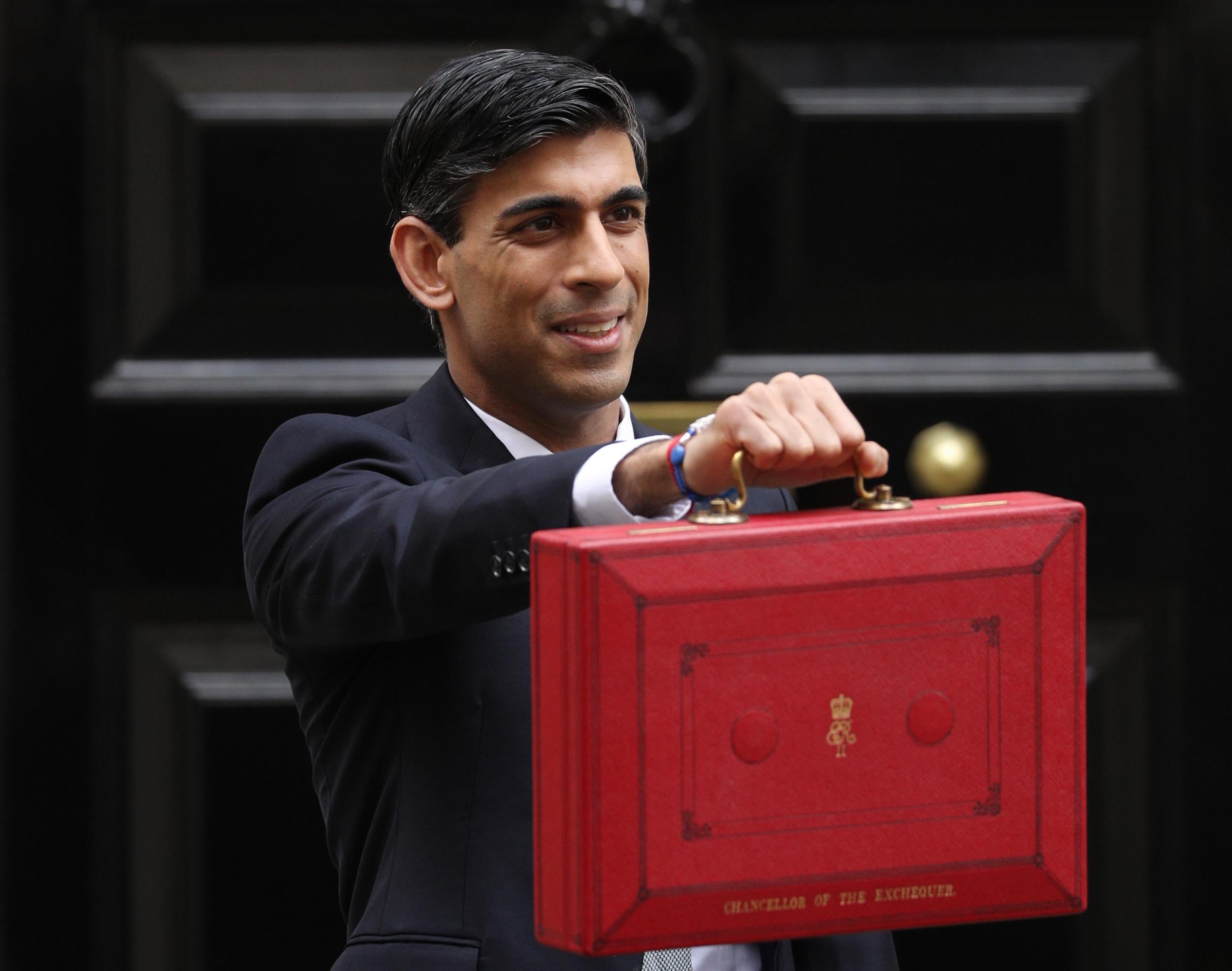

Budget 2020: Here are the key points from Rishi Sunak's speech

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Today marked the first Budget for the new government, the first for a new chancellor who has only been in the job a few weeks and the first for almost 18 months. It could, however, be the first of several budgets in 2020.

In a Budget overshadowed by Covid-19, the chancellor started by announcing a package of measures aimed at easing the burden for individuals and businesses, including extending statutory sick pay, offering a reduction to business rates for small businesses and allowing more time to pay taxes.

The chancellor’s hands seemed to be slightly tied, and the only notable change for workers was an increase to the National Insurance threshold to £9,500 providing a £100 annual saving.

For the first time in 10 years, there was no increase to the personal allowance, which remained at £12,500. In fact, there were no changes to the majority of the personal tax thresholds with the basic rate band, inheritance tax nil rate band and the high-income child benefit threshold all untouched.

In a measure aimed at appeasing NHS doctors and consultants, the pensions annual allowance will only begin to reduce for individuals with income above £240,000 (currently £150,000). However, at the other end of the spectrum, the minimum pensions annual allowance will be reduced to £4,000 (currently £10,000), affecting individuals with income above £300,000.

The chancellor wielded an axe on entrepreneurs’ relief without going as far as abolishing it completely. In an overnight move (which has its own complexities), the entrepreneurs’ relief lifetime allowance was slashed from £10m to £1m, reducing the tax saving to £100,000.

Apparently, the reduced limit should only affect 20 per cent of entrepreneurs while raising £6.3bn for the Treasury in the process over the next five years. Entrepreneurs’ relief has gone full circle, as the limit was £1m when first introduced in 2008 and worth £80,000.

At a time when all UK businesses are facing hugely uncertain futures, it was disappointing that the chancellor, only a few weeks into the job, decided to make the move without any review or consultation.

For the first time in many years, there were few changes to property taxes, with the government moving ahead with a 2 per cent Stamp Duty Land Tax surcharge for overseas buyers, which will take effect from April 2021 (presumably to encourage overseas buyers to transact before a higher SDLT cost applies).

However, it’s worth noting that several property tax changes are due to take effect from 6 April 2020, including a reduction to main residence relief, the mortgage interest relief restriction taking full effect and reducing the timeframe in which capital gains tax should be paid to 30-days when selling a residential property.

The only giveaway for savers was an increase to the Junior ISA limit to £9,000. At a time when the stock markets have tumbled and interest rates cut, pensioners and savers may have been looking to the Government for some help.

Nimesh Shah is a partner at leading accounting and tax advisory firm Blick Rothenberg.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments