Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

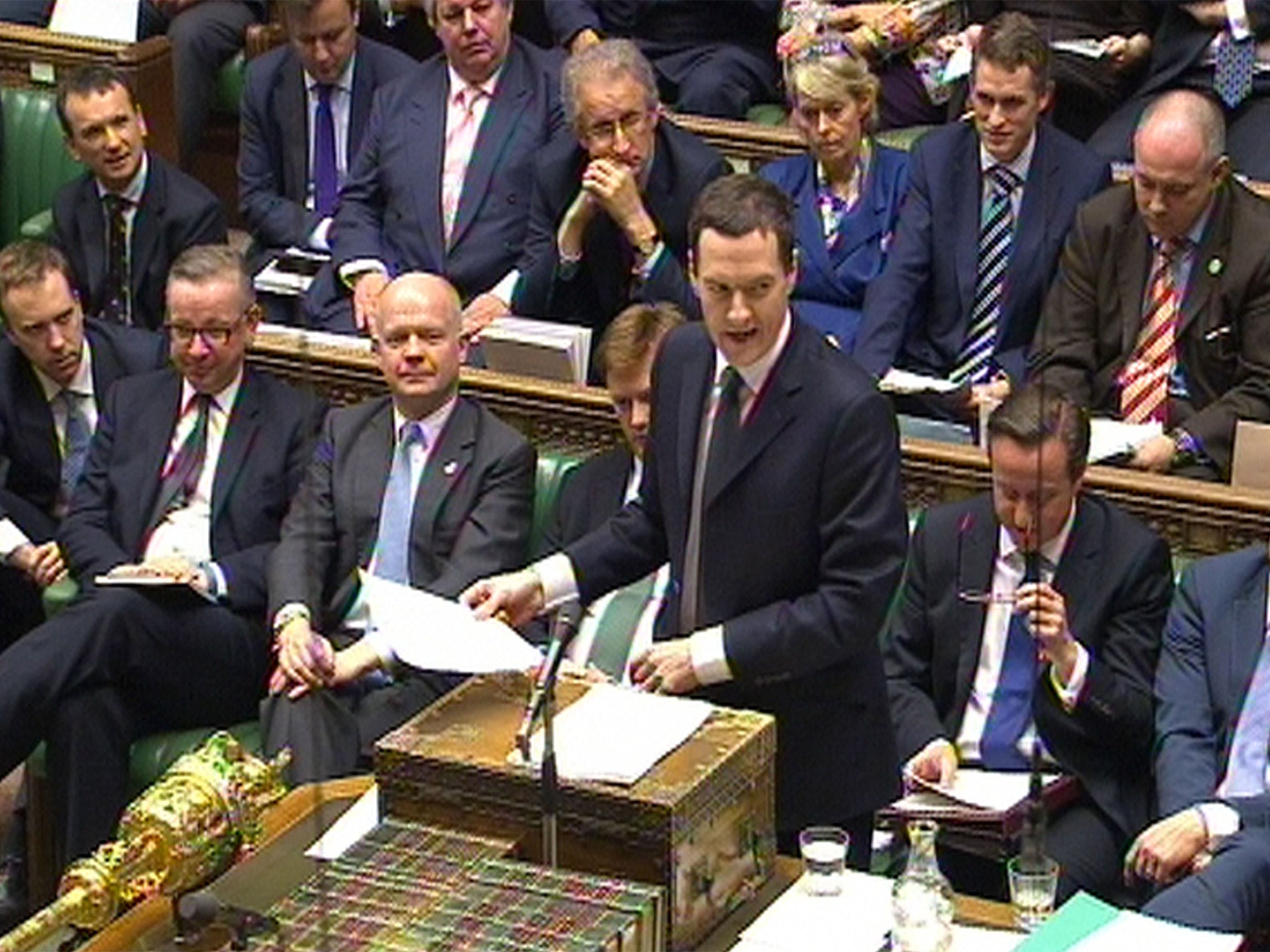

Your support makes all the difference.How much cash does George Osborne need the public to start borrowing again to reduce the deficit and keep the economy growing?

The answer lies in the inescapable fact that the economies are sustained by spending. There are four main sectors: households, firms, government and what can be summed up as “foreigners” – people abroad who buy our exports. And when one of these sectors cuts its spending drastically, the total level of economic output, or gross domestic product, will automatically fall.

This is why the economy tanked in 2008 – households reined in spending because of the global financial crisis. They became alarmed at the amount of debt they held, relative to their incomes.

Firms, seeing demand fall off a cliff, also stopped investing. Foreigners, who had their own serious financial balance sheet issues, also cut back on buying UK exports. The result was the biggest economic slump since the Great Depression.

But what stopped things getting even worse in 2008 was the fact that one sector kept on spending: the Government. By running a big budget deficit, the state supported GDP growth.

Now that prop is being removed. George Osborne plans to accelerate his state spending cuts in service of his goal of running a budget surplus by 2018-19.

But what will fill the gap? Business will help a little, according to the Office for Budget Responsibility, with investment projected to rise. Foreigners will help too, with demand for our exports projected to creep up. But the big surge is forecast to come from households.

The OBR sees the household sector as a whole spending considerably more than its total income over the next five years. This implies an increase in household debt, as we report today, to pay for all that spending.

But what would happen if households didn’t take on more debt? The answer is that growth would collapse and the Government’s deficit would, most likely, start increasing yet again.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments